1. What amount of permanent difference between book income and taxable income existed at year end? a. 520,000 b. 360,000 c. 800,000 d. 280,000

1. What amount of permanent difference between book income and taxable income existed at year end? a. 520,000 b. 360,000 c. 800,000 d. 280,000

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 24CE

Related questions

Question

1. What amount of permanent difference between book income and taxable income existed at year end?

a. 520,000

b. 360,000

c. 800,000

d. 280,000

2. What amount of current tax expense should be reported?

a. 786,000

b. 510,000

c. 750,000

d. 678,000

3. What amount of income tax payable should be reported?

a. 498,000

b. 606,000

c. 330,000

d. 570,000

4. What amount of total tax expense should be reported?

a. 714,000

b. 726,000

c. 642,000

d. 594,000

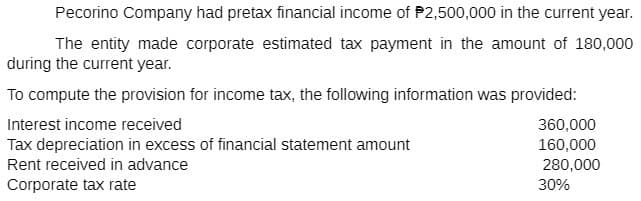

Transcribed Image Text:Pecorino Company had pretax financial income of P2,500,000 in the current year.

The entity made corporate estimated tax payment in the amount of 180,000

during the current year.

To compute the provision for income tax, the following information was provided:

Interest income received

360,000

Tax depreciation in excess of financial statement amount

160,000

Rent received in advance

280,000

Corporate tax rate

30%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT