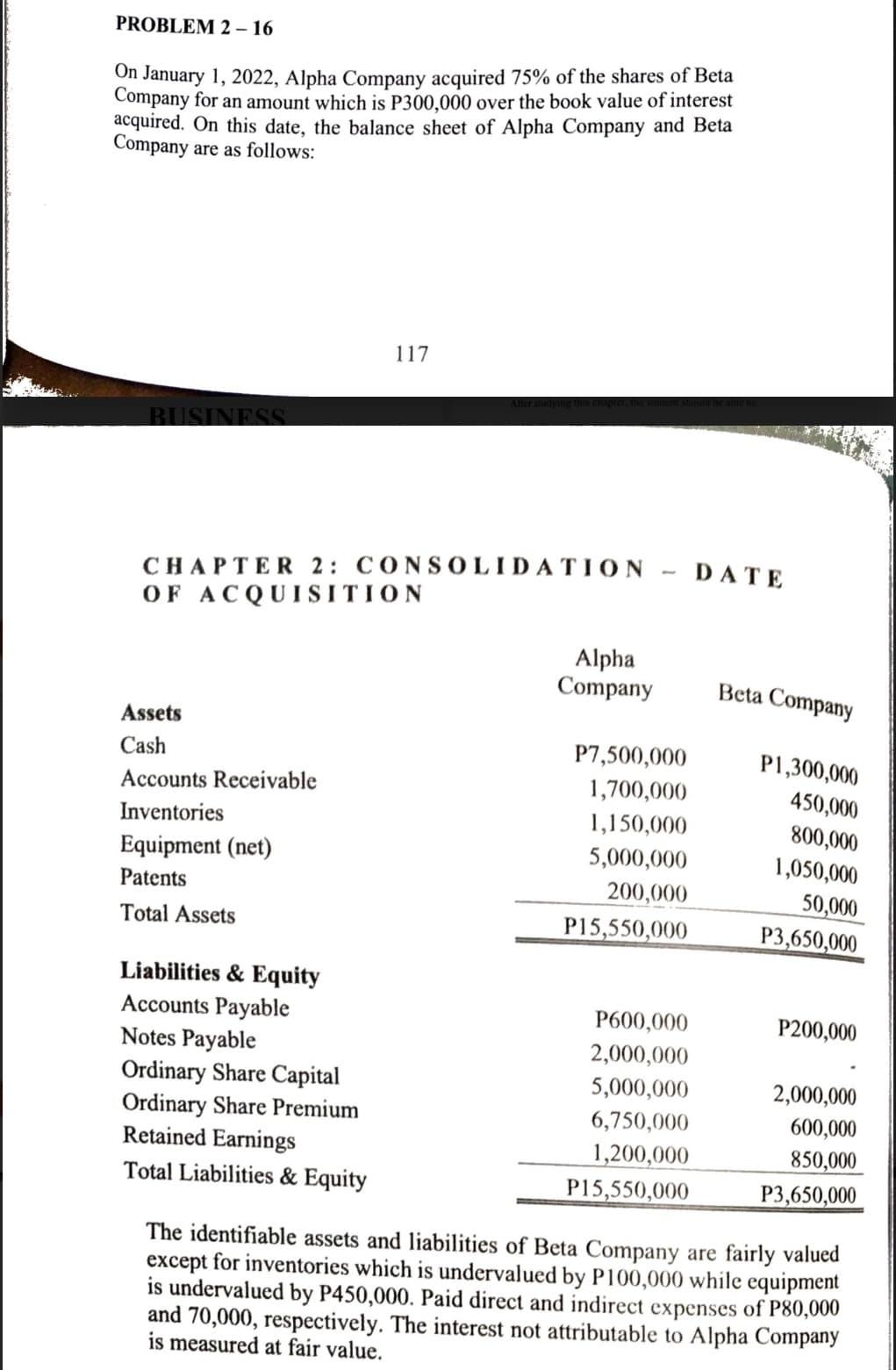

a. How much is the Goodwill/Gain on Bargain Purchase? b. How much is the Consolidated Assets?

Q: The meaning of goodwill in accounting is:

A: The correct answer is: (A) The amount by which a company's value exceeds the value of its individual…

Q: You are getting ready to start a new project that will incur some cleanup and shutdown costs when it…

A: In order to calculate NPV, we must first determine the present value of all cash inflows and the…

Q: Decisions where relevant cost analysis might be used effective is Segment Elimination. Explain IN…

A: Segment elimination refers to the elimination of segment based on analysis of relevant revenue and…

Q: You are considering making a movie. The movie is expected to cost $10.9 million up front and take a…

A: The question has asked to compute the payback period and net present value. Capital budgeting:…

Q: A Corporation reports operating expenses in two categories: (1) Cost of goods sold, (2) selling and…

A: Cost of goods available for sale means the cost of opening inventory and cost of goods purchased…

Q: When a change in the tax rate is enacted, the effect on existing future income tax assets or…

A: The correct answer is: (D) recorded as an adjustment to income tax expense in the period of the rate…

Q: Interpret this value. Enter your answer for dollar value in whole dollar. For example, an answer of…

A: Leverage is essentially an investment where debt or borrowed funds are used to increase an…

Q: Choose the amount of loss and the type of loss that shall be recognized on the above transaction. P…

A: An impairment loss is the recognition of the reduction in the value of the asset due to changes in…

Q: The Platter Valley factory of Bybee Industries manufactures field boots. The cost of each boot…

A: Answer to Question 1:- Fixed OH spending variance =Budgeted OH - Actual OH…

Q: Crosshill Company's total overhead costs at various levels of activity are presented below: Month…

A: The high low method is used to separate the variable and fixed cost from the mixed costs of…

Q: Black and Shannon have decided to form a partnership. They have agreed that Black is to invest…

A: Lets understand the basics. Partnership is a agreement between two or more person who works togather…

Q: Ivanhoe Industries collected $104,000 from customers in 2022. Of the amount collected, $24,800 was…

A: Cash basis of net income only considers cash collected for revenue less cash paid for expenses in…

Q: A new machine tool is being purchased for $260,000 and is expected to have a $50,000 salvage value…

A: Straight-line depreciation is one of the methods of depreciation. As the name depicts, the…

Q: Entries for Costs in a Job Order Cost System Royal Technology Company uses a job order cost system.…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Rachel Weitzman's basis in investment-use land was $15,000. She received a gross condemnation award…

A: Introduction:- Calculation of unrealized gain as follows:- Unrealized gain = Net condemnation award…

Q: The accounts below were taken from the unadjusted trial balance of a company as at December 31,…

A: The basic Accounting Equation is Assets = Equity + Liabilities Assets are the resources owned by the…

Q: A standard cost system is used to measure performance and value inventory. Variance reports are…

A: Answer:- Standard costing:- Standard costing is the practice of predicting production related costs…

Q: Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a…

A: When the decision with regard to keep or to replace the machine is to be made then we make use of…

Q: A Corporation provided the following information for the current year: Income from continuing…

A: The question has asked to compute the total amount of other comprehensive income. The other…

Q: In regard to all of the identified cost drivers for overhead, 20% of the identified cost drivers…

A: This question relates to 80:20 rule. This rule says that with only 20% of efforts, 80% of the…

Q: Brittany, who is an employee, drove her automobile a total of 20,000 business miles in 2022. She…

A: Solution: STANDAR MILAGE RATE METHOD 20,000 * 0.555 11,100…

Q: what is the maximum amount she can contribute to an individual 401(k) for 2022?

A: The maximum self-employment income compensation for Solo 401(k) contribution for 2022 is $305,000…

Q: On January 1, Year 1, Camdenton Corporation issues $100,000 of 5% bonds maturing in 10 years when…

A: Bond valuation with semi annual interest rate: The interest rate on bonds are provided on an an…

Q: Given the following, calculate: Cost of goods available for sale, the ending inventory at retail,…

A: The gross profit is calculated as excess of sales revenue over cost of goods sold. The retail price…

Q: 1. Record the transactions, assuming Clothing Frontiers has no-par common stock. (If no entry is…

A: Answer to Question:- ASSEMBLED JOURNAL ENTRY Serial No Account…

Q: A Company reported the following balances on its unadjusted trial balance as of December 31, 2021:…

A: There are four different types of financial statements, cumulatively called as the primary financial…

Q: The following data is provided for Garcon Company and Pepper Company for the year ended December 31.…

A: The statement of cost of goods manufactured includes the cost of goods that are manufactured during…

Q: If the cost of an item of inventory is $60 and the current replacement cost is $75, the amount…

A: Note: Under the lower of Cost or market-value inventory method, inventory is valued on the basis of…

Q: A hospital reported the following uncollectible amounts: $15,000 for services rendered to homeless…

A: ANSWER THE REVENUE SHOULD NOT BE RECOGNISED IN CASE OF SERVICE RENDERED WITH NO INTENTION TO…

Q: 3. Northstar had the following amonts in their adjusted trial balance. Prepare the closing journal…

A: A closing entry appears to be a journal entry executed at the end of each accounting period to…

Q: On January 1, 2018, Black Inc. issued stock options for 200,000 shares to a division manager. The…

A: Stock options is the number of shares or stock which is granted to the employees at a lower rate…

Q: Presented below is a partial amortization schedule for a three-year installment note requiring…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: XYZ Corporation had the following financial data for the past year's operations in 2020: Market…

A: PRICE EARNING RATIO Price Earning Ratio indicates the number of times the earning per share is…

Q: Sunland Company has the following balances in selected accounts on December 31, 2022. Accounts…

A: JOURNAL ENTRIES Journal Entry is the First stage of Process of Accounting. Journal Entry is the…

Q: QUESTION 9 Analytical CRM can calculate the Customer Lifetime Value (CLTV), which is: the prediction…

A: Answer Correct option is = 1 st option the prediction of the net-profit attributed to the…

Q: 1. Millennium Bakery has its operations in producing bakery and confectioneries for 10 years in the…

A: Please see the answer below as fallows: Answer: The Millenium Bakery's information system will…

Q: Which type of account can be used as a retirement savings account? Section 529 Plan. Health…

A: A Health Savings Account (HSA) is a tax-advantaged account that enables individuals to save money…

Q: Given the conditions cited above, what transfer price would be used according to the transfer price…

A: Lets understand the basics. Transfer price is a price through which transfer of units between inter…

Q: Addison, Inc. uses a perpetual inventory system. The following is information about one inventory…

A: LIFO: LIFO stands for Last-In, First-Out. In this method inventory purchased at last will be sold…

Q: Knowledge Check 01 On January 1, Year 1, Zeta Corporation issues $100,000 of 8% bonds maturing in 10…

A: The bonds are issued at premium when market rate is lower than the coupon rate of bonds payable.…

Q: Question 27 Fundamentally, the identification of a performance shortfall becomes an exercise in…

A: Performance analysis is the process of observing the operation and evaluating the information…

Q: On September 12, Fang Company sold merchandise of $5,800 to Brown Company, with credit terms of…

A: Sales discount is an attempt to attract customers to make each payments for credit sales on time. It…

Q: Prepare a ten-column work sheet for Health Care Consultants using the trial balance is given below.…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period. The…

Q: Assume a company is preparing a budget for its first two months of operations. During the first and…

A: Cash Budget is prepared to analyze the cash transaction or cash flow of the business. Non-cash items…

Q: Which of the following is a formula for a financial ratio? 1) earnings before interest and taxes /…

A: Ratio analysis allows the business organizations to compare one firm to another within the same…

Q: Kunze Corporation has $1 par value Common Stock with 100,000 shares authorized and 25,000 shares…

A: Journal entry is the procedure for initially documenting commercial transactions in the books of…

Q: on January 18th 2021 Maureen purchased a put option for $600 the option expired on August the 2nd 20…

A: Put options gives you the opportunity to sell the stock on the expiration of period but there is no…

Q: equity Following is the stockholders' section from ABC Company's balance sheet as of Dec 31, Yr 1:…

A: Issued stock = Par value + paid in capital Outstanding shares = Issued shares- Treasury stock

Q: Castleton Corporation manufactured 31,500 units during March. The following fixed overhead data…

A: FIXED OVERHEAD SPENDING VARIANCE Fixed overhead variance which arises due to the difference…

Q: The modified accelerated cost recovery system (MACRS): Multiple Choice Is not acceptable for…

A: A company may recover the cost basis of some assets that lose value over time using the modified…

Questions:

a. How much is the

b. How much is the Consolidated Assets?

c.

Step by step

Solved in 3 steps

- Problem 1-16 Humility Inc. acquired 70% interest of Forgiveness Company, a printing business. The sale and purchase agreement specify the amount payable as: Cash of P12 million to be paid on acquisition date, and b. Additional 2,000 shares of its P100 par value ordinary shares to be issued after two (2) years if specified product receives the target market share. The fair value of Forgiveness Company's net assets is P11 million and estimated fair value of the contingent consideration is P300,000. NCI is measured using the proportionate method. Required 1. Assuming the target was met and shares was issued to the former shareholders of Forgiveness, the estimated fair value of contingent consideration is P400,000, how much goodwill will be presented in the consolidated financial statements two years after the acquisition? 2. Journal entry in the books of Humility Inc. (a) on the date of business combination and (b) on the issuance of 2,000 shares, in relation to #1. 3. Assuming the target…Problem 3-25 (Algo) (LO 3-1, 3-3a, 3-4) Allison Corporation acquired all of the outstanding voting stock of Mathias, Inc., on January 1, 2020, in exchange for $6,121,000 in cash. Allison intends to maintain Mathias as a wholly owned subsidiary. Both companies have December 31 fiscal year-ends. At the acquisition date, Mathias’s stockholders’ equity was $2,060,000 including retained earnings of $1,560,000. At the acquisition date, Allison prepared the following fair-value allocation schedule for its newly acquired subsidiary: Consideration transferred $ 6,121,000 Mathias stockholders' equity 2,060,000 Excess fair over book value $ 4,061,000 to unpatented technology (8-year remaining life) $ 896,000 to patents (10-year remaining life) 2,620,000 to increase long-term debt (undervalued, 5-year remaining life) (160,000 ) 3,356,000 Goodwill $ 705,000 Postacquisition, Allison…Illustration 2. Business Combination Achieved in Stages and without transfer of considerationOn January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL).Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows:a. The previously held interest of Tatay are currently quoted at 20% higher than its book value.b. The assets and liabilities of Walanay are all equivalent to their market values.c. Tatay elected to measure NCI at ‘proportionate share’. 5. How much is the fair value of the net identifiable assets acquired?a. P 1,965,000.00b. P…

- Illustration 2. Business Combination Achieved in Stages and without transfer of considerationOn January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL).Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows:a. The previously held interest of Tatay are currently quoted at 20% higher than its book value.b. The assets and liabilities of Walanay are all equivalent to their market values.c. Tatay elected to measure NCI at ‘proportionate share’. With the stated facts, answer the following:1. How much is the Consideration Transferred?a. P…Illustration 2. Business Combination Achieved in Stages and without transfer of considerationOn January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL).Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows:a. The previously held interest of Tatay are currently quoted at 20% higher than its book value.b. The assets and liabilities of Walanay are all equivalent to their market values.c. Tatay elected to measure NCI at ‘proportionate share’. 7. How much is the total Goodwill in the books of Tatay, Co. after the business combination?a. P…Illustration 2. Business Combination Achieved in Stages and without transfer of considerationOn January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL).Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows:a. The previously held interest of Tatay are currently quoted at 20% higher than its book value.b. The assets and liabilities of Walanay are all equivalent to their market values.c. Tatay elected to measure NCI at ‘proportionate share’. 7. How much is the total Goodwill in the books of Tatay, Co. after the business combination?a. P…

- Illustration 2. Business Combination Achieved in Stages and without transfer of considerationOn January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL).Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows:a. The previously held interest of Tatay are currently quoted at 20% higher than its book value.b. The assets and liabilities of Walanay are all equivalent to their market values.c. Tatay elected to measure NCI at ‘proportionate share’. 4. How much is the unrealized gain in Profit and Loss?a. P 90,000.00b. P 450,000.00c. P 500,000.00d.…Illustration 2. Business Combination Achieved in Stages and without transfer of considerationOn January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL).Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows:a. The previously held interest of Tatay are currently quoted at 20% higher than its book value.b. The assets and liabilities of Walanay are all equivalent to their market values.c. Tatay elected to measure NCI at ‘proportionate share’. With the stated facts, answer the following:…Illustration 2. Business Combination Achieved in Stages and without transfer of considerationOn January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL). Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows: a. The previously held interest of Tatay are currently quoted at 20% higher than its book value.b. The assets and liabilities of Walanay are all equivalent to their market values.c. Tatay elected to measure NCI at ‘proportionate share’. With the stated facts, answer the following:1. How much is the Consideration Transferred?a. P…

- Illustration 2. Business Combination Achieved in Stages and without transfer of considerationOn January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL). Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows: a. The previously held interest of Tatay are currently quoted at 20% higher than its book value.b. The assets and liabilities of Walanay are all equivalent to their market values.c. Tatay elected to measure NCI at ‘proportionate share’. With the stated facts, answer the following: 1. How much is the Fair Value of the previously held…Illustration 2. Business Combination Achieved in Stages and without transfer of consideration On January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the assets, liabilities and equity of Tatay and Walanay before the business combination are as follows: Case 1: last year, on July 1, 2021, Tatay, Co. acquired 45% ownership interest in Walanay, Inc. for P 450,000.00. Tatay classified the investment as ‘Held for Trading Securities’ (FVPL). Now, January 1, 2022, Tatay, Co. paid P250,000.00 cash from the bank in exchange for an additional 10% ownership interest in Walanay, Inc. The following relevant Information follows: a.The previously held interest of Tatay are currently quoted at 20% higher than its book value. b.The assets and liabilities of Walanay are all equivalent to their market values. c.Tatay elected to measure NCI at ‘proportionate share’. With the stated facts, answer the following: 1. How much is the unrealized gain in Profit and…Question 3: Prepare acquisition analysis and Consolidation worksheet entries Syd Ltd acquired all the issued shares (Cum-div.) of Mel Ltd on 1 July 2020. At this date the financial position of Matt Ltd was as follows: Carrying Amount Fair Value Plant $300 000 270 000 Accumulated Depreciation (60 000) Account Receivables 35 200 35 200 Cash 15 000 15 000 Inventories 15 600 19 600 305 800 Share Capital 230 000 General Reserve 23 400 Retained Earnings 24 200 Provisions of Employee benefits 19 200 19 200 Dividend Payable 9 000 9 000 305 800 Additional information: The assets of Mel Ltd did not include a patent that was valued by Syd Ltd at $12 000. Its useful life was considered to be 6 years, with benefits being received equally over that period. The plant was considered to have a further 10-year life and is depreciated on…