REQUIRED: a. How much is the partnership profit during the period? b. Prepare a Statement of Partners' Equity for the period ended December 31, 200A.

REQUIRED: a. How much is the partnership profit during the period? b. Prepare a Statement of Partners' Equity for the period ended December 31, 200A.

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 53P

Related questions

Question

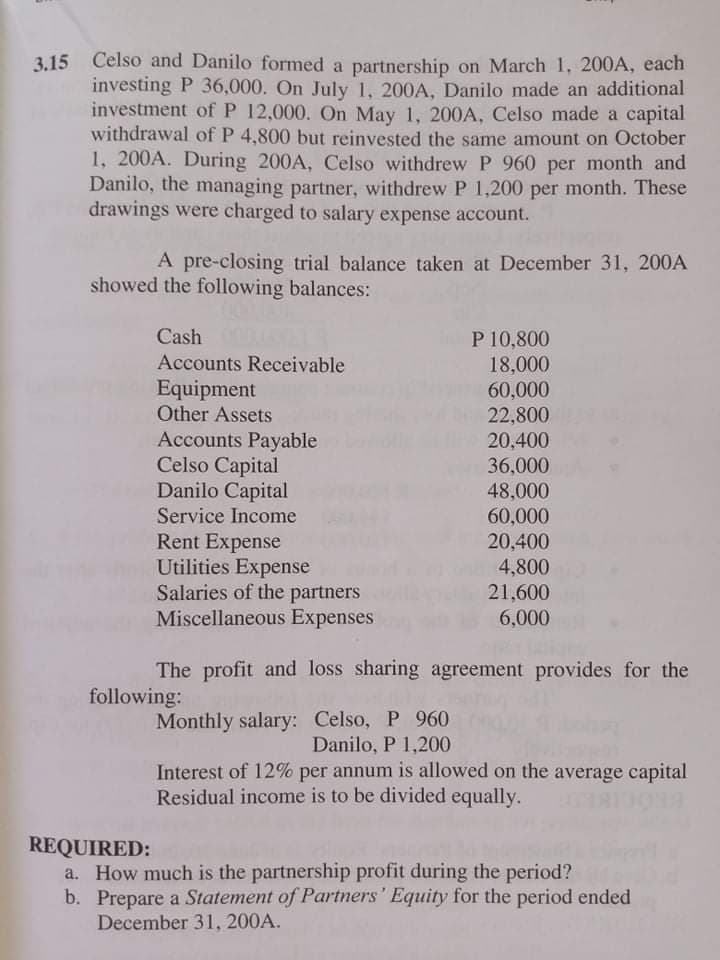

Transcribed Image Text:3.15 Celso and Danilo formed a partnership on March 1, 200A, each

investing P 36,000. On July 1, 200A, Danilo made an additional

investment of P 12,000. On May 1, 200A, Celso made a capital

withdrawal of P 4,800 but reinvested the same amount on October

1, 200A. During 200A, Celso withdrew P 960 per month and

Danilo, the managing partner, withdrew P 1,200 per month. These

drawings were charged to salary expense account.

A pre-closing trial balance taken at December 31, 200A

showed the following balances:

Cash

P 10,800

18,000

Accounts Receivable

Equipment

Other Assets

60,000

22,800

20,400

Accounts Payable

Celso Capital

Danilo Capital

36,000

48,000

60,000

20,400

4,800

Service Income

Rent Expense

Utilities Expense

Salaries of the partners

Miscellaneous Expenses

21,600

6,000

The profit and loss sharing agreement provides for the

following:

Monthly salary: Celso, P 960

Danilo, P 1,200

Interest of 12% per annum is allowed on the average capital

Residual income is to be divided equally.

REQUIRED:

How much is the partnership profit during the period?

b. Prepare a Statement of Partners' Equity for the period ended

December 31, 200A.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT