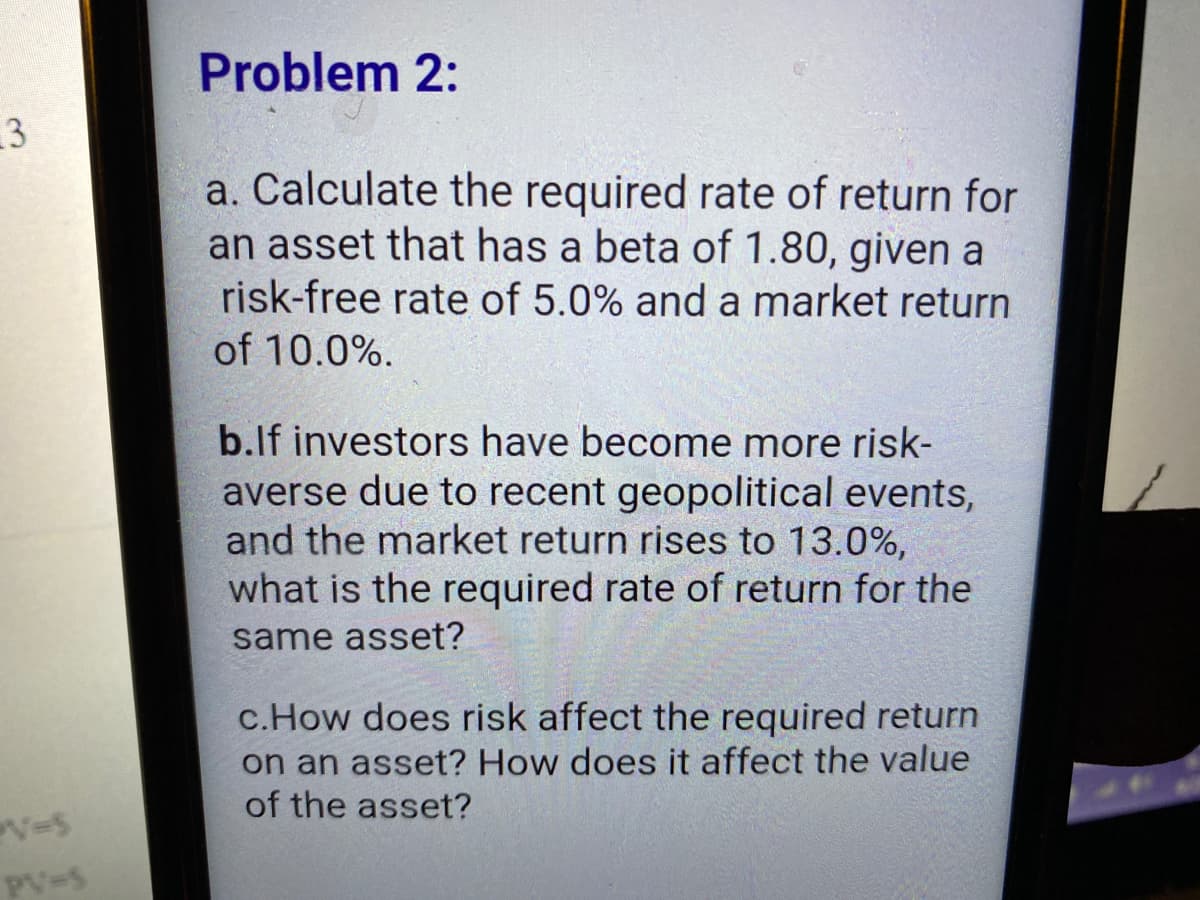

a. Calculate the required rate of return fo an asset that has a beta of 1.80, given a risk-free rate of 5.0% and a market retur of 10.0%. b.lf investors have become more risk- averse due to recent geopolitical events, and the market return rises to 13.0%, what is the required rate of return for the same asset? c.How does risk affect the required return on an asset? How does it affect the value of the asset?

Q: Compute the expected rate of return on investment i given the followinginformation: Rf = 8%; E(RM) =…

A: Expected rate of return is the minimum return which the investors would require for investing in a…

Q: Which of the following statements is TRUE? O A. If the risk-free rate is 1.5% and the market risk…

A: Capital Asset Pricing Model: According to the Capital Asset Pricing Model (CAPM), the link between…

Q: You estimate of the market risk premium is 7%. The risk-free rate of return is 3.1 % and General…

A: In the given question we are require to calculate the expected return of General Motors from the…

Q: Asset Y has a beta of 1.2. The risk-free rate of return is 6 percent, while the return on the market…

A: In this question we need to compute the asset's market risk premium. We can solve this question…

Q: Security X has an expected rate of return of 13% and a beta of 1.15. The risk-free rate is 5% and…

A: Overpriced securities are those securities whose required rate of return is more than the expected…

Q: Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of…

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at…

Q: You invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation…

A: Given: Expected return of risky asset(A) = 17% Return of T-bill (B) = 4% So, Expected return of…

Q: Puji International Freight Company (PIFC) wishes to determine the required return on Asset J, which…

A: Hi, since the question has multiple sub-parts, we will answer the first three sub-parts,as per…

Q: Assume a risky asset has a mean return of us = 0.05 and volatility of gs = 0.1 and the risk-free…

A: Given, Risky Asset Mean returns are 5 % & volatility is 0.1 Risk Free Asset Mean returns are…

Q: An investor owns a portfolio of assets that willl generate a cash flow of $445 with prob. 0.25,…

A: Benefit function: b(x) = x^0.5 Let the lowest acceptable price = P

Q: ider an asset with a beta of 1.2, a risk-free rate of 4.3%, and a market return of 12%. What is the…

A: Given, Beta = 1.2 Risk free rate = 4.3% Market return = 12%

Q: Within the context of the capital asset pricing model (CAPM), assume: ∙ Expected return on the…

A: The capital asset pricing model is a financial technique that helps to determine the return required…

Q: Suppose that the rate of return on risky assets is given by the following single factor model: ri =…

A: Meaning of Arbitrage Pricing Theory Arbitrage pricing theory (APT ) was basically developed to…

Q: Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of…

A: The capital asset pricing model describes the relationship between systematic risk and the expected…

Q: Suppose that there are two assets: A and B. Asset A has expected return of 20%. B has expected…

A: Hello since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Consider a two period economy with a risk free asset yielding a net return r>0 in period 2 and an…

A: The investors in the stock market have different approaches. Some investors are risk-takers, some…

Q: Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns…

A: To calculate expected return CAPM is used. CAPM stands for capital asset pricing model.

Q: What is the expected risk-free rate of return if asset X, with a beta of 1.5, has an expected return…

A: The risk free rate of return can be calculated with the help of CAPM equation

Q: Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns…

A:

Q: Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns…

A:

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: Security market line (SML) represents the graphical outcome of Capital asset pricing Model (CAPM).…

Q: An investor owns a portfolio of assets that will generate a cash flow of $445 with prob. 0.25,…

A: A portfolio is a collection of financial investments that may include closed-end funds and exchange…

Q: Suppose the risk-free rate is 5%. The expected return and standard deviation of a risky asset are…

A: Expected return (Re) = 10% Risk free rate (Rf) = 5% Standard deviation (SD) = 20%

Q: Suppose the CAPM is true. Consider two assets, X and Y, and the market M. Suppose cov(X,M) = .3,…

A: Honor code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Suppose that a two-factor model, where the factors are the market return and the growth rate of…

A: With risk premium of factor 1 (RP1), risk premium of factor 2 (RP2), sensitivity of portfolio to…

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: SML means security market line. CAPM means capital asset pricing model.

Q: Puji International Freight Company (PIFC) wishes to determine the required return on Asset J, which…

A: Asset Risk: In the context of investments, investment risk may be described as the possibility or…

Q: Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns…

A: The question is based on the concept of capital asset pricing model (CAPM) , the model used to…

Q: a. If the market return increased by 13%, what impact would this change be expected to have on the…

A: Capital asset pricing model (CAPM) is a model or method which is used by the company to define the…

Q: Your opinion is that CSCO has an expected rate of return of 0.1375. It has a beta of 1.3. The…

A: Given, CSCO Expected rate of return = 0.1375 Beta = 1.3 Risk Free Rate = 0.04 Market expected…

Q: Assume that the short-term risk-free rate is 6%, the market index S&P500 is expected to pay returns…

A: Excel Spreadsheet:

Q: Suppose there are only three assets (A, B, and C) in a market. Given the following information:…

A: Formula for expected return of the portfolio will be:

Q: The CAPM states that the expected (required) return on an asset is : E(Ri)=Rf+βi[E(RM)−Rf] where…

A: The Market portfolio will be reflective of a portfolio which has completely eliminated all the…

Q: (SINGLEJ Your opinion is that ABF has an expected rate of return of -10%. It has a beta of 1.1. The…

A: given information expected rate of return = -10 risk free rate = 1% beta = 1.1 market expected rate…

Q: Use the basic equation for the CAPM to rework each of the following problems for above case. Case…

A: The Capital Asset Pricing Model (CAPM) describes the link between systematic risk and expected…

Q: Assume that the expected rates of return and the beta coefficients of the alternatives supplied by…

A: Beta coefficient is a relative risk measure. It measures and indicates risk of a particular security…

Q: a. Calculate the required rate of return for an asset that has a beta of 1.8, given a risk-free rate…

A: Investors have different options to make investments, and the motive behind investments is to…

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: we will only answer the first three subparts. For the remaining subparts kindly resubmit the…

Q: d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay…

A:

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: 1.) Beta E(R)= RF +betaX(RM-RF) 0 5.00% 0.1 5.40% 0.2 5.80% 0.3 6.20% 0.4 6.60% 0.5…

Q: Puji International Freight Company (PIFC) wishes to determine the required return on Asset J, which…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: We believe that the single factor model can predict any individual asset’s realized rate of return…

A: Here, A B β 1.2 0.8 E(r) 0.1 0.08

Q: a. Suppose an investor is appraising an investment under the following conditions: Forecast NPV Pi…

A: Given: Forecast Pi NPV 1 0.15 $30,000.00 2 0.15 $20,000.00 3 0.5 $15,000.00 4 0.2…

Q: The asset's market risk premium is

A: Market risk premium = Return on market portfolio - Risk free rate of return

Q: What is the expected return on asset A if the expected return on the market is 8%, the risk-free…

A: Data given: Expected return on the market = 8% Risk-free rate = 4% Beta of asset A = 2 Formula…

Q: Within the context of the capital asset pricing model (CAPM), assume:∙ Expected return on the market…

A: Capital asset pricing model (CAPM) represents the relationship between the risk and return of an…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

- Question 2: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?a. Calculate the required rate of return for an asset that has a beta of 1.19, given a risk-free rate of 2.7% and a market return of 8.9%. b. If investors have become more risk-averse due to recent geopolitical events, and the market return rises to 12.1%, what is the required rate of return for the same asset?Calculate the required rate of return for an asset that has a beta of 1.01, given a risk-free rate of %3.4 and a market return of %9.1 . b. If investors have become more risk-averse due to recent geopolitical events, and the market return rises to %11.6, what is the required rate of return for the same asset? a. The required rate of return for the asset is enter your response here%. (Round to two decimal places.) Part 2 b. If investors have become more risk-averse due to recent geopolitical events, and the market return rises to 11.6%, the required rate of return for the same asset is enter your response here%. (Round to two decimal places.)

- Puji International Freight Company (PIFC) wishes to determine the required return on Asset J, which has a beta of 1.75. The risk-free rate of return is 6.4% and the return on the market portfolio of assets is 10.8%. Suppose PIFC is also considering investing in asset K, which has a beta of 1.8. Is there a market premium or market discount? Justify your answer. Determine the required return of assets J and K. Show your solutions. Interpret your answer. Graph the Security Market Line for both assets. Between assets J and K, can you determine which has more total risk and which has more market risk? Determine which stock has a higher cost of equity capital. If you are the financial consultant of PIFC, what will be your investment strategy?Question 2: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Draw the security market line (SML) Use the CAPM to calculate the required return, on asset A. Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?Question 2: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Draw the security market line (SML) Use the CAPM to calculate the required return, on asset A. Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. Step 1 Security market line (SML) is a graphical representation of how the approach of the capital asset pricing model (CAPM) operates. SML represents the combination of risk-free return, market return, and beta to depict the expected return of the security. CAPM is a financial approach that helps to determine the expected return of security by creating a relationship between the systematic risk associated with the security and returns of assets. Expected return on a stock is the…

- Question D is required. Thank you. d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standard deviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also has standard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whether asset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i ( , where are standard deviations of asset i and market portfolio, is the correlation between asset i and the market portfolio)Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10. (could be done on word document or excel). Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?The risk-free rate is currently 3.3%, and the market return is 14.8%. Assume you are considering the following investments: Investment Beta A 1.54 B 1.16 C 0.51 D 0.11 E 2.14 . a. Which investment is most risky? Least risky? b. Use the capital asset pricing model (CAPM) to find the required return on each of the investments. c. Find the security market line (SML), using your findings in part b. d. On the basis of your findings in part c, what relationship exists between risk and return? Explain.

- Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has a beta, of 1.10 a) Draw the security market line (SML) b) Use the CAPM to calculate the required return, on asset A. c) Assume that as a result of recent economic events, inflationary expectations have declined by 3%, lowering RF and RM to 5% and 9%, respectively. Draw the new SML on the axes in part a, and calculate and show the new required return for asset A. d) Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 2%, to be14%. Ignoring the shift in part c, draw the new SML on the same set of axes that you used before, and calculate and show the new required return for asset A. e) From the previous changes, what conclusions can be drawn about the impact of (1) decreased inflationary expectations and (2) increased risk aversion on the required returns of risky assets?A firm wishes to assess the impact of changes in the market return on an asset that has a beta of 1.1. a. If the market return increased by 13%, what impact would this change be expected to have on the asset's return? b. If the market return decreased by 9%, what impact would this change be expected to have on the asset's return? c. If the market return did not change, what impact, if any, would be expected on the asset's return? d. Would this asset be considered more or less risky than the market?The risk-free rate of return is 2.5% and the market risk premium is 8%. Rogue Transport has a beta of 2.2. Using the capital asset pricing model, what is Rogue Transport's cost of retained earnings? a.20.1% b.19.6% c.17.7% d.16.4%