Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 10MC

Related questions

Question

Help

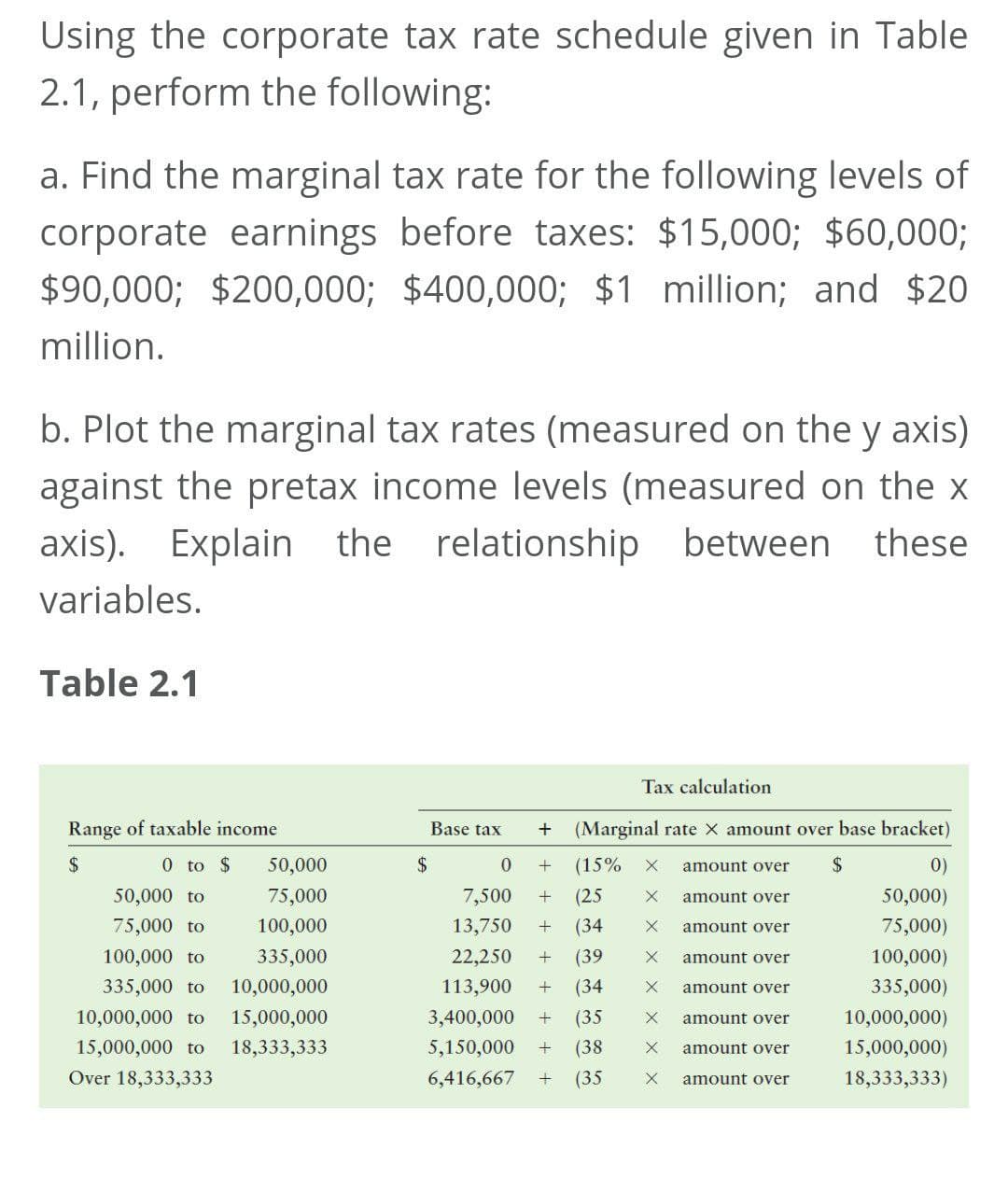

Transcribed Image Text:Using the corporate tax rate schedule given in Table

2.1, perform the following:

a. Find the marginal tax rate for the following levels of

corporate earnings before taxes: $15,000; $60,000;

$90,000; $200,000; $400,000; $1 million; and $20

million.

b. Plot the marginal tax rates (measured on the y axis)

against the pretax income levels (measured on the x

axis). Explain the relationship between these

variables.

Table 2.1

Tax calculation

Range of taxable income

Base tax

(Marginal rate X amount over base bracket)

2$

0 to $

50,000

+

(15%

amount over

2$

0)

50,000 to

75,000

7,500

(25

amount over

50,000)

75,000 to

100,000

13,750

(34

amount over

75,000)

100,000 to

335,000

22,250

(39

amount over

100,000)

335,000 to

10,000,000

113,900

(34

amount over

335,000)

10,000,000 to

15,000,000

3,400,000

(35

amount over

10,000,000)

15,000,000 to

18,333,333

5,150,000

(38

amount over

15,000,000)

Over 18,333,333

6,416,667

(35

amount over

18,333,333)

二8:

+ + + + + t +

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning