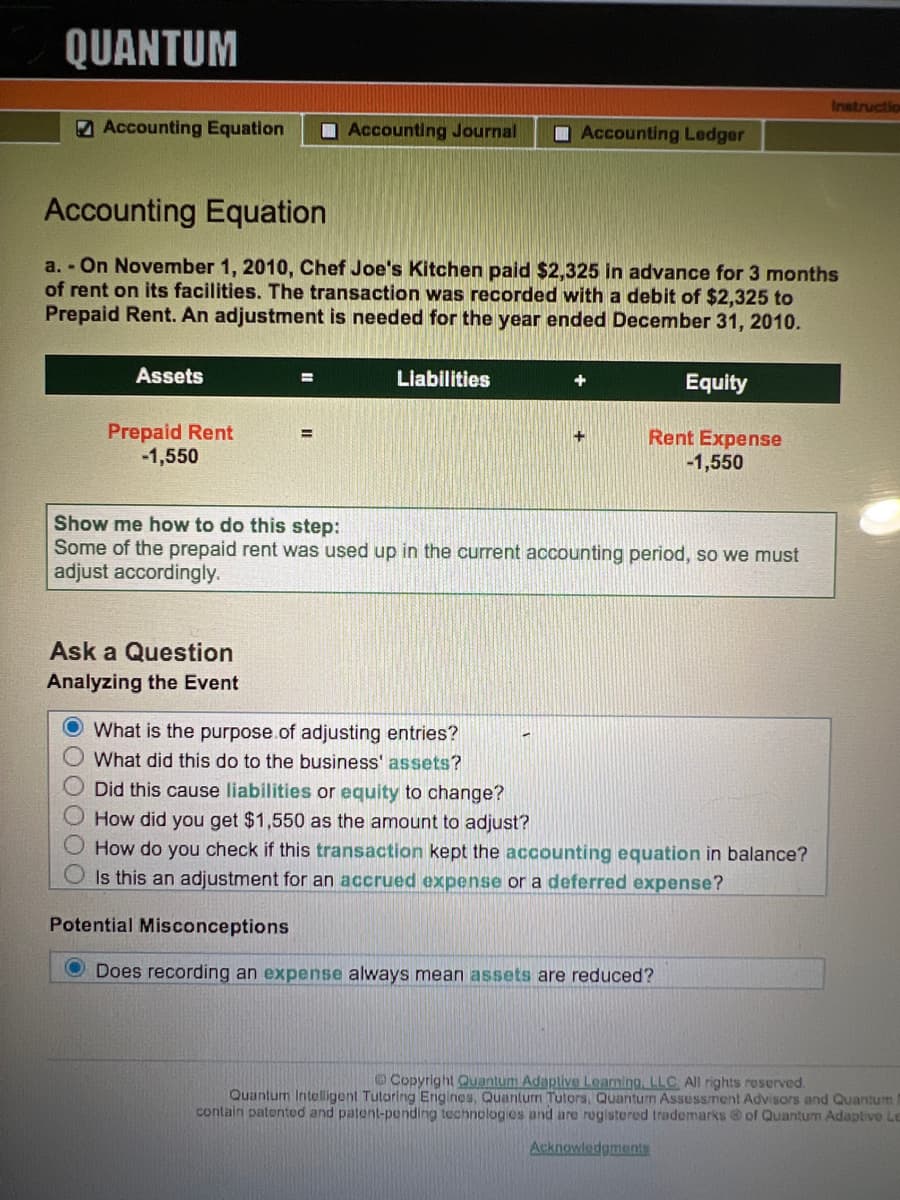

a. - On November 1, 2010, Chef Joe's Kitchen paid $2,325 in advance for 3 months of rent on its facilities. The transaction was recorded with a debit of $2,325 to Prepaid Rent. An adjustment is needed for the year ended December 31, 2010. Assets Liabilities Equity Prepaid Rent -1,550 Rent Expense -1,550 Show me how to do this step: Some of the prepaid rent was used up in the current accounting period, so we must adjust accordingly. II

a. - On November 1, 2010, Chef Joe's Kitchen paid $2,325 in advance for 3 months of rent on its facilities. The transaction was recorded with a debit of $2,325 to Prepaid Rent. An adjustment is needed for the year ended December 31, 2010. Assets Liabilities Equity Prepaid Rent -1,550 Rent Expense -1,550 Show me how to do this step: Some of the prepaid rent was used up in the current accounting period, so we must adjust accordingly. II

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter21: Accounting For Accruals, Deferrals, And Reversing Entries

Section: Chapter Questions

Problem 2AP

Related questions

Question

Okay it’s helps me with the answer but not how to calculate it for other problems. Can someone help me ? How did they calculate this ?

Transcribed Image Text:QUANTUM

Instructio

Accounting Equation

OAccounting Journal

O Accounting Ledger

Accounting Equation

a. - On November 1, 2010, Chef Joe's Kitchen paid $2,325 in advance for 3 months

of rent on its facilities. The transaction was recorded with a debit of $2,325 to

Prepaid Rent. An adjustment is needed for the year ended December 31, 2010.

Assets

Liabilities

%3D

Equity

Prepaid Rent

-1,550

Rent Expense

-1,550

Show me how to do this step:

Some of the prepaid rent was used up in the current accounting period, so we must

adjust accordingly.

Ask a Question

Analyzing the Event

What is the purpose.of adjusting entries?

What did this do to the business' assets?

Did this cause liabilities or equity to change?

How did you get $1,550 as the amount to adjust?

How do you check if this transaction kept the accounting equation in balance?

Is this an adjustment for an accrued expense or a deferred expense?

Potential Misconceptions

ODoes recording an expense always mean assets are reduced?

OCopyright Quantum Adaplive Learning, LLC All rights reserved.

Quantum Intellgent Tutoring Engines, Quanturm Tutors, Quantum Assessment Advisors and Quantum I

contain patented and patent-pending technologios and are rogistored trademarks of Quantum Adaplive Le

Acknowledgments

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning