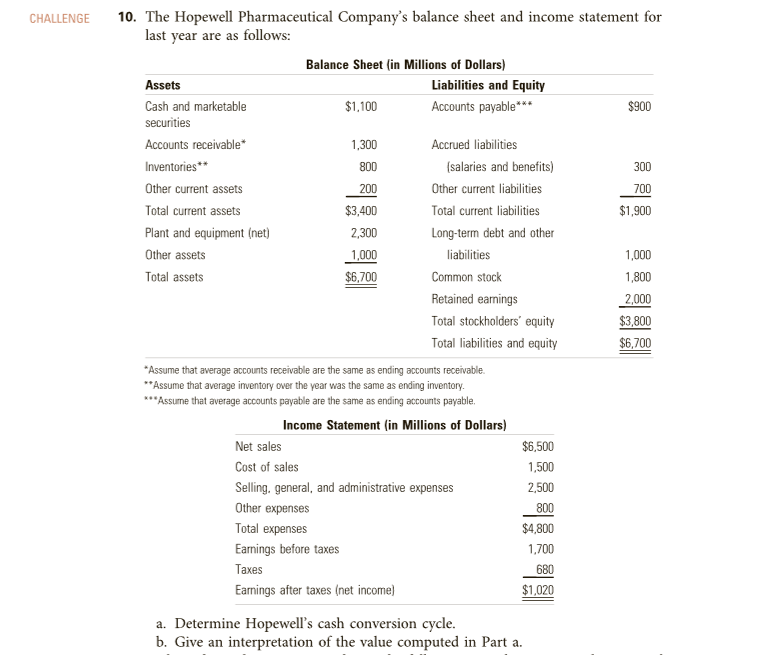

10. The Hopewell Pharmaceutical Company's balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Liabilities and Equity Cash and marketable $1,100 Accounts payable*** $900 securities Accounts receivable* 1,300 Accrued liabilities Inventories** 800 (salaries and benefits) 300 Other current assets 200 Other current liabilities 700 Total current assets $3,400 Total current liabilities $1,900 Plant and equipment (net) 2,300 Long-term debt and other Other assets 1,000 liabilities 1,000 Total assets $6,700 Common stock 1,800 Retained earnings 2,000

10. The Hopewell Pharmaceutical Company's balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Liabilities and Equity Cash and marketable $1,100 Accounts payable*** $900 securities Accounts receivable* 1,300 Accrued liabilities Inventories** 800 (salaries and benefits) 300 Other current assets 200 Other current liabilities 700 Total current assets $3,400 Total current liabilities $1,900 Plant and equipment (net) 2,300 Long-term debt and other Other assets 1,000 liabilities 1,000 Total assets $6,700 Common stock 1,800 Retained earnings 2,000

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 19P

Related questions

Question

Transcribed Image Text:10. The Hopewell Pharmaceutical Company's balance sheet and income statement for

last year are as follows:

CHALLENGE

Balance Sheet (in Millions of Dollars)

Assets

Liabilities and Equity

Cash and marketable

$1,100

Accounts payable***

$900

securities

Accounts receivable*

1,300

Accrued liabilities

Inventories**

800

(salaries and benefits)

300

Other current assets

200

Other current liabilities

700

Total current assets

$3,400

Total current liabilities

$1,900

Plant and equipment (net)

2,300

Long-term debt and other

Other assets

1,000

liabilities

1,000

Total assets

$6,700

Common stock

1,800

Retained eamings

2,000

Total stockholders" equity

$3,800

Total liabilities and equity

$6,700

*Assume that average accounts receivable are the same as ending accounts receivable.

**Assume that average inventory over the year was the same as ending inventory.

***Assume that average accounts payable are the same as ending accounts payable.

Income Statement (in Millions of Dollars)

Net sales

$6,500

Cost of sales

1,500

Selling, general, and administrative expenses

2,500

Other expenses

800

Total expenses

$4,800

Eamings before taxes

1,700

Тахes

680

Earmings after taxes (net income)

$1,020

a. Determine Hopewell's cash conversion cycle.

b. Give an interpretation of the value computed in Part a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning