a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors? b. Based on input from the marketing department, Buhler is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV of this project if revenues are 10% lower than forecast?

a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors? b. Based on input from the marketing department, Buhler is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV of this project if revenues are 10% lower than forecast?

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 1P

Related questions

Question

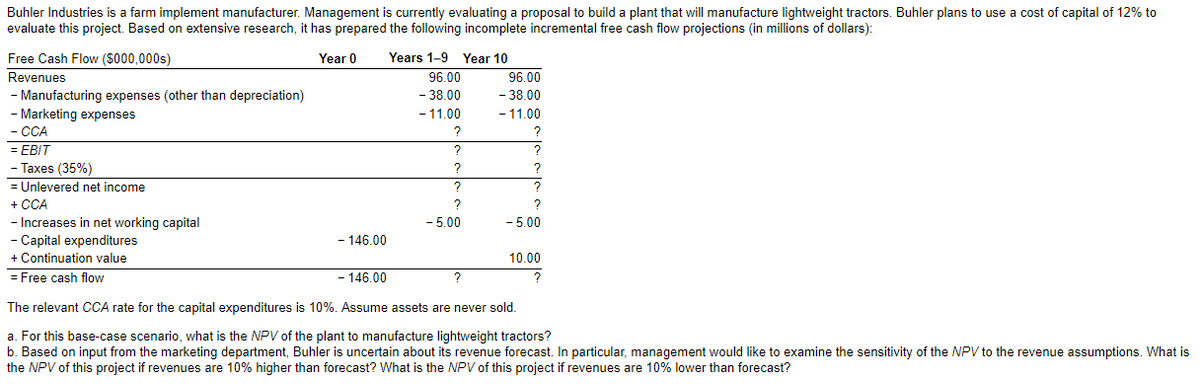

Transcribed Image Text:Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight tractors. Buhler plans to use a cost of capital of 12% to

evaluate this project. Based on extensive research, it has prepared the following incomplete incremental free cash flow projections (in millions of dollars):

Free Cash Flow ($000,000s)

Revenues

- Marketing expenses

- CCA

= EBIT

Year 0 Years 1-9 Year 10

- Manufacturing expenses (other than depreciation)

96.00

-38.00

96.00

- 38.00

- 11.00

- 11.00

?

?

?

?

?

?

?

?

?

- 5.00

- 5.00

-146.00

10.00

- 146.00

?

- Taxes (35%)

= Unlevered net income

+ CCA

-Increases in net working capital

- Capital expenditures

+ Continuation value

= Free cash flow

The relevant CCA rate for the capital expenditures is 10%. Assume assets are never sold.

a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors?

b. Based on input from the marketing department, Buhler is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is

the NPV of this project if revenues are 10% higher than forecast? What is the NPV of this project if revenues are 10% lower than forecast?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning