a. Project A costs $7,000 and will generate annual after-tax net cash inflows of $2,850 for 5 years. What is the payback period for this investment under the assumption that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) . Project B costs $7,000 and will generate after-tax cash inflows of $950 in year 1, $1,850 in year 2, $2,900 in year 3, $2,850 in year 4, and $2,900 in year 5. What is the payback period (in years) for this investment assuming that the cash inflows occur evenly hroughout the year? (Round your answer to 2 decimal places.) c. Project C costs $7,000 and will generate net cash inflows of $3,250 before taxes for 5 years. The firm uses straight-line depreciation with no salvage value and is subject to a 30% tax rate. What is the payback period under the assumption that all cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) 1. Project D costs $7,000 and will generate sales of $4,700 each year for 5 years. The cash expenditures will be $1,850 per year. The rm uses straight-line depreciation with an estimated salvage value of $400 and has a tax rate of 30%. What is the accounting (book) rate of return based on the original investment? (Round your answer to 2 decimal places.) 2) What is the book rate of return based on the average book value? (Round your answer to 2 decimal places.) se the built-in NPV function in Excel to calculate the amounts for projects a through d. (Round your answers to the nearest whole ollar amount.) What is the NPV of project A? Assume that the firm requires a minimum after-tax return of 6% on investment. 2. What is the NPV of project B? Assume that the firm requires a minimum after-tax return of 6% on investment. What is the NPV of project C? Assume that the firm requires a minimum after-tax return of 6% on investment. - What is the NPV of project D? Assume that the firm requires a minimum after tax return of 6% on investment.

a. Project A costs $7,000 and will generate annual after-tax net cash inflows of $2,850 for 5 years. What is the payback period for this investment under the assumption that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) . Project B costs $7,000 and will generate after-tax cash inflows of $950 in year 1, $1,850 in year 2, $2,900 in year 3, $2,850 in year 4, and $2,900 in year 5. What is the payback period (in years) for this investment assuming that the cash inflows occur evenly hroughout the year? (Round your answer to 2 decimal places.) c. Project C costs $7,000 and will generate net cash inflows of $3,250 before taxes for 5 years. The firm uses straight-line depreciation with no salvage value and is subject to a 30% tax rate. What is the payback period under the assumption that all cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) 1. Project D costs $7,000 and will generate sales of $4,700 each year for 5 years. The cash expenditures will be $1,850 per year. The rm uses straight-line depreciation with an estimated salvage value of $400 and has a tax rate of 30%. What is the accounting (book) rate of return based on the original investment? (Round your answer to 2 decimal places.) 2) What is the book rate of return based on the average book value? (Round your answer to 2 decimal places.) se the built-in NPV function in Excel to calculate the amounts for projects a through d. (Round your answers to the nearest whole ollar amount.) What is the NPV of project A? Assume that the firm requires a minimum after-tax return of 6% on investment. 2. What is the NPV of project B? Assume that the firm requires a minimum after-tax return of 6% on investment. What is the NPV of project C? Assume that the firm requires a minimum after-tax return of 6% on investment. - What is the NPV of project D? Assume that the firm requires a minimum after tax return of 6% on investment.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 16P: REPLACEMENT CHAIN The Lesseig Company has an opportunity to invest in one of two mutually exclusive...

Related questions

Question

100%

Transcribed Image Text:3

IS

Book

Ask

rint

rences

to search

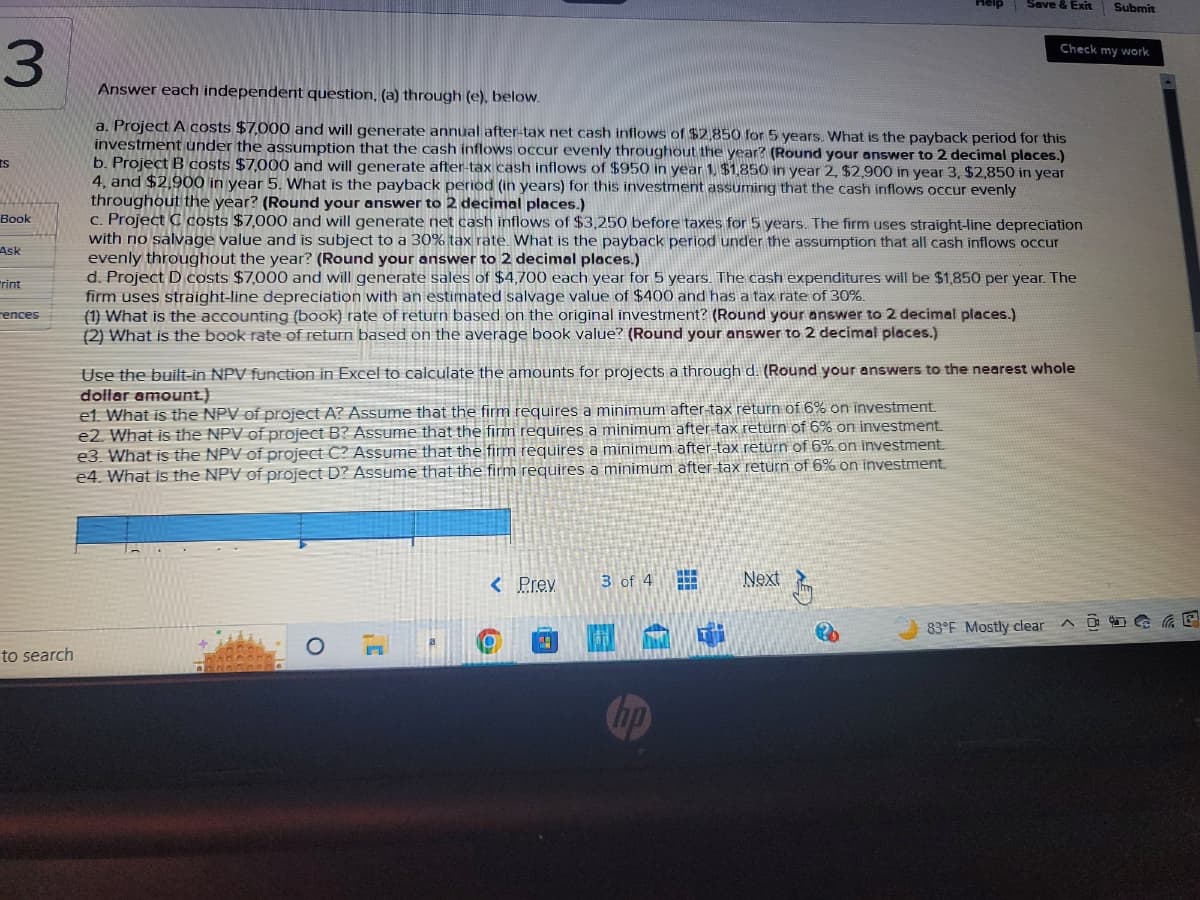

Answer each independent question, (a) through (e), below.

a. Project A costs $7,000 and will generate annual after-tax net cash inflows of $2,850 for 5 years. What is the payback period for this

investment under the assumption that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.)

b. Project B costs $7,000 and will generate after-tax cash inflows of $950 in year 1, $1,850 in year 2, $2,900 in year 3, $2,850 in year

4, and $2,900 in year 5. What is the payback period (in years) for this investment assuming that the cash inflows occur evenly

throughout the year? (Round your answer to 2 decimal places.)

c. Project C costs $7,000 and will generate net cash inflows of $3,250 before taxes for 5 years. The firm uses straight-line depreciation

with no salvage value and is subject to a 30% tax rate. What is the payback period under the assumption that all cash inflows occur

evenly throughout the year? (Round your answer to 2 decimal places.)

d. Project D costs $7,000 and will generate sales of $4,700 each year for 5 years. The cash expenditures will be $1,850 per year. The

firm uses straight-line depreciation with an estimated salvage value of $400 and has a tax rate of 30%.

(1) What is the accounting (book) rate of return based on the original investment? (Round your answer to 2 decimal places.)

(2) What is the book rate of return based on the average book value? (Round your answer to 2 decimal places.)

O

Use the built-in NPV function in Excel to calculate the amounts for projects a through d. (Round your answers to the nearest whole

dollar amount.)

e1. What is the NPV of project A? Assume that the firm requires a minimum after-tax return of 6% on investment.

e2. What is the NPV of project B? Assume that the firm requires a minimum after-tax return of 6% on investment.

e3. What is the NPV of project C? Assume that the firm requires a minimum after-tax return of 6% on investment.

e4. What is the NPV of project D? Assume that the firm requires a minimum after-tax return of 6% on investment.

E

< Prev

19

Save & Exit

3 of 4

Next

Check my work

Jay

Submit

83°F Mostly clear AG

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning