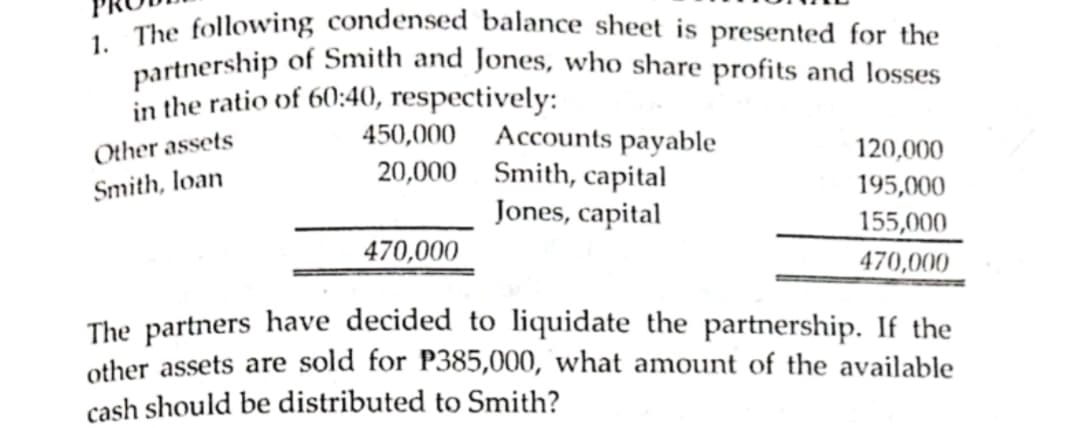

1. The following condensed balance sheet is presented for the partnership of Smith and Jones, who share profits and losses in the ratio of 60:40, respectively: 450,000 Accounts payable 20,000 Smith, capital Jones, capital Other assets 120,000 Smith, loan 195,000 155,000 470,000 470,000 The partners have decided to liquidate the partnership. If the other assets are sold for P385,000, what amount of the available cash should be distributed to Smith?

1. The following condensed balance sheet is presented for the partnership of Smith and Jones, who share profits and losses in the ratio of 60:40, respectively: 450,000 Accounts payable 20,000 Smith, capital Jones, capital Other assets 120,000 Smith, loan 195,000 155,000 470,000 470,000 The partners have decided to liquidate the partnership. If the other assets are sold for P385,000, what amount of the available cash should be distributed to Smith?

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 14MC: Thandie and Marco are partners with capital balances of $60,000. They share profits and losses at...

Related questions

Question

Under partnership liquidation

Transcribed Image Text:1. The following condensed balance sheet is presented for the

partnership of Smith and Jones, who share profits and losses

in the ratio of 60:40, respectively:

450,000 Accounts payable

20,000 Smith, capital

Jones, capital

Other assets

120,000

Smith, loan

195,000

155,000

470,000

470,000

The partners have decided to liquidate the partnership. If the

other assets are sold for P385,000, what amount of the available

cash should be distributed to Smith?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT