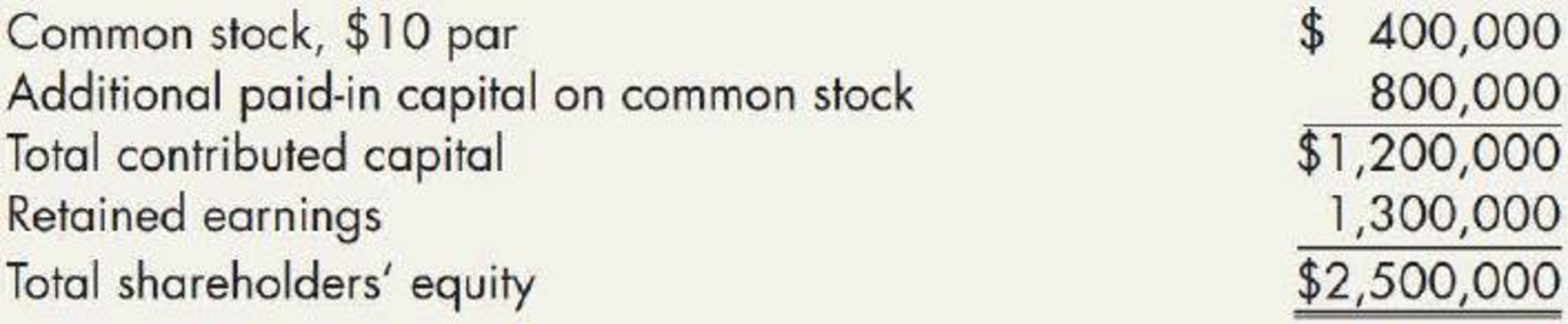

Stock Dividend Comparison Although Oriole Company has enough

Required:

- 1. Assuming a 15% stock dividend is declared and issued, prepare the shareholders’ equity section immediately after the date of issuance.

- 2. Assuming, instead, that a 30% stock dividend is declared and issued, prepare the shareholders’ equity section immediately after the date of issuance.

- 3. Next Level What unusual result do you notice when you compare your answers from Requirement 1 with Requirement 2? From a theoretical standpoint, how might this have been avoided?

Trending nowThis is a popular solution!

Chapter 16 Solutions

Intermediate Accounting: Reporting And Analysis

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Managerial Accounting: Tools for Business Decision Making

Financial Accounting, Student Value Edition (4th Edition)

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Financial Accounting (11th Edition)

- Alert Companys shareholders equity prior to any of the following events is as follows: The company is considering the following alternative items: 1. An 8% stock dividend on the common stock when it is selling for 30 per share. 2. A 30% stock dividend on the common stock when it is selling for 32 per share. 3. A special stock dividend to common shareholders consisting of 1 share of preferred stock for every 100 shares of common stock. The preferred stock and common stock are selling for 123 and 31 per share, respectively. 4. A 2-for-1 stock split on the common stock, reducing the par value to 5 per share (assume the same date for declaration and issuance). The market price is 30 per share on the common stock. 5. A property dividend to common shareholders consisting of 100 bonds issued by West Company. These bonds are carried on the Alert Company books as an available-for sale investment at a fair value of 48,000 (which is also its cost); it has a current value of 54,000. 6. A cash dividend, consisting of a normal dividend and a liquidating dividend, on both the preferred and the common stock. The 10% preferred dividend includes a 2% liquidating dividend, and the 2.30 per share common dividend includes a 0.30 per share liquidating dividend (separate liquidating dividend contra accounts should be used). Required: For each of the preceding alternative items: 1. Record (a) the journal entry at the date of declaration and (b) the journal entry at the date of issuance. 2. Compute the balances in the shareholders equity accounts immediately after the issuance (any gains or losses are to be reflected in the retained earnings balance; ignore income taxes).arrow_forwardStock Dividends and Stock Splits The balance sheet of Castle Corporation includes the following stockholders equity section: Required: Assume that Castle issued 60,000 shares for cash at the inception of the corporation and that no new shares have been issued since. Determine how much cash was received for the shares issued at inception. Assume that Castle issued 30,000 shares for cash at the inception of the corporation and subsequently declared a 2-for-l stock split. Determine how much cash was received for the shares issued at inception. Assume that Castle issued 57,000 shares for cash at the inception of the corporation and that the remaining 3,000 shares were issued as the result of stock dividends when the stock was selling for $53 per share. Determine how much cash was received for the shares issued at inception.arrow_forwardPreferred Stock Dividends Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has $200,000 available for dividends in 2019, how much could it pay to the common stockholders Seashell Corporation has 25,000 shares outstanding of 8%, S10 par value, cumulative preferred stock. In 2017 and 2018, no dividends were declared on preferred stock. In 2019, Seashell had a profitable year and decided to pay dividends to stockholders of both preferred and common stock. Required: If Seashell has S200,000 available for dividends in 2019, how much could it pay to the common stockholdersarrow_forward

- Stock Dividends Crystal Corporation has the following information regarding its common stock: S10 par. with 500.000 shares authorized, 213,000 shares issued, and 183,700 shares outstanding. On August 22, 2019, Crystal declared and paid a 15% stock dividend when the market price of the common stock was $30 per share. Required: Prepare the journal entries to record declaration and payment of this stock dividend. Prepare the journal entries to record declaration and payment assuming it was a 30% stock dividend.arrow_forwardStockholders' Equity Terminology A list of terms and a list of definitions or examples are presented below. Make a list of the numbers 1 through 12 and match the letter of the most directly related definition or example with each number Definitions and Examples Capitalizes retained earnings. Shares issued minus treasury shares. Emerson Electric will pay a dividend to all persons holding shares of its common stock on December 15, 2019, even if they just bought the shares and sell them a few days later. The accumulated earnings over the entire life of the corporation that have not been paid out in dividends. Common Stock account balance divided by the number of shares issued. The state of Louisiana set an upper limit of 1,000,000 on the number of shares that Gumps Catch Inc. can issue. Shares that never earn dividends. Any changes to stockholders equity from transactions with no owners. A right to purchase stock at a specified future time and specified price. j. A stock issue that requires no journal entry. k. Shares that may earn guaranteed dividends. 1. On October 15, 2019, General Electric announced its intention to pay a dividend on common stock.arrow_forwardNutritious Pet Food Companys board of directors declares a small stock dividend (20%) on June 30 when the stocks market value per share is $30. At that time, there are 10,000 shares of $1 par value common stock outstanding (none held in treasury). What is the journal entry to record the stock dividend distribution on July 31?arrow_forward

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.arrow_forwardNutritious Pet Food Companys board of directors declares a large stock dividend (50%) on June 30 when the stocks market value per share is $30. At that time, there are 10,000 shares of $1 par value common stock outstanding (none held in treasury). What is the journal entry to record the stock dividend distribution on July 31?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College