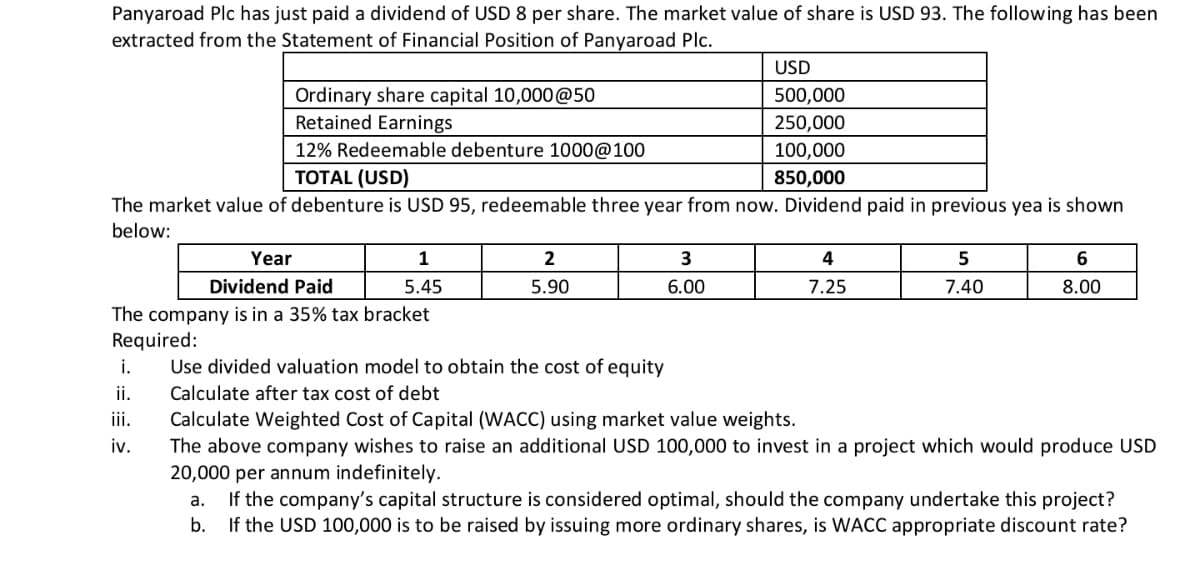

Panyaroad Plc has just paid a dividend of USD 8 per share. The market value of share is USD 93. The following has been extracted from the Statement of Financial Position of Panyaroad Plc. USD Ordinary share capital 10,000@50 Retained Earnings 500,000 250,000 12% Redeemable debenture 1000@100 100,000 TOTAL (USD) 850,000 The market value of debenture is USD 95, redeemable three year from now. Dividend paid in previous yea is shown below: Year 1 2 4 5 6 Dividend Paid 5.45 5.90 6.00 7.25 7.40 8.00 The company is in a 35% tax bracket Required: i. Use divided valuation model to obtain the cost of equity ii. Calculate after tax cost of debt iii. Calculate Weighted Cost of Capital (WACC) using market value weights.

Panyaroad Plc has just paid a dividend of USD 8 per share. The market value of share is USD 93. The following has been extracted from the Statement of Financial Position of Panyaroad Plc. USD Ordinary share capital 10,000@50 Retained Earnings 500,000 250,000 12% Redeemable debenture 1000@100 100,000 TOTAL (USD) 850,000 The market value of debenture is USD 95, redeemable three year from now. Dividend paid in previous yea is shown below: Year 1 2 4 5 6 Dividend Paid 5.45 5.90 6.00 7.25 7.40 8.00 The company is in a 35% tax bracket Required: i. Use divided valuation model to obtain the cost of equity ii. Calculate after tax cost of debt iii. Calculate Weighted Cost of Capital (WACC) using market value weights.

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:Panyaroad Plc has just paid a dividend of USD 8 per share. The market value of share is USD 93. The following has been

extracted from the Statement of Financial Position of Panyaroad Plc.

USD

Ordinary share capital 10,000@50

Retained Earnings

500,000

250,000

12% Redeemable debenture 1000@100

100,000

TOTAL (USD)

850,000

The market value of debenture is USD 95, redeemable three year from now. Dividend paid in previous yea is shown

below:

Year

1

2

3

Dividend Paid

5.45

5.90

6.00

7.25

7.40

8.00

The company is in a 35% tax bracket

Required:

i.

Use divided valuation model to obtain the cost of equity

ii.

Calculate after tax cost of debt

iii.

Calculate Weighted Cost of Capital (WACC) using market value weights.

The above company wishes to raise an additional USD 100,000 to invest in a project which would produce USD

20,000 per annum indefinitely.

iv.

If the company's capital structure is considered optimal, should the company undertake this project?

If the USD 100,000 is to be raised by issuing more ordinary shares, is WACC appropriate discount rate?

а.

b.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning