a. Journalize the entries by Silverman Enterprises to record the December 28, 20Y3 sale, using the net method under a perpetual inventory system. If an amount box does not require an entry, leave it blank.

a. Journalize the entries by Silverman Enterprises to record the December 28, 20Y3 sale, using the net method under a perpetual inventory system. If an amount box does not require an entry, leave it blank.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6E

Related questions

Topic Video

Question

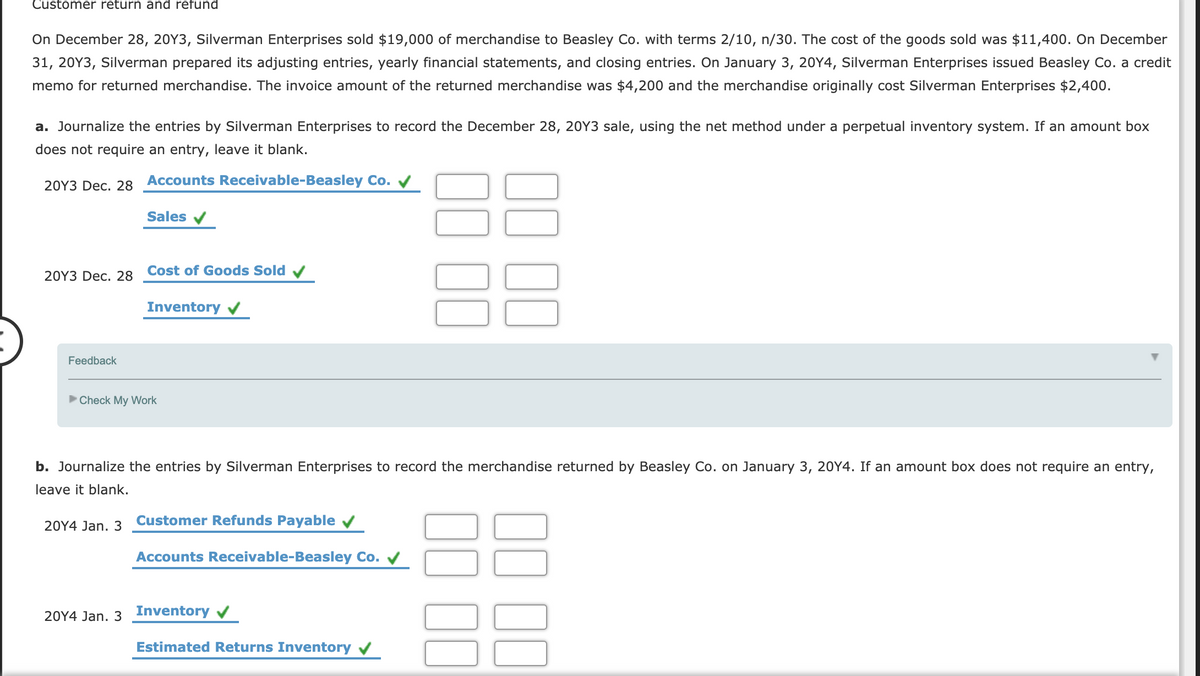

Transcribed Image Text:Customer return and refund

On December 28, 20Y3, Silverman Enterprises sold $19,000 of merchandise to Beasley Co. with terms 2/10, n/30. The cost of the goods sold was $11,400. On December

31, 20Y3, Silverman prepared its adjusting entries, yearly financial statements, and closing entries. On January 3, 20Y4, Silverman Enterprises issued Beasley Co. a credit

memo for returned merchandise. The invoice amount of the returned merchandise was $4,200 and the merchandise originally cost Silverman Enterprises $2,400.

a. Journalize the entries by Silverman Enterprises to record the December 28, 20Y3 sale, using the net method under a perpetual inventory system. If an amount box

does not require an entry, leave it blank.

20Y3 Dec. 28 Accounts Receivable-Beasley Co. V

Sales

20Y3 Dec. 28

Cost of Goods Sold v

Inventory v

Feedback

Check My Work

b. Journalize the entries by Silverman Enterprises to record the merchandise returned by Beasley Co. on January 3, 20Y4. If an amount box does not require an entry,

leave it blank.

Customer Refunds Payable v

20Y4 Jan. 3

Accounts Receivable-Beasley Co. V

20Y4 Jan. 3 Inventory v

Estimated Returns Inventory v

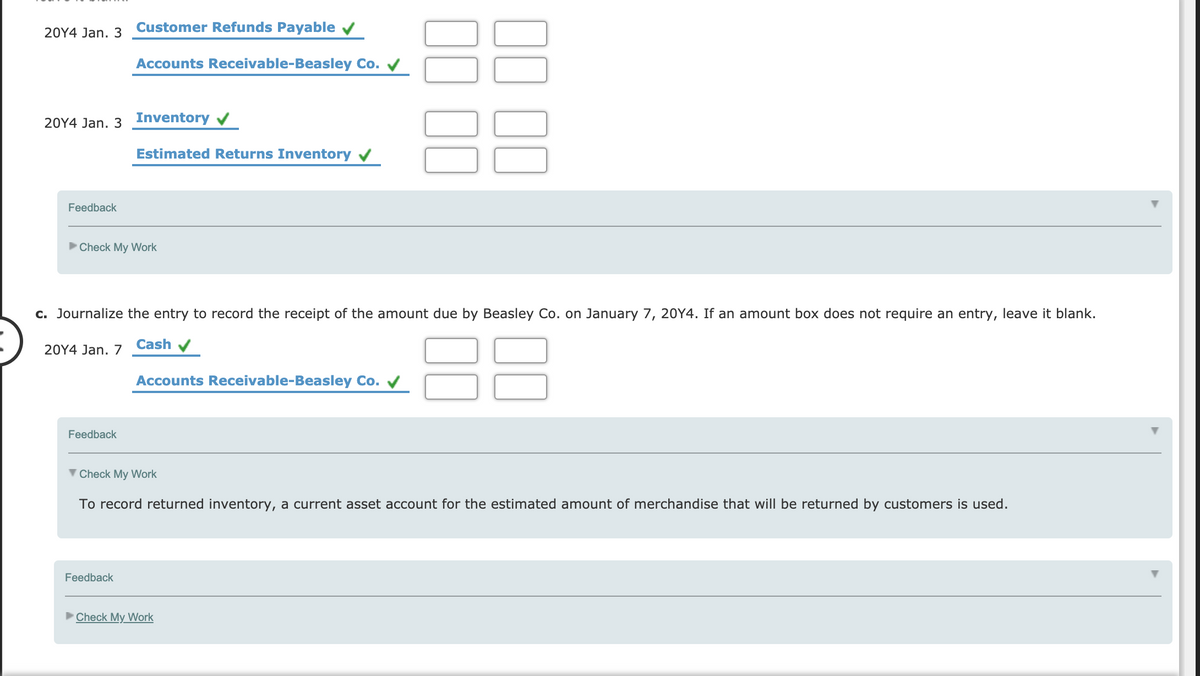

Transcribed Image Text:Customer Refunds Payable v

20Y4 Jan. 3

Accounts Receivable-Beasley Co. V

20Y4 Jan. 3 Inventory

Estimated Returns Inventory v

Feedback

Check My Work

c. Journalize the entry to record the receipt of the amount due by Beasley Co. on January 7, 20Y4. If an amount box does not require an entry, leave it blank.

88

Cash

20Y4 Jan. 7

Accounts Receivable-Beasley Co.

Feedback

V Check My Work

To record returned inventory, a current asset account for the estimated amount of merchandise that will be returned by customers is used.

Feedback

Check My Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,