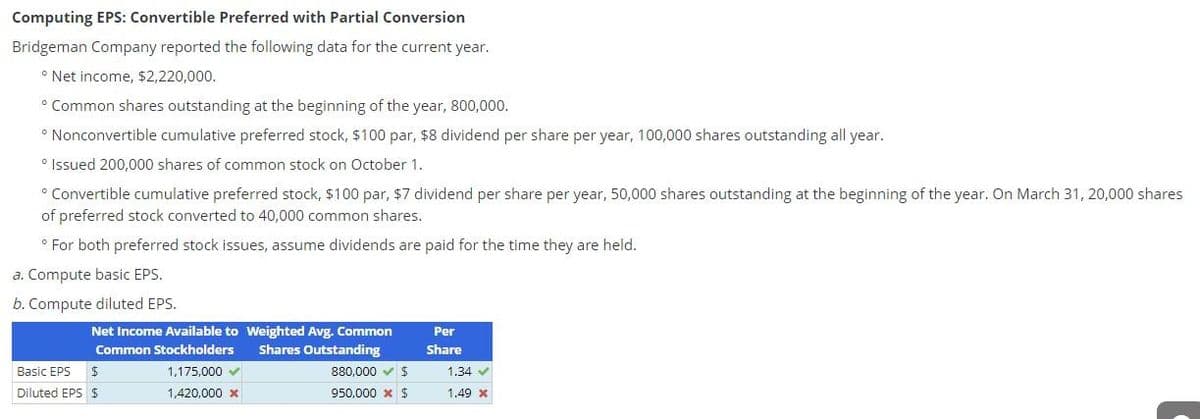

a. Compute basic EPS. b. Compute diluted EPS.

Q: Statement of Cost of Goods Manufactured for a Manufacturing Company Cost data for Johnstone…

A: The statement of cost of goods manufactured is prepared to record the cost of goods that are…

Q: Vista Company manufactures electronic equipment. In 2021, it purchased from an outside supplier the…

A: The break-even point is reached when overall costs and total revenues are equal, leaving your small…

Q: Inventory Costing Methods-Periodic Method The following information is for the Bud Company; the…

A: First-in-First-out Method - Under this method inventory that is brought at the earlier date is sold…

Q: 2. Weightless Inc. produces a Bath and Gym version of its popular electronic scale. The anticipated…

A: Production Budget :— This budget is prepared to estimate the number of units to be produced during…

Q: Define the following term using 1 or 2 complete sentences (not just key words). Cost-Plus Contract

A: There are many types of contracts and it depends on the nature of work type of contract is…

Q: The Institute of Management Accountants issues which certification? OA. CFE B. O C. CIA O D. CPA CMA

A: Institute of management accounting is central body in United states of America and provides and…

Q: The management of Nixon Corporation is investigating purchasing equipment that would cost $540,000…

A: A simple rate of return can be calculated by dividing the net income by total assets. It indicates…

Q: Jurassic Jumpers Co. (JJ Co.) offers bungee jumping for those looking for an extreme outing. JJ Co.…

A: Adjusting Entries Date General Journal Debit Credit 31-Dec…

Q: A machine has a first cost of P88,155.25 and has an expected salvage value after 10 years…

A: Declining balance method : Under this method , depreciation is charged a fixed percentage on the…

Q: Under the cash receipts method, which of the following is true (mark all that apply): OA. The cash…

A: Payment receipts are recorded in the period in which they are received when using the cash…

Q: The only long-term liability of Range Corporation is a note payable for $1 million secured by a…

A: The financial commitments of a corporation that are due more than a year from now are known as…

Q: What are the differences between a direct-financing and a sales-type lease for a lessor? Why would a…

A: First of all, let us understand the concepts of lessor and lessee. So essentially, a lessor is de…

Q: mison'srelevant range is sales of between$120,000 and $630,000. Prepare contribution margin…

A: Solution... Contribution margin Ratio = Contribution margin / sales = $315,000 / $525,000 =…

Q: 10 (Algo) Computing break-even LO P2 hao Company has fixed costs of $429,000. Its single product…

A: Answer : Break even point in Units : Break even point in Units = Fixed cost / Contribution margin…

Q: Kesterson Corporation has provided the following information: Cost per Unit Cost per Period…

A: Lets understand the basics. Overhead is total of indirect costs. In other words all indirect…

Q: Required Write a memo explaining why one company's P/E ratio may be higher than another company's…

A: Introduction: The price/earnings ratio reveals investors how much a company is worth. The P/E ratio…

Q: 1. Capital structure is important as it helps maintains a proper and adequate level of capital,…

A: Capital Structure refers to a specific combination of debt and equity used by a company for…

Q: Income/compensation Jaime an apprentice chef, slices his index finger off during we $5,000 Jaime is…

A: There is need for the taxes to paid on the money received but some are exempted and some are not…

Q: Following is a table for the present value of $1 at compound interest: Year 6% 10% 1 0.943 0.909 2…

A: The present value of a single future value amount is calculated by the following formula: If the…

Q: What is fraud?

A: Fraud can be defined as gaining or acquiring something illegally by deceiving someone intentionally.…

Q: Richard has been a highly regarded employee of the Brier Corporation for almost 20 years. Her…

A: Accounting fraud is the deliberate manipulation of financial records to provide the impression that…

Q: Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars):…

A: WACC is the Weighted Average Cost of Capital. It means the average tax cost of capital from all the…

Q: AP Shruti Shrills is considering an expansion of one of its existing buildings to add more…

A: The question is based on the concept of Financial Management. Payback period is period in which the…

Q: Which is not one of Adam Smith's canons (principles) of taxation OA. Economy in collection B.…

A: * As per Bartleby policy, if two different questions are asked then to answer first only. The four…

Q: On September 1, Year 1, Test Company purchased 2,000 shares of A Company common stock for $25 per…

A: Here are the journal entries related to the investment for easier understanding:

Q: Sidney is a car salesman. As a result of being the best salesman for the year, his employer permits…

A: Answer:- Income meaning:- The phrase "income" often refers to the total sum of cash, assets and…

Q: What is fraud?

A: Misstatement risk: It implies to a risk that the financial statements of the company are…

Q: Nov. 30, 2024: ClassicCard collected the fees for the month of November. Assume the November 15 tr…

A: Journal entries are the first step in recording financial transactions. It's based on the double…

Q: Prepare the journal entries necessary to record the receipt of the note by Hooper, the accrual of…

A: A note receivable is a promissory note form in which one person promises to pay the money to another…

Q: The costs incurred on jobs that are currently in production but are not yet complete would appear in…

A: Work-in-Process is used to refer to such goods which are partially complete. Finished Goods are…

Q: Example: Marginal Vs. Average Rates Suppose your firm earns $4 million in taxable income. What is…

A: The average tax rate is the total tax paid divided by taxable income. While marginal tax rates show…

Q: Pestiferous Manufacturing produces a chemical pesticide and uses process costing. There are three…

A: EQUIVALENT UNITS OF PRODUCTION Equivalent units of production is Computed by multiply the…

Q: A machine has an initial cost of P91,123.71 and a salvage value of P14,839.26 after 7 years. What is…

A: Total Depreciation under Straight Line Depreciation = Annual Depreciation x No. of years Annual…

Q: Which of the following circumstances will cause sales to fixed assets to be abriprmally low? OA. A…

A: Sales to Fixed Asset is calculated by dividing sales by average fixed assets. It indicates how well…

Q: A machine costing $210,200 with a four-year life and an estimated $19,000 salvage value is installed…

A: Depreciation per annum as per straight line method = (Cost - Salvage value)/Useful life

Q: Which of the following indicates that a decision has precedential value for future cases?

A: Temporary book-tax differences arise when there is a difference between the amount of income or…

Q: 4. Assume that Crimbring opted to carry this note at its fair value. What should be the value of the…

A: Journal entry refers to the entries which are made at the end of the period and it records the daily…

Q: M & M Foods 2010 2011 Sales $5,831 $6,423 COGS 3,670 4,109 Interest 291 280 Depreciation 125 122…

A: INCOME STATEMENT Income statement is one of the important financial statement of the Company. It…

Q: Socks Unlimited produces sports socks. The company has fixed expenses of $85,000 and variable…

A: CONTRIBUTION MARGIN Contribution margin per unit is computed by deducting Total Variable Cost per…

Q: Explain the following and Include atleast two references. A: The significance of audit data…

A: An audit is an independent review of the books of accounts for a specific period (i.e., a specific…

Q: Assume a company that uses activity-based costing (ABC) has only two products – A and B. The company…

A: Solution: Overhead cost of setup activity cost pool = Total nos of setups * activity rate per setup…

Q: An invoice for $9156.86 is dated June 23, 2022 with terms 4/10, 2/20, n/60 ROG. The goods are…

A: Here 4/10 means 4% discount will be given if payment is made with in 10 days.

Q: Manatee Corporation purchased a special conveyor system on December 31, 2025. The purchase agreement…

A: Present value: It implies to the current valuation of a future stream of cash flows, discounted at a…

Q: There are some excellent free personal finance apps available: Mint.com, GoodBudget, Mvelopes,…

A: A note is a formal instrument that expresses an obligation to repay a debt to a creditor or an…

Q: Your office is on the 68th floor of your building. The CEO’s office is on the 77th floor. The two of…

A: The modifications to the inventory valuation technique must be true and legitimate. If a…

Q: The controller of Crane Production has collected the following monthly cost data for analyzing the…

A: The high-low method is used to differentiate the mixed cost. The mixed cost is the combination of…

Q: controversy, the ipany initiated light of esting system follow: Activity Cost Pool Removing asbestos…

A: First stage allocation of cost to activity cost pools is based on total cost and percentage of usage…

Q: Peking Palace reported the following: Standard hours per unit 1.5 hrs. Standard rate per hour…

A: The question is based on the concept of Cost Accounting. Direct labor time variance is calculated by…

Q: Advertising of a specific product is an example of O A. batch-level costs. O B. product-sustaining…

A: Batch level costs are those costs which are associated with the units which are produced in the…

Q: Assume the following information for Skysong Corp. Accounts receivable (beginning balance) Allowance…

A: Writing off Uncollectible Receivables: Eliminating an uncollectible accounts receivable from the…

PLEASE HELP ME

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

- Given the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.Preferred Dividends Eastern Inc.s equity includes 8%, $25 par preferred stock. There are 100,000 shares authorized and 45,000 shares outstanding. Assume that Eastern declares and pays preferred dividends quarterly. Required: Prepare the journal entry to record declaration of one quarterly dividend. Prepare the journal entry to record payment of the one quarterly dividend.COMMON AND PREFERRED CASH DIVIDENDS Ramirez Company currently has 100,000 shares of 1 par common stock outstanding and 5,000 shares of 50 par preferred stock outstanding. On July 10, the board of directors declared a semiannual dividend of 0.30 per share on common stock to shareholders of record on August 1, payable on August 5. On July 15, the board of directors declared a semiannual dividend of 5 per share on preferred stock to shareholders of record on August 5, payable on August 10. Prepare journal entries for the declaration and payment of the common and preferred stock cash dividends.

- Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Treasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.Issuances of Stock Cada Corporation is authorized to issue 10,000 shares of 100 par, convertible, callable preferred stock and 80,000 shares of no-par, no-stated value common stock. There are currently 7,000 shares of preferred and 30,000 shares of common stock outstanding. The following are several alternative transactions: 1. Purchased land by issuing 640 shares of preferred stock and 1,000 shares of common stock. Preferred and common are currently selling at 113 and 36 per share, respectively, No reliable appraisal of the land is available. 2. Same as Transaction 1, except that land is appraised at 104,000, and the preferred stock has no current market value. 3. Issued, for 99,000 cash, a combination of 400 shares of preferred stock and bonds payable with a face value of 50,000. Currently, the preferred stock is selling for 120 per share and the bonds at 104. 4. Same as Transaction 3, except that the bonds do not have a current market value. 5. Same as Transaction 3, except that the preferred stock does not have a current market value. 6. Preferred shareholders (who had originally paid the corporation 110 per share for their stock) convert 6,500 preferred shares into 19,500 shares of common stock. The current market prices of the preferred stock and the common stock are 120 and 41 per share, respectively. 7. The corporation calls the 7,000 shares of preferred stock (originally issued at 110 per share) at 123 per share. Common stock is currently selling for 42 per share. Shareholders elect not to convert into common stock. 8. Same as Transaction 7, except that shareholders owning 2,000 shares of preferred stock elect to convert each share into 3 shares of common stock The remaining 5,000 preferred shares are retired. Required: Next Level Prepare the journal entry necessary to record each transaction. Below each entry, explain your reason for the values used.

- Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. Preferred stock subscriptions receivable 50,000 Preferred stock, 10 par, 9% (200,000 shares authorized; 20,000 shares issued)200,000 Preferred stock subscribed (10,000 shares)100,000 Paid-in capital in excess of parpreferred stock40,000 Common stock, 10 par (100,000 shares authorized; 60,000 shares issued)600,000 Paid-in capital in excess of parcommon stock250,000 Retained earnings750,000 During 20--, Gonzales Company completed the following transactions affecting stockholders equity: (a) Received 20,000 for the balance due on subscriptions for 4,000 shares of preferred stock with a par value of 40,000 and issued the stock. (b) Purchased 10,000 shares of common treasury stock for 18 per share. (c) Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d) Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e) Sold 5,000 shares of common treasury stock for 100,000. (f) Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g) Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.STOCK SUBSCRIPTIONS Juneau Associates had the following stock transactions during the year: (a) Received subscriptions for 100,000 shares of 1 par common stock for 105,000. (b) Received subscriptions for 5,000 shares of 15 par, 8% preferred stock for 80,000. (c) Received a payment of 55,000 on the common stock subscription. (d) Received a payment of 40,000 on the preferred stock subscription. (e) Issued 40,000 shares of 1 par common stock in exchange for a truck with a fair market value of 48,000. (f) Received the balance in full for the common stock subscription and issued the stock. (g) Received the balance in full for the preferred stock subscription and issued the stock. REQUIRED Prepare general journal entries for these transactions, identifying each by letter.Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. (a)Received 20,000 for the balance due on subscriptions for preferred stock with a par value of 40,000 and issued the stock. (b)Purchased 10,000 shares of common treasury stock for 18 per share. (c)Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d)Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e)Sold 5,000 shares of common treasury stock for Si00,000. (f)Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g)Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.