a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $16,800; $59,500; $89,600; $151,000; $245,000; $451,200; $1,000,000 b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis).

a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $16,800; $59,500; $89,600; $151,000; $245,000; $451,200; $1,000,000 b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis).

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 26P

Related questions

Question

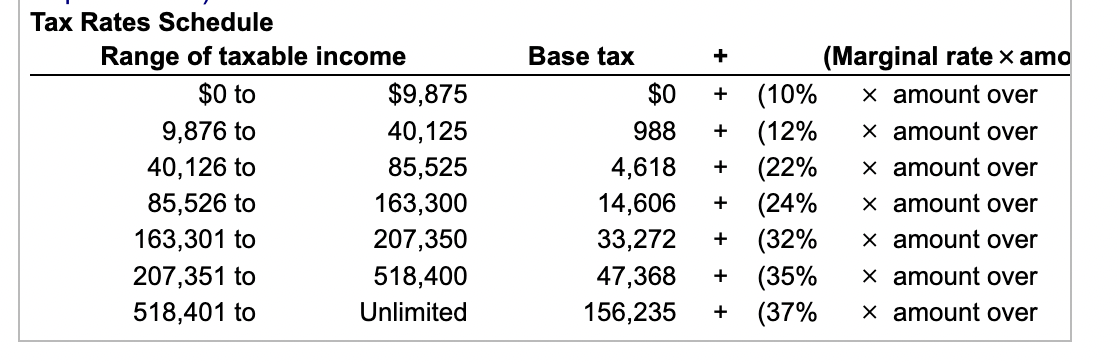

Marginal tax rates Using the tax rate schedule attached

Perform the following:a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes:

$16,800;

$59,500;

$89,600;

$151,000;

$245,000;

$451,200;

$1,000,000

b. Plot the marginal tax rates (measured on the

y-axis)

against the pretax income levels (measured on the

x-axis).

Transcribed Image Text:Tax Rates Schedule

Range of taxable income

$0 to

9,876 to

40,126 to

85,526 to

163,301 to

207,351 to

518,401 to

$9,875

40,125

85,525

163,300

207,350

518,400

Unlimited

Base tax

+

$0 + (10%

988 + (12%

4,618 + (22%

14,606 + (24%

33,272 +

(32%

47,368 +

(35%

156,235 +

(37%

(Marginal rate x amo

x amount over

x amount over

x amount over

x amount over

x amount over

x amount over

x amount over

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you