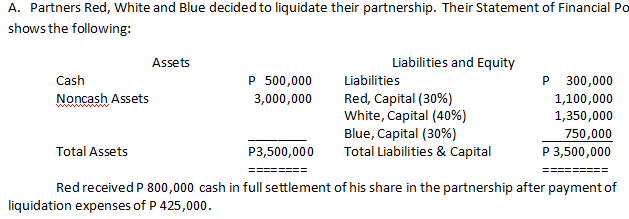

A. Partners Red, White and Blue decided to liquidate their partnership. Their Statement of Financial Po shows the following: Assets Liabilities and Equity Cash P 500,000 Liabilities P 300,000 Noncash Assets Red, Capital (30%) White, Capital (40%) Blue, Capital (30%) Total Liabilities & Capital 3,000,000 1,100,000 1,350,000 750,000 P 3,500,000 Total Assets P3,500,000 Red received P 800,000 cash in full settlement of his share in the partnership after payment of liquidation expenses of P 425,000.

A. Partners Red, White and Blue decided to liquidate their partnership. Their Statement of Financial Po shows the following: Assets Liabilities and Equity Cash P 500,000 Liabilities P 300,000 Noncash Assets Red, Capital (30%) White, Capital (40%) Blue, Capital (30%) Total Liabilities & Capital 3,000,000 1,100,000 1,350,000 750,000 P 3,500,000 Total Assets P3,500,000 Red received P 800,000 cash in full settlement of his share in the partnership after payment of liquidation expenses of P 425,000.

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 59P

Related questions

Question

How much did Blue receive from the liquidation?

Transcribed Image Text:A. Partners Red, White and Blue decided to liquidate their partnership. Their Statement of Financial Po

shows the following:

Assets

Liabilities and Equity

Cash

P 500,000

Liabilities

P

300,000

Red, Capital (30%)

White, Capital (40%)

Blue, Capital (30%)

Total Liabilities & Capital

Noncash Assets

3,000,000

1,100,000

1,350,000

750,000

P 3,500,000

Total Assets

P3,500,000

====

====== ===

Red received P 800,000 cash in full settlement of his share in the partnership after payment of

liquidation expenses of P 425,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College