A. On the 1st of June 2011 GoodTaste purchased a new freezer for €23,000 of which €2,000 was the VAT tax. In addition GoodTaste had to pay €250 for transport to its facility, €1,500 for installation and €230 in non-refundable environment taxes. Calculate the initial value of the freezer and explain the treatment of any expenses not included in the initial value.

A. On the 1st of June 2011 GoodTaste purchased a new freezer for €23,000 of which €2,000 was the VAT tax. In addition GoodTaste had to pay €250 for transport to its facility, €1,500 for installation and €230 in non-refundable environment taxes. Calculate the initial value of the freezer and explain the treatment of any expenses not included in the initial value.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

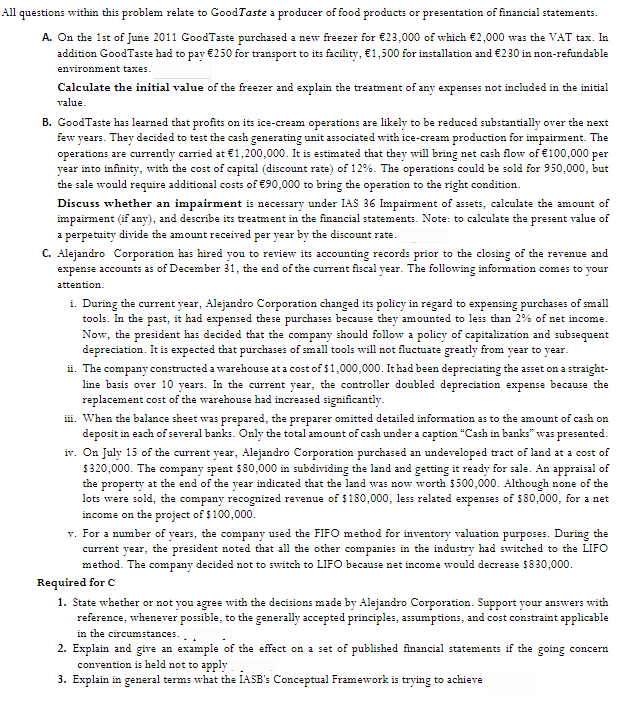

Transcribed Image Text:All questions within this problem relate to GoodTaste a producer of food products or presentation of financial statements.

A. On the 1st of June 2011 GoodTaste purchased a new freezer for €23,000 of which €2,000 was the VAT tax. In

addition GoodTaste had to pay €250 for transport to its facility, €1,500 for installation and €230 in non-refundable

environment taxes.

Calculate the initial value of the freezer and explain the treatment of any expenses not included in the initial

value.

B. GoodTaste has learned that profits on its ice-cream operations are likely to be reduced substantially over the next

few years. They decided to test the cash generating unit associated with ice-cream production for impairment. The

operations are currently carried at €1,200,000. It is estimated that they will bring net cash flow of €100,000 per

year into infinity, with the cost of capital (discount rate) of 12%. The operations could be sold for 950,000, but

the sale would require additional costs of €90,000 to bring the operation to the right condition.

Discuss whether an impairment is necessary under IAS 36 Impairment of assets, calculate the amount of

impairment (if any), and describe its treatment in the financial statements. Note: to calculate the present value of

a perpetuity divide the amount received per year by the discount rate.

C. Alejandro Corporation has hired you to review its accounting records prior to the closing of the revenue and

expense accounts as of December 31, the end of the current fiscal year. The following information comes to your

attention.

i. During the current year, Alejandro Corporation changed its policy in regard to expensing purchases of small

tools. In the past, it had expensed these purchases because they amounted to less than 2% of net income.

Now, the president has decided that the company should follow a policy of capitalization and subsequent

depreciation. It is expected that purchases of small tools will not fluctuate greatly from year to year.

ii. The company constructed a warehouse at a cost of $1,000,000. It had been depreciating the asset on a straight-

line basis over 10 years. In the current year, the controller doubled depreciation expense because the

replacement cost of the warehouse had increased significantly.

ii. When the balance sheet was prepared, the preparer omitted detailed information as to the amount of cash on

deposit in each of several banks. Only the total amount of cash under a caption "Cash in banks" was presented.

iv. On July 15 of the current year, Alejandro Corporation purchased an undeveloped tract of land at a cost of

$320,000. The company spent $80,000 in subdividing the land and getting it ready for sale. An appraisal of

the property at the end of the year indicated that the land was now worth $500,000. Although none of the

lots were sold, the company recognized revenue of $180,000, less related expenses of $80,000, for a net

income on the project of $100,000.

v. For a number of years, the company used the FIFO method for inventory valuation purposes. During the

current year, the president noted that all the other companies in the industry had switched to the LIFO

method. The company decided not to switch to LIFO because net income would decrease $830,000.

Required for C

1. State whether or not you agree with the decisions made by Alejandro Corporation. Support your answers with

reference, whenever possible, to the generally accepted principles, assumptions, and cost constraint applicable

in the circumstances.

2. Explain and give an example of the effect on a set of published financial statements if the going concern

convention is held not to apply

3. Explain in general terms what the IASB's Conceptual Framework is trying to achieve

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning