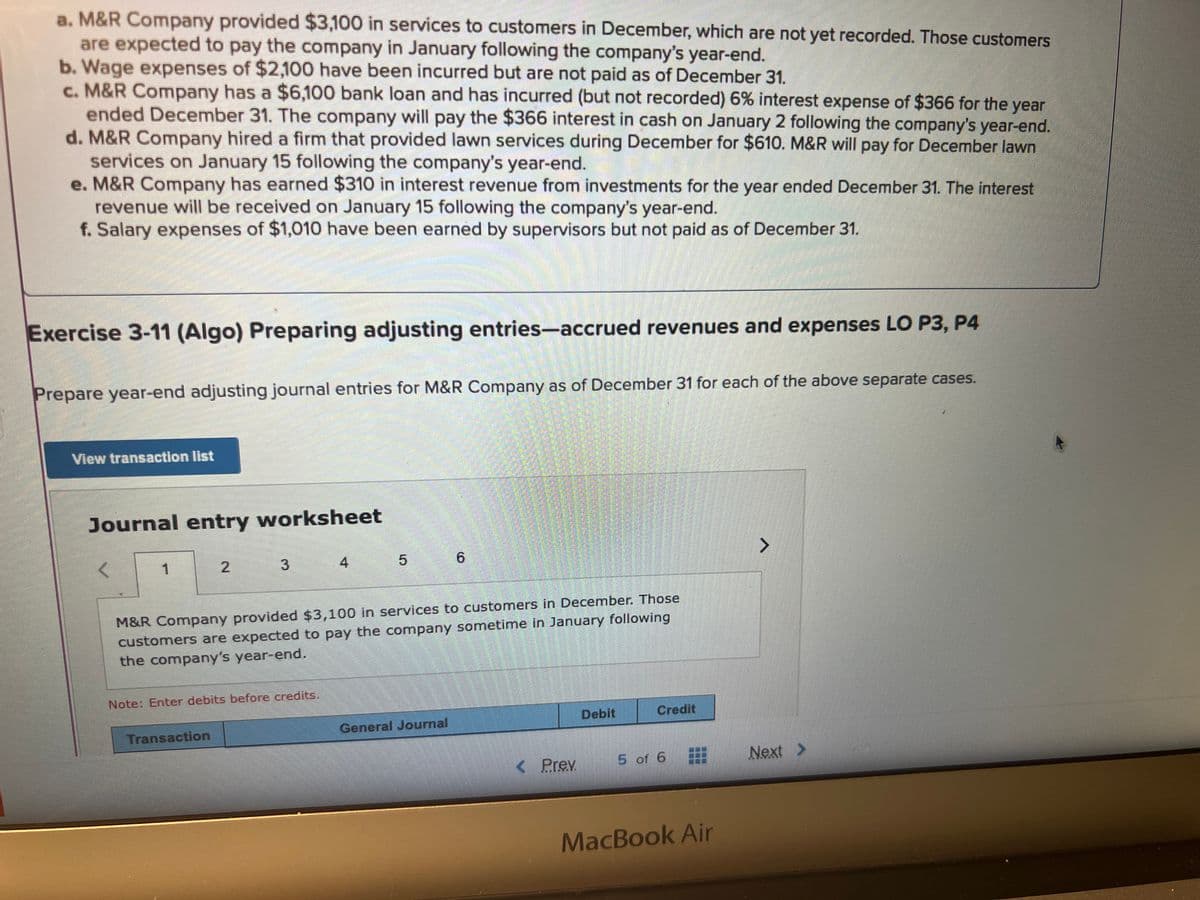

a. M&R Company provided $3,100 in services to customers in December, which are not yet recorded. Those customers are expected to pay the company in January following the company's year-end. b. Wage expenses of $2,100 have been incurred but are not paid as of December 31. c. M&R Company has a $6,100 bank loan and has incurred (but not recorded) 6% interest expense of $366 for the year ended December 31. The company will pay the $366 interest in cash on January 2 following the company's year-end. d. M&R Company hired a firm that provided lawn services during December for $610. M&R will pay for December lawn services on January 15 following the company's year-end. e. M&R Company has earned $310 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the company's year-end. f. Salary expenses of $1,010 have been earned by supervisors but not paid as of December 31. Exercise 3-11 (Algo) Preparing adjusting entries-accrued revenues and expenses LO P3, P4 Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list Journal entry worksheet < 1 2 3 4 Note: Enter debits before credits. 5 6 M&R Company provided $3,100 in services to customers in December. Those customers are expected to pay the company sometime in January following the company's year-end. Debit Credit

a. M&R Company provided $3,100 in services to customers in December, which are not yet recorded. Those customers are expected to pay the company in January following the company's year-end. b. Wage expenses of $2,100 have been incurred but are not paid as of December 31. c. M&R Company has a $6,100 bank loan and has incurred (but not recorded) 6% interest expense of $366 for the year ended December 31. The company will pay the $366 interest in cash on January 2 following the company's year-end. d. M&R Company hired a firm that provided lawn services during December for $610. M&R will pay for December lawn services on January 15 following the company's year-end. e. M&R Company has earned $310 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the company's year-end. f. Salary expenses of $1,010 have been earned by supervisors but not paid as of December 31. Exercise 3-11 (Algo) Preparing adjusting entries-accrued revenues and expenses LO P3, P4 Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list Journal entry worksheet < 1 2 3 4 Note: Enter debits before credits. 5 6 M&R Company provided $3,100 in services to customers in December. Those customers are expected to pay the company sometime in January following the company's year-end. Debit Credit

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 11EB: Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from...

Related questions

Question

Prepare the

Transcribed Image Text:a. M&R Company provided $3,100 in services to customers in December, which are not yet recorded. Those customers

are expected to pay the company in January following the company's year-end.

b. Wage expenses of $2,100 have been incurred but are not paid as of December 31.

c. M&R Company has a $6,100 bank loan and has incurred (but not recorded) 6% interest expense of $366 for the year

ended December 31. The company will pay the $366 interest in cash on January 2 following the company's year-end.

d. M&R Company hired a firm that provided lawn services during December for $610. M&R will pay for December lawn

services on January 15 following the company's year-end.

e. M&R Company has earned $310 in interest revenue from investments for the year ended December 31. The interest

revenue will be received on January 15 following the company's year-end.

f. Salary expenses of $1,010 have been earned by supervisors but not paid as of December 31.

Exercise 3-11 (Algo) Preparing adjusting entries-accrued revenues and expenses LO P3, P4

Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases.

View transaction list

Journal entry worksheet

1

2

3

Transaction

Note: Enter debits before credits.

4

5

M&R Company provided $3,100 in services to customers in December. Those

customers are expected to pay the company sometime in January following

the company's year-end.

6

General Journal

< Prev.

Debit

Credit

5 of 6

MacBook Air

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning