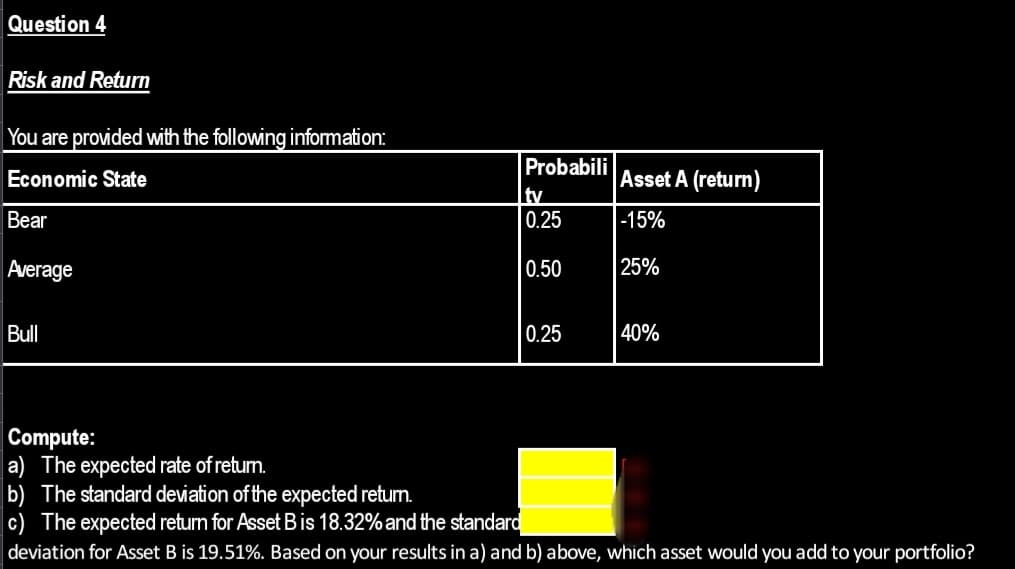

Compute: a) The expected rate of return. b) The standard deviation of the expected return. c) The expected return for Asset B is 18.32% and the standard deviation for Asset B is 19.51%. Based on your results in a) and b) above, which asset would you add to your portfolio?

Q: A professional investor that you know makes the following observation about the assets on his…

A: Hindsight bias is when the investor overestimates his predictive abilities and try to reason saying…

Q: Dave took out a $6200 loan at 14% and eventually repaid $10,540 (principal and interest). What was…

A: Future value of amount includes the original amount and amount of interest being accumulated over…

Q: Suppose a firm uses a constant WACC in determining the value of capital budgeting projects rather…

A: WACC is the weighted average return that a company pays over all its assets. The WACC of a company…

Q: What is the gain in Mexican peso value that the parent company (Space Mountain Rollercoasters) can…

A: We need to calculate exchange rates using 2 methods:IRP - Covered interest rate Parity. This is the…

Q: Mr. Abdullah is planning to invest $ 100,000 and looking for a good investment opportunity. that…

A: An individual faces several investment options. We need to advise the best investment option backed…

Q: The following certificate of deposit (CD) was released from a particular bank. Find the compound…

A: Future value of amount being accumulated over the period of time and amount of investment done…

Q: If a person deposits $3,000 at 6% per year simple interest, what compound interest rate would yield…

A:

Q: A local pension scheme collects contributions from its members each year end. The planned collection…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Miguel purchased a hot tub costing $5,070 by taking out an installment loan. He made a down payment…

A: APR (Annual Percentage Return) The rate of interest charged by a creditor on the amount lent or the…

Q: All else being constant, a bond will sell at __________ when the coupon rate is __________ the yield…

A: Bonds refer to investment securities in which money is to be lent to the company by an investor…

Q: If you owned a company, would you prefer the market value of its assets to rise $10million or the…

A: The fixed assets are the long-term assets that the company uses for more than a year. The assets…

Q: Q.4 Use present value analysis to determine which of the following three payment sequences would you…

A: In question 4 we need to choose the option that gives the highest PV. We need to calculate the PV of…

Q: On the basis of the data provided at question 3, what is your expected NPV if you invest $ 150 mi in…

A: NPV is a capital budgeting tool to decide on whether the capital project is useful or not. If NPV of…

Q: S Ltd. Has equity of Rs.6Lacs issued at par. The following additional information is provided: r . .…

A: Please find attachment below In step 2 balence sheet with working notes

Q: yield that Brian would earn by selling the bonds today? (Round answer to 2 dec !places, e.g. 15.25%)…

A: In simple words, yield is the rate of return that an investor earns in the form of interest or…

Q: 1. Practicing good financial management while still in college benefits you because: A. Budgets…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: You are looking at two investment options, A and B. Investment A is a 13-year annuity that needs an…

A: Compounding: Compounding is the method through which interest is added to both the principle balance…

Q: 2-7 SCENARIO ANALYSIS Huang Industries is considering a proposed project whose estimated NPV is $12…

A: As per the given information: Economic Scenario Probability of Outcome NPV Recession 0.05 ($70…

Q: Miguel purchased a hot tub costing $5,010 by taking out an installment loan. He made a down payment…

A: The APR is used for representing the interest rate paid on the outstanding loan balance. It takes…

Q: With an annual inflation rate of 1.57%, how much did an item that now costs $5700 cost 4 years…

A: Inflation rate is 1.57% Current Cost of Item is $5700 Time period is 4 years To Find: Cost of an…

Q: 2. At the end of the first month of operations for Glenniel's Delivery Service, the business had the…

A: Data given: Accounts Receivable= Php 1200 Prepaid insurance= Php 500 Equipment = Php 36,200 (It is…

Q: State Federal Bank (SFB) offers two borrowing options to businesses: (1) a simple interest loan with…

A: The effective annual rate refers to the rate of return that is arisen from the investment after…

Q: Determine for each, whether the interest parity condition holds or not, if E/€ = 1.10 (American…

A: Interest rate parity is a theory according to which the interest rate differential between two…

Q: Versalife has built up a strong balance sheet due to immunology related drugs and nanotechnology…

A: Fixed Rate Floating Rate Versalife 3.08% LIBBOR+0.7% The 'Ton Hotel 8.93% LIBBOR+1.74%

Q: Assume that each of these projects is independent and that each is just as risky as the firm’s…

A: Internal Rate of Return: It is a method of capital budgeting used to measure relative…

Q: Government of Canada three-month Treasury Bills and 2,000 Suncor shares. When the portfolio was…

A: After ignoring premium, payoff from: Long call = max (S - K, 0); Short call = - max (S - K, 0); long…

Q: PLEASE SKIP IF YOU ALREADY DID THIS OTHERWISE DOWNVOTE. THANK YOU

A: Your solution: The cost of capital for this project is 7%. The NPV for this project is P37,553. The…

Q: A warehouse was bought for PHP 10,000,000 downpayment and 15 quarterly payment of PHP 3,120,000…

A: Cash value is the total value of the asset including down payment and installment. It includes…

Q: FaceBook Inc. Twitter, Inc. Yahoo, Inc. LinkedIn Sales EBITDA Market Capitalization (US$ Millions)…

A: We have to apply the relative valuation using multiple parameters and then come up with an…

Q: 4. Thom J.A.M. Company has P80,000 to invest and is considering two different projects, Vlogging and…

A: The company evaluates two alternatives by comparing the net present value of projects. The company…

Q: [Determination of Selling Price] Question 18: The following data are obtained from the records of a…

A: I solved four parts in step 2 As per bartleby guidelines we are allowed 3 parts only I answered…

Q: On October 31, Year 1, Trailer Homes Company (THC) determines that it will need to buy 175,000 lbs…

A: With the strike price (X) and the market spot price (S) at forward date when trading take place. Net…

Q: onsider the pricing of a futures contract on copper. What would you expect to happen if storage…

A: Future contracts are to be settled after some period of time but they derive their value from the…

Q: Question 3: A manufacturing Co. Ltd. opens the costing records, with the balances as on 1 April,…

A:

Q: Suppose the price of a share of Google stock is $500. An April call option on Google stock has a…

A: Call Option:- Call option means right to buy in future at price decided at intianial date.

Q: We have a three-month forward rate agreement (FRA) with underlying 90 day LIBOR starting on Jan 1,…

A: In valuation of FRA and in implementing FRA formula, following time line should be considered.

Q: 4. Thom J.A.M. Company has P80,000 to invest and is considering two different projects, Vlogging and…

A: Net present value(NPV) of the project is calculated using following equation NPV = -CF0 +…

Q: A property was purchased 5 years ago for $1mil and provided NOI of $70,000 in Year 1, increasing at…

A: Purchase price of the property five years ago (P0) = $1,000,000 NOI for year 1 (NOI1) = $70,000 NOI…

Q: ZULU Mortgagors offers houses for sale on mortgage terms of 50% down payment of the property value…

A: Value of the house is K450,000,000 Down payment is 50% Interest rate is 8.2% Time period is 4 years…

Q: You, a foreign exchange dealer of your bank, are informed that your bank has sold a T.T. on…

A: Arbitrage profit caliculated in step 2

Q: a mother earned $15000.00 from royalties on her cookbook. She set aside 20% of this for a down…

A: Amount earned in royalties is $15,000 Amount set aside is 20% Amount invested is 15000×1-20%=…

Q: Assume the U.S. official Net International Investment Position (NIIP) at the end of 2020 was minus…

A: Investment refers to an asset that is invested for building wealth and saving money from the…

Q: Canuck Oil Corporation is a Canadian crude oil producer. Today is July 15. Canuck’s estimated oil…

A: 1. Canuck Oil is producer of oil. If the prices of oil keeps fluctuating then they won't be able to…

Q: Petfeed plc has outstanding, a high yield Bond with following features: Face Value £ 10,000 Coupon…

A: Answer to Part 1) 10923 Part 2) 1742

Q: Stufful Corporation currently manufactures a subassembly for its main product. The costs per unit…

A: Whenever business has more than one alternative, it should choose that alternative which has maximum…

Q: 3) A savings bonds pay 3% annual real rate of return compounded daily. Professor John Jones invests…

A: The purchasing power of a currency is the number of products or services that one unit of money can…

Q: estion 6/14 ssume that 12 payments of $9,000 each are to be repaid monthly at the end of each onth.…

A: As per the given information: Number of payments - 12Amount of payments - $9,000Effective monthly…

Q: Your company has 50 million shares trading at a price of $80, and perpetual debt with face value of…

A: A Bond refers to a concept that is defined as an instrument that represents the loan being made by…

Q:

A: State A B Probability Normal 25% 13% 40% Recession 8% 9% 60% Weight 60% 40%

Q: mind map’

A: The preparation and use of the most important requirements and equipment to protect passengers and…

Step by step

Solved in 4 steps with 3 images

- 6.Calculate the project's Modified Internal Rate of Return (MIRR). What critical assumption does the MIRR make that differentiates it from the IRR? TIP : look for the definition of Modified Internal Rate of Return, and then do it in excel, easy !!! Year Net Cash flow Future Value of Net Cash flow 0 -$20.8 example 1 $4.5 $7.97 (n=6, i=10%)=fv(.1,6,,4.5) 2 $6.3 (n=5, i=10%) 3 $5.2 (n=4, i=10%) 4 $3.9 (n=3, i=10%) 5 $2.1 (n=2, i=10%) 6 $1.3 (n=1, i=10%) 7 $0.5 (n=0, i=10%) Sum = $XX.XX MIRR = ( in excel ) Rate ( 7,-20.8, xx.xx) 7.Where does the value of MIRR fall relative to the discount rate and IRR?Compute the expected rate of return on investment i given the followinginformation: Rf = 8%; E(RM) = 14%; βi = 1.0.b. Recalculate the required rate of return assuming βi is 1.8.Q11. n is the number of periods of an investment, PV is the starting value, FVn is the future value n periods ahead, and ^ means 'to the power of'. What is the correct formula for calculating return? Group of answer choices 1. (FVn/PV)^n - 1 2. (FVn/PV)^n 3. (PV/FVn)^n - 1 4. 1 - (FVn/PV)^n

- Compute the expected rate of return on investment i given the followinginformation: Rf = 8%; E(RM) = 14%; βi = 1.0.b. Recalculate the required rate of return assuming βi is 1.8.25. a. Compute the expected rate of return on investment i given the followinginformation: the market risk premium is 5%; Rf = 6%; βi = 1.2.b. Compute E(RM)Compute the expected rate of return on investment i, given the following information: Rf=9%; CAPM=14%; beta i=1.0. Recalculate the required rate of return assuming beta i is 1.5For investment A, the probability of the return being 20.0% is 0.5, 10.0% is 0.4, and -10.0% is 0.1 Compute the standard deviation for the investment with the given information. (Round your answer to one decimal place.) a. 85.00% b. 15.00% c. 34.00% d. 17.00% e. 9.00%

- Question 2: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?Q25 Following are three economic states, their likelihoods, and the potential returns: Economic State Probability Return Fast growth 0.3 40 % Slow growth 0.4 10 Recession 0.3 –25 Determine the standard deviation of the expected return. (Do not round intermediate calculations and round your answer to 2 decimal places.) STANDARD DEVIATION. %(iii) M/S Azra and Co. analyzed a project as follow: 05 NPV is Rs. 57631 at 24% discount rateNPV is Rs. (-) 38014 at 28% discount rateDetermine the internal rate of return of the project.

- Question D is required. Thank you. d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standard deviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also has standard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whether asset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i ( , where are standard deviations of asset i and market portfolio, is the correlation between asset i and the market portfolio)Considering the following information gathered: State of Economy Probability of State of Economy Rate of Return if State Occurs Recession 0.11 -0.03 Normal 0.45 0.16 Boom 0.44 0.29 Please Calculate the expected return. Multiple Choice 18.65% 2.80% 19.63% 20.61% 20.42%Consider the investment project with net cash flows shown. There are 2 rates of return for the project. One is 43.47%. What is the other? Enter as a percentage without the percent sign. For instance, if your answer is 10.23%, enter as 10.23. n Net Cash Flow 0 -$8000 1 $10000 2 $30000 3 -$40000