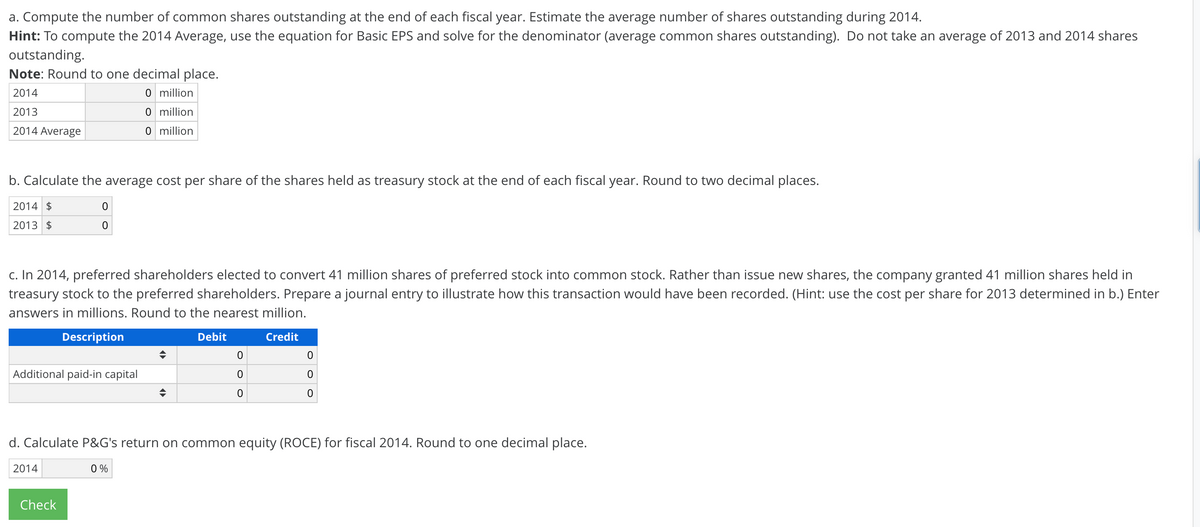

a. Compute the number of common shares outstanding at the end of each fiscal year. Estimate the average number of shares outstanding during 2014. Hint: To compute the 2014 Average, use the equation for Basic EPS and solve for the denominator (average common shares outstanding). Do not take an average of 2013 and 2014 shares outstanding. Note: Round to one decimal place. 2014 O million 2013 O million 2014 Average O million b. Calculate the average cost per share of the shares held as treasury stock at the end of each fiscal year. Round to two decimal places. 2014 $ 2013 $ c. In 2014, preferred shareholders elected to convert 41 million shares of preferred stock into common stock. Rather than issue new shares, the company granted 41 million shares held in treasury stock to the preferred shareholders. Prepare a journal entry to illustrate how this transaction would have been recorded. (Hint: use the cost per share for 2013 determined in b.) Enter answers in millions. Round to the nearest million. Description Debit Credit Additional paid-in capital d. Calculate P&G's return on common equity (ROCE) for fiscal 2014. Round to one decimal place. 2014 0 % Check

a. Compute the number of common shares outstanding at the end of each fiscal year. Estimate the average number of shares outstanding during 2014. Hint: To compute the 2014 Average, use the equation for Basic EPS and solve for the denominator (average common shares outstanding). Do not take an average of 2013 and 2014 shares outstanding. Note: Round to one decimal place. 2014 O million 2013 O million 2014 Average O million b. Calculate the average cost per share of the shares held as treasury stock at the end of each fiscal year. Round to two decimal places. 2014 $ 2013 $ c. In 2014, preferred shareholders elected to convert 41 million shares of preferred stock into common stock. Rather than issue new shares, the company granted 41 million shares held in treasury stock to the preferred shareholders. Prepare a journal entry to illustrate how this transaction would have been recorded. (Hint: use the cost per share for 2013 determined in b.) Enter answers in millions. Round to the nearest million. Description Debit Credit Additional paid-in capital d. Calculate P&G's return on common equity (ROCE) for fiscal 2014. Round to one decimal place. 2014 0 % Check

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.12AMCP

Related questions

Question

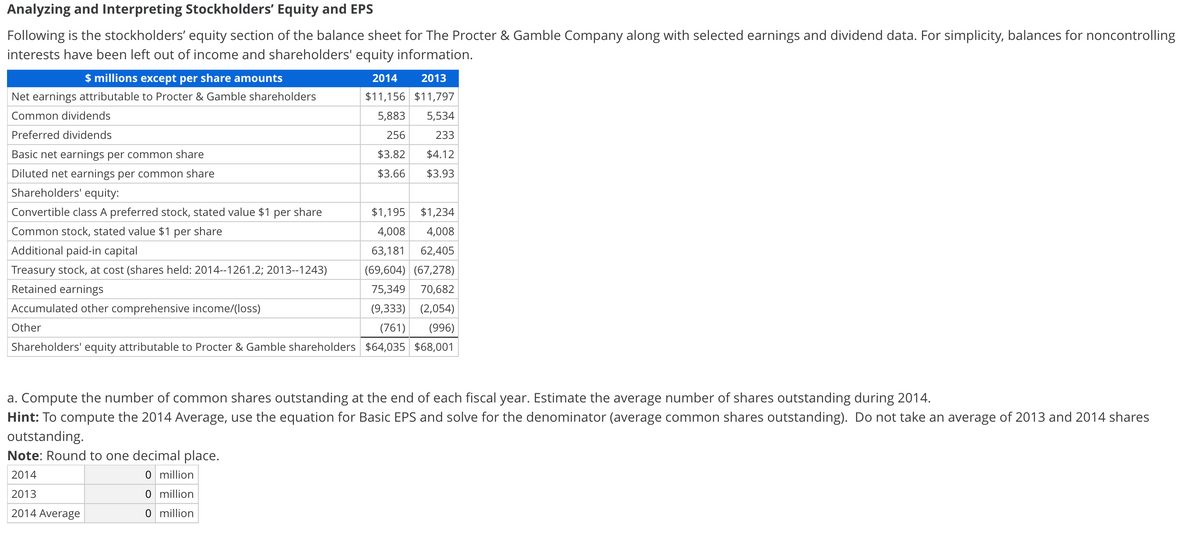

Transcribed Image Text:Analyzing and Interpreting Stockholders' Equity and EPS

Following is the stockholders' equity section of the balance sheet for The Procter & Gamble Company along with selected earnings and dividend data. For simplicity, balances for noncontrolling

interests have been left out of income and shareholders' equity information.

$ millions except per share amounts

2014

2013

Net earnings attributable to Procter & Gamble shareholders

$11,156 $11,797

Common dividends

5,883

5,534

Preferred dividends

256

233

Basic net earnings per common share

$3.82

$4.12

Diluted net earnings per common share

$3.66

$3.93

Shareholders' equity:

Convertible class A preferred stock, stated value $1 per share

$1,195

$1,234

Common stock, stated value $1 per share

4,008

4,008

Additional paid-in capital

63,181

62,405

Treasury stock, at cost (shares held: 2014--1261.2; 2013--1243)

(69,604) (67,278)

Retained earnings

75,349

70,682

Accumulated other comprehensive income/(loss)

(9,333) (2,054)

Other

(761)

(996)

Shareholders' equity attributable to Procter & Gamble shareholders $64,035 $68,001

a. Compute the number of common shares outstanding at the end of each fiscal year. Estimate the average number of shares outstanding during 2014.

Hint: To compute the 2014 Average, use the equation for Basic EPS and solve for the denominator (average common shares outstanding). Do not take an average of 2013 and 2014 shares

outstanding.

Note: Round to one decimal place.

2014

0 million

2013

0 million

2014 Average

0 million

Transcribed Image Text:a. Compute the number of common shares outstanding at the end of each fiscal year. Estimate the average number of shares outstanding during 2014.

Hint: To compute the 2014 Average, use the equation for Basic EPS and solve for the denominator (average common shares outstanding). Do not take an average of 2013 and 2014 shares

outstanding.

Note: Round to one decimal place.

2014

0 million

2013

0 million

2014 Average

0 million

b. Calculate the average cost per share of the shares held as treasury stock at the end of each fiscal year. Round to two decimal places.

2014 $

2013 $

c. In 2014, preferred shareholders elected to convert 41 million shares of preferred stock into common stock. Rather than issue new shares, the company granted 41 million shares held in

treasury stock to the preferred shareholders. Prepare a journal entry to illustrate how this transaction would have been recorded. (Hint: use the cost per share for 2013 determined in b.) Enter

answers in millions. Round to the nearest million.

Description

Debit

Credit

Additional paid-in capital

d. Calculate P&G's return on common equity (ROCE) for fiscal 2014. Round to one decimal place.

2014

0 %

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning