A. Calculate the expected return of his new portfolio. B. Calculate the covariance of ABC stock returns with the original portfolio. C. Calculate the risk level of the new portfolio.

Q: Which of the following measures reflects the excess return earned on a portfolio per unit of its…

A: Treynor's measure is the measure of excess return earned per unit of beta of portfolio. Treynor…

Q: d) What is the reward-to-volatility ratio of the best feasible CAL? e) You require that your…

A: Sharpe ratio is refer as reward to volatility ratio which used to determine the performance of an…

Q: In evaluating (stock) portfolio return we use the market values at the beginning of the period to…

A: The percentage of a particular stock or any asset in a portfolio is known as the weight of the asset…

Q: You are given: (1) The risk-free interest rate is 0.04 (ii) The market Portfolio has an expected…

A:

Q: How do I calculate portfolio return and risk for an equally weighted portfolio using expected…

A: The portfolio return is defined as the gain/loss that is realized through an investment portfolio,…

Q: Describe the goal of a portfolio owner in terms of risk and return. How does he or she evaluate the…

A: The question is based on the concept of portfolio management and objective of portfolio. Portfolio…

Q: Which are the most efficient combination of securities that provides investors with maximum…

A: The efficient frontier is a set of optimal portfolios that provide the greatest expected return for…

Q: Is it possible to construct a portfolio of real-world stocks that has a required return equalto the…

A: The theoretical rate of return for an investment with no risk is known as the risk-free rate of…

Q: It is a risk adjusted performance measure that represents the average return on a portfolio. a.…

A: Correct answer is (a) sharp ratio

Q: Is it possible to construct a portfolio of real-world stocks that has an expected return equal to…

A: Portfolio refers to basket of various financial assets and commodities that are held by single…

Q: What are the the key concepts (e.g., the standard deviation of the portfolio is less than the…

A: The question is based on the explanation of key concept behind creating a portfolio with different…

Q: c) What are the beta of the two stocks? d) Based on your calculation in b and c, which stock is…

A: Expected return E(r) = ∑p*r Standard deviation = √∑p*(r-E(r))2 Standard deviation measures the…

Q: Beta Expected return Determine whether this portfolio have more or less systematic risk than an…

A: The question is based on the concepts of portfolio theory. A portfolio is a pool of investment in…

Q: d. Calculate the variance and standard deviation of the portfolio assuming that the correlation…

A: The variance and standard deviation of a portfolio: The possibility that the actual outcome will be…

Q: e) Calculate the portfolio return for each alternative. f) Calculate the portfolio standard…

A: Portfolio return refers to the proportionate return of each investment alternative. The standard…

Q: . The difference between the expected (c equired) return for the market portfolio ar he risk-free…

A: This pertains to the CAPM (capital asset pricing model). The difference between expected return on a…

Q: As the number of securities in a portfolio is increased, what happens to the average portfolio…

A: Standard Deviation: It is a statistical measure of dispersion and measures the dispersion in the…

Q: A portfolio consists of two securities and the expected return on them is 11% and 15% respectively.…

A: Information Provided: Expected Return of Security 1 = 11% Expected Return of Security 2 = 15% Weight…

Q: What is risk and how is it measured? How is risk measured in a portfolio compared to risk in a…

A: Risk is measured by the amount of volatility, that is, the difference between actual returns and…

Q: What is a characteristic line? How is this line usedto estimate a stock’s beta coefficient? Write…

A: Characteristic line With the help of regression analysis, a straight line is being formed which…

Q: Suppose an investor starts with a portfolio consisting of one randomly selected stock. As moreand…

A: There is a positive correlation of stocks with one another when the economy good, and thus is the…

Q: Interpret your results in (c) above, assuming that the historical average return of 8.5% from the…

A: d) In part c, at a rate of 8.59% the stock is considered to be fairly priced. However, since the…

Q: a. Calculate the expected return of your portfolio. (Hint: The expected return of a portfolio equals…

A: Data given: Stock % of Portfolio Beta Return Expected 1 10% 1 12% 2 25% 0.75 11% 3 15% 1.3…

Q: c. Calculate the standard deviation of returns for each asset and for the portfolio. How does the…

A:

Q: The security market line depicts: a. Expected return as a function of systematic risk (indicated…

A: The security market line (SML) is a graphical representation of the capital asset pricing model…

Q: An investor must look not only at the over-all return of a portfolio but also the risk of that…

A: The risk-return trade-off argues that when risk grows, so does the possible reward. Individuals…

Q: A. Compute for EGDL Corporation's Standard Deviation. B. Compute for JSS Corporation's Standard…

A: Standard deviation is a measure of risk associated with stock. Higher the standard deviation, higher…

Q: When a portfolio consists of only a risky asset and a risk-free asset, increasing the fraction of…

A: Principally, it is an established rule that higher the risk, higher the return.

Q: What is the beta for the other stock in your portfolio? What is the expected return of the risk-free…

A: Portfolio is the collection of securities or investments. It is the collection of securities…

Q: Suppose you plan to form your overall investment portfolio in two steps: STEP 1: Choose a portfolio…

A: The Portfolio frontier: A portfolio frontier is constructed by using various combinations (weights)…

Q: Suppose you have the following expectations about the market condition and the returns on Stocks X…

A: Given:

Q: The standard deviation of a stock’s return is a measure of its? Multiple Choice systematic…

A: Financial management consists of directing, planning, organizing and controlling of financial…

Q: You are given: (1) The risk-free interest rate is 0.04 (i) The market Portfolio has an expected…

A: The expected return on the stock: The Capital Asset Pricing Model or CAPM gives the expected return…

Q: how do financial analysts determine the portfolio that has the lowest risk and yields a high…

A: The combination of investments undertaken to minimize the risk and maximize the return is called…

Q: You form a portfolio by investing equally in four securities: stock A, stock B, the risk-free…

A: Computation:

Q: The concept of Portfolio Effect indicates that the more assets added to the portfolio, the less risk…

A: Portfolio means collection of various financial investments. Such investments can be in mutual…

Q: Assume the risk-free rate is r = 3%. Consider the data in the table below: Stock Expected Return…

A: The capital market line (CML) represents portfolios that optimally combine risk and return. capital…

Q: Beta is a measure of? Risk in a well diversified portfolio Systematic risk The extent to which the…

A: Beta is measure of stocks movement or volatility in respect to market. Stocks with higher beta are…

Q: Mean returns for portfolios are calculated by taking the weighted average of the mean returns for…

A: The return on a particular portfolio is calculated by dividing the portfolio's net loss or profit by…

Q: Compute: a) The expected rate of return. b) The standard deviation of the expected return. c) The…

A: Expected Return The minimum risk expected by an investor for the risk undertaken in the process of…

Q: geometric average return on this stock

A: The geometric return shows the calculation of the average rate of return on investment compounded in…

Step by step

Solved in 5 steps

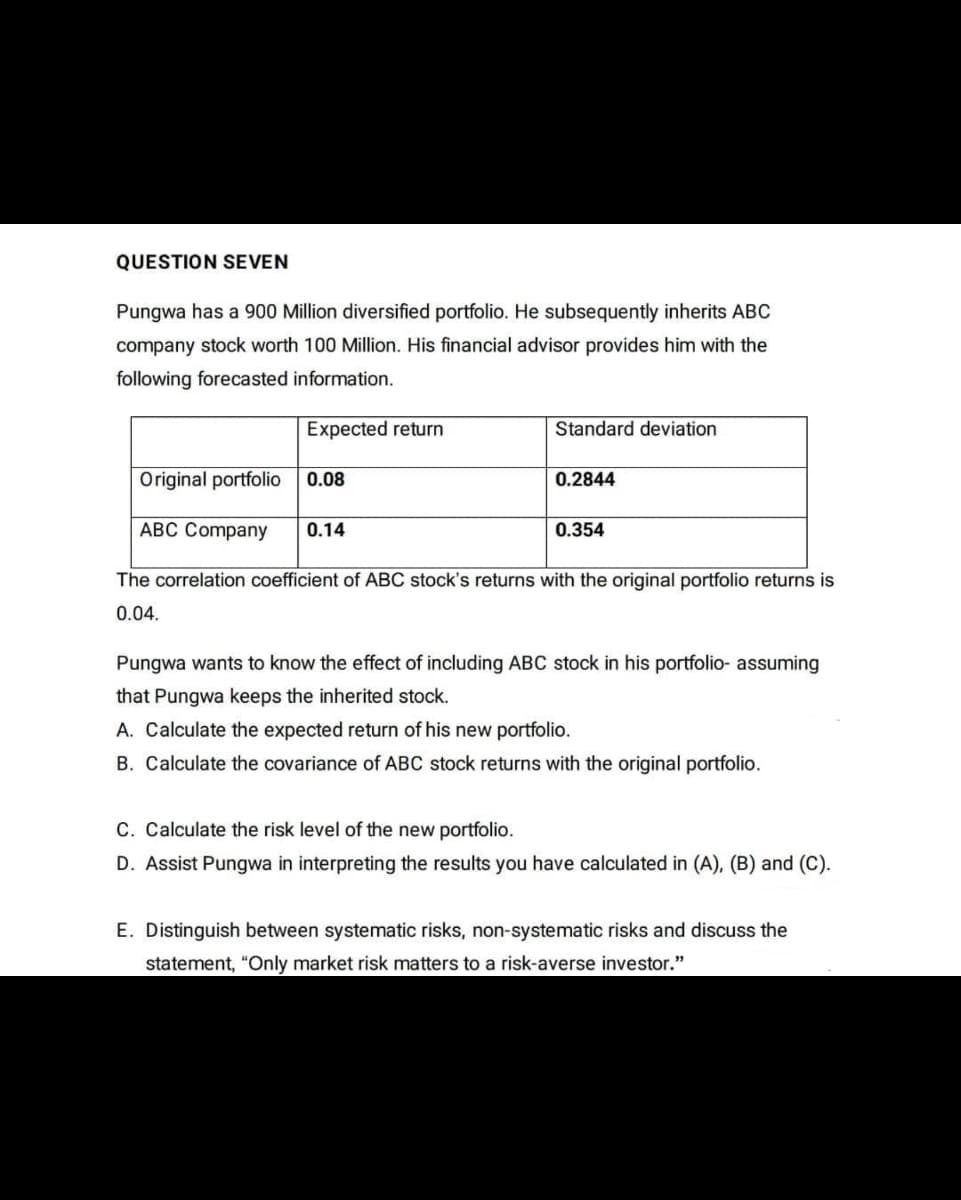

- Abigail Grace has a $900,000 fully diversified portfolio. She subsequently inherits ABC Company common stock worth $100,000. Her financial adviser provided her with the following estimates: Risk and Return Characteristics Expected Monthly Returns Standard Deviation of Monthly Returns Original Portfolio 0.67% 2.37% ABC Company 1.25 2.95 The correlation coefficient of ABC stock returns with the original portfolio returns in .40. If Grace sells the ABC stock, she will invest the proceeds in risk-free government securities yielding .42% monthly. Assuming Grace sells the ABC stock and replaces it with the government securities, calculate the Expected return of her new portfolio, which includes the government securities. Covariance of the government security returns with the original portfolio returns. Standard deviation of her new portfolio, which includes the government securities.An investor holds a diversified portfolio consisting of a P20,000 investment in each of 20 different ordinary stocks. The total investment portfolio amounts to P400,000 while the portfolio beta is equal to 1.2. The investor decided to sell one of the ordinary stocks that has a beta equal to 0.7 for P20,000. The investor plans to use the whole proceeds to purchase another ordinary stock that has a beta of 1.4. What will be the beta of the new portfolio? a. 1.165 b. 1.235 c. 1.222 d. 0.07An investor holds a diversified portfolio consisting of a P2,100 investment in each of 10 different common stocks. The portfolio beta is equal to 1.5. You have decided to sell one of your stocks, whose beta is equal to 1, for P2,100 and used the proceeds to buy different P2,100 of stock of a retail company whose beta is 1.2. What will be the new beta of the portfolio? (No rounding off until the final answer)

- Abigail Grace has a $900,000 fully diversified portfolio. She subsequently inherits ABC Company common stock worth $100,000. Her financial adviser provided her with the following estimates: Risk and Return Characteristics Expected Monthly Returns Standard Deviation of Monthly Returns Original Portfolio 0.67% 2.37% ABC Company 1.25 2.95 The correlation coefficient of ABC stock returns with the original portfolio returns in .40. The inheritance changes Grace’s overall portfolio, and she is deciding whether to keep the ABC stock. Assuming Grace keeps the ABC stock, calculate the: Expected return of her new portfolio, which includes the ABC stock. Covariance of ABC stock returns with the original portfolio returns. Standard deviation of her new portfolio, which includes the ABC stock.Johnny holds the following portfolio:Stock Investment BetaA $150,000 1.40B $50,000 0.80C $100,000 1.00D $75,000 1.20Johnny plans to sell Stock A and replace it with Stock E, which has a beta of 0.75. By howmuch will the portfolio beta change? (Please state your answer in 2 decimal points)Suppose Megan owns a two-stock portfolio that invests in Happy Dog Soap Company (HDS) and Black Sheep Broadcasting (BSB). Three-quarters of Megan’s portfolio value consists of Happy Dog Soap’s shares, and the remaining balance consists of Black Sheep Broadcasting’s shares. Each stock’s expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Probability of Expected Returns Occurrence HDS BSB Strong 20% 50% 70% Normal 35% 30% 40% Weak 45% -40% -50% Calculate the expected returns for the individual stocks in Megan’s portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. • The expected rate of return on Happy Dog Soap’s stock over the next year is . • The expected rate of return on Black Sheep Broadcasting’s stock over the next…

- David owns a two-stock portfolio that invests in Falcon Freight Company (FF) and Pheasant Pharmaceuticals (PP). Three-quarters of David’s portfolio value consists of FF’s shares, and the balance consists of PP’s shares. Each stock’s expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Probability of Occurrence Falcon Freight Pheasant Pharmaceuticals Strong 0.50 10% 14% Normal 0.25 6% 8% Weak 0.25 -8% -10% Calculate expected returns for the individual stocks in David’s portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. • The expected rate of return on Falcon Freight’s stock over the next year is . • The expected rate of return on Pheasant Pharmaceuticals’s stock over the next year is . • The expected rate of return on…An investor holds a diversified portfolio with a beta equal to 1.5, consisting of a P100 investment ineach of 10 different common stocks. He sold one of your stocks that has a beta equal to 0.5 for P100.The whole proceeds were used to purchase another stock that has a beta equal to 1. Determine thebeta of the new portfolio?9. Portfolio beta and weights Brandon is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 38.00% Arthur Trust Inc. (AT) 20% 1.400 42.00% Li Corp. (LC) 15% 1.300 45.00% Transfer Fuels Co. (TF) 30% 0.500 49.00% Brandon calculated the portfolio’s beta as 0.888 and the portfolio’s required return as 12.6600%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 6%, and the market risk premium is 7.50%. A. According to Brandon’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s…

- Mrs. Landis has a 2-stock portfolio with a total value of $520,000. $175,000 is invested in Stock A with a beta of 1.25 and the remainder is invested in Stock B with a beta of 1.25. What is her portfolio's beta?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. Group of answer choices 1.01 1.30 1.25 1.39 1.15Daniel have established an investment portfolio of two stocks A and B five years ago. Required: Assume that expected return of the stock A in his portfolio is 13.2%. The risk premium on the stocks of the same industry are 4.6%, the risk-free rate of return is 4.8% and the inflation rate was 1.5. Calculate beta of this stock using Capital Asset Pricing Model (CAPM)? Assume that Daniel bought 3,000 stock B in the portfolio for total investment of $12,000, now the market price of the stock is $15, the dividend paid for this stock is $2 each year. Calculate the total rate of return of this stock? Assume that the following data available for the portfolio, calculate the expected return, variance and standard deviation of the portfolio given stock A accounts for 35% and stock B accounts for 65% of your portfolio? A B Expected return 19.5% 12.5% Standard Deviation of return 7% 2.5% Correlation of coefficient (p) 0.45AKD investment company invested equal amount in 5 stocks to form investment portfolio that has a beta 1.5. AKD is planning to dispose riskiest stock in the portfolio which has beta co-efficient to 2.2 and replace it with another stock. If AKD replaces its beta 2.2 stock with beta 1.2 stock, (of equal amount), what will be the new beta of his investment portfolio?