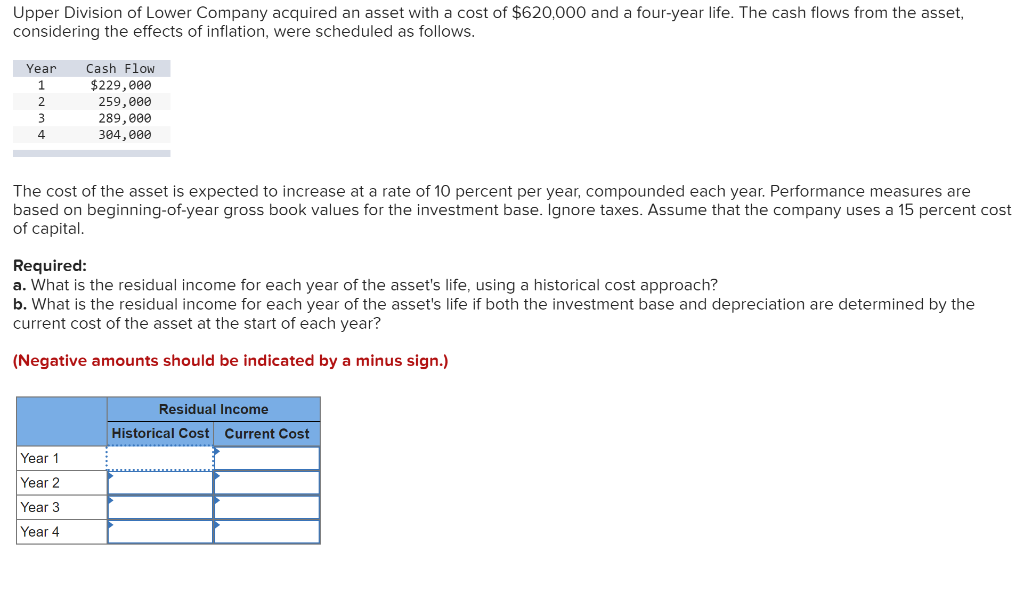

Upper Division of Lower Company acquired an asset with a cost of $620,000 and a four-year life. The cash flows from the asset, considering the effects of inflation, were scheduled as follows. Year 1 2 3 4 Cash Flow $229,000 259,000 289,000 304,000 The cost of the asset is expected to increase at a rate of 10 percent per year, compounded each year. Performance measures are based on beginning-of-year gross book values for the investment base. Ignore taxes. Assume that the company uses a 15 percent cos of capital. Required: a. What is the residual income for each year of the asset's life, using a historical cost approach? b. What is the residual income for each year of the asset's life if both the investment base and depreciation are determined by the current cost of the asset at the start of each year? (Negative amounts should be indicated by a minus sign.) Year 1 Year 2 Year 3 Year 4 Residual Income Historical Cost Current Cost

Upper Division of Lower Company acquired an asset with a cost of $620,000 and a four-year life. The cash flows from the asset, considering the effects of inflation, were scheduled as follows. Year 1 2 3 4 Cash Flow $229,000 259,000 289,000 304,000 The cost of the asset is expected to increase at a rate of 10 percent per year, compounded each year. Performance measures are based on beginning-of-year gross book values for the investment base. Ignore taxes. Assume that the company uses a 15 percent cos of capital. Required: a. What is the residual income for each year of the asset's life, using a historical cost approach? b. What is the residual income for each year of the asset's life if both the investment base and depreciation are determined by the current cost of the asset at the start of each year? (Negative amounts should be indicated by a minus sign.) Year 1 Year 2 Year 3 Year 4 Residual Income Historical Cost Current Cost

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 20P

Related questions

Question

Transcribed Image Text:Upper Division of Lower Company acquired an asset with a cost of $620,000 and a four-year life. The cash flows from the asset,

considering the effects of inflation, were scheduled as follows.

Year Cash Flow

1

2

3

4

$229,000

259,000

289,000

304,000

The cost of the asset is expected to increase at a rate of 10 percent per year, compounded each year. Performance measures are

based on beginning-of-year gross book values for the investment base. Ignore taxes. Assume that the company uses a 15 percent cost

of capital.

Year 1

Year 2

Year 3

Year 4

Required:

a. What is the residual income for each year of the asset's life, using a historical cost approach?

b. What is the residual income for each year of the asset's life if both the investment base and depreciation are determined by the

current cost of the asset at the start of each year?

(Negative amounts should be indicated by a minus sign.)

Residual Income

Historical Cost Current Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning