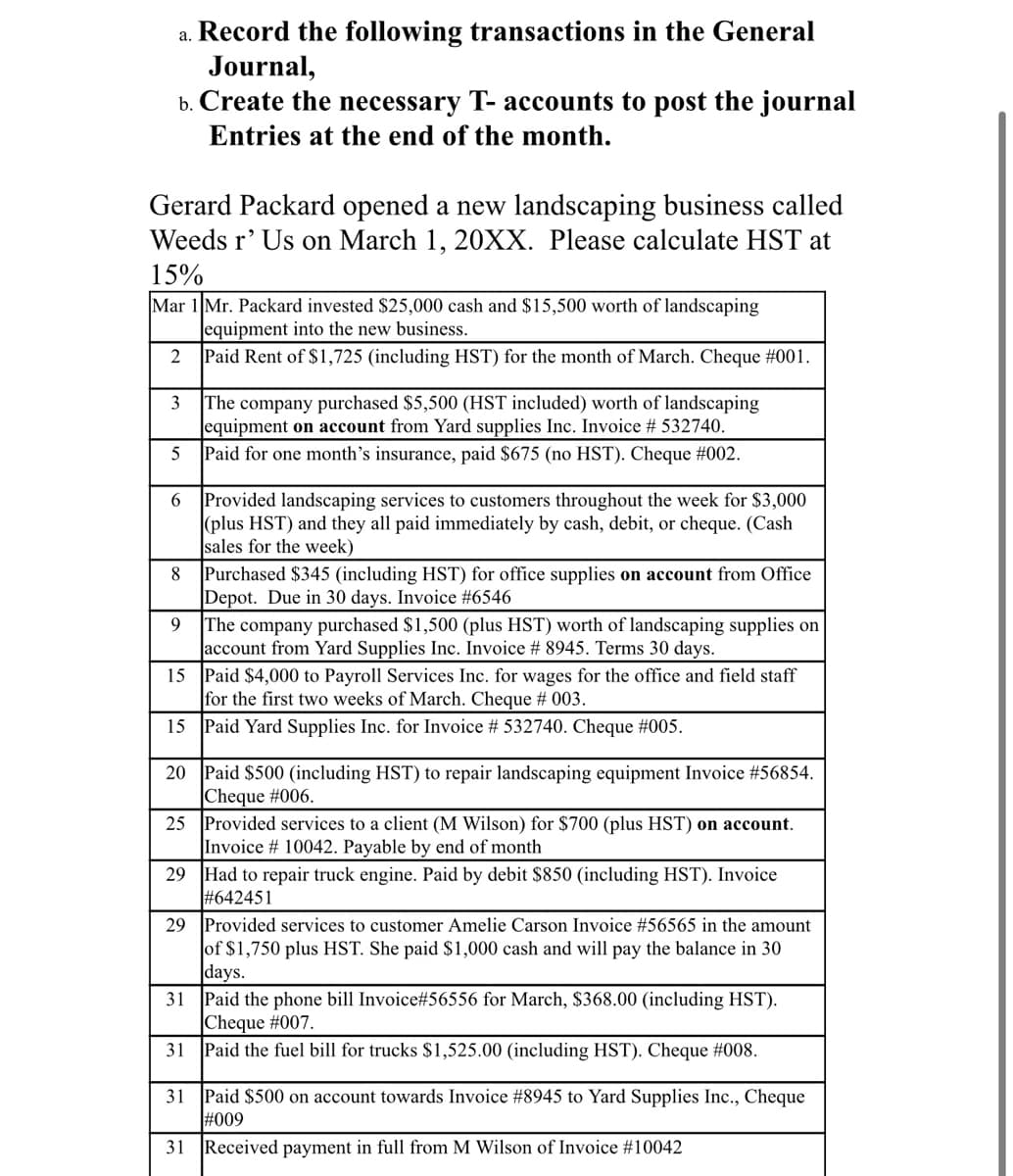

a. Record the following transactions in the General Journal, b. Create the necessary T- accounts to post the journal Entries at the end of the month. Gerard Packard opened a new landscaping business called Weeds r' Us on March 1, 20XX. Please calculate HST at 15% Mar 1 Mr. Packard invested $25,000 cash and $15,500 worth of landscaping equipment into the new business. 2 Paid Rent of $1,725 (including HST) for the month of March. Cheque #001. 3 The company purchased $5,500 (HST included) worth of landscaping equipment on account from Yard supplies Inc. Invoice # 532740. Paid for one month's insurance, paid $675 (no 5 Cheque #002. 6 Provided landscaping services to customers throughout the week for $3,000 (plus HST) and they all paid immediately by cash, debit, or cheque. (Cash sales for the week) 8 Purchased $345 (including HST) for office supplies on account from Office Depot. Due in 30 days. Invoice #6546 9 The company purchased $1,500 (plus HST) worth of landscaping supplies on account from Yard Supplies Inc. Invoice # 8945. Terms 30 days. 15 Paid $4,000 to Payroll Services Inc. for wages for the office and field staff for the first two weeks of March. Cheque # 003. 15 Paid Yard Supplies Inc. for Invoice # 532740. Cheque #005. 20 Paid $500 (including HST) to repair landscaping equipment Invoice #56854. Cheque #006. 25 Provided services to a client (M Wilson) for $700 (plus HST) on account. Invoice # 10042. Payable by end of month 29 Had to repair truck engine. Paid by debit $850 (including HST). Invoice #642451 29 Provided services to customer Amelie Carson Invoice # 56565 in the amount of $1,750 plus HST. She paid $1,000 cash and will pay the balance in 30 days. 31 Paid the phone bill Invoice#56556 for March, $368.00 (including HST). Cheque #007. 31 Paid the fuel bill for trucks $1,525.00 (including HST). Cheque #008. 31 Paid $500 on account towards Invoice # 8945 to Yard Supplies Inc., Cheque #009 31 Received payment in full from M Wilson of Invoice #10042

a. Record the following transactions in the General Journal, b. Create the necessary T- accounts to post the journal Entries at the end of the month. Gerard Packard opened a new landscaping business called Weeds r' Us on March 1, 20XX. Please calculate HST at 15% Mar 1 Mr. Packard invested $25,000 cash and $15,500 worth of landscaping equipment into the new business. 2 Paid Rent of $1,725 (including HST) for the month of March. Cheque #001. 3 The company purchased $5,500 (HST included) worth of landscaping equipment on account from Yard supplies Inc. Invoice # 532740. Paid for one month's insurance, paid $675 (no 5 Cheque #002. 6 Provided landscaping services to customers throughout the week for $3,000 (plus HST) and they all paid immediately by cash, debit, or cheque. (Cash sales for the week) 8 Purchased $345 (including HST) for office supplies on account from Office Depot. Due in 30 days. Invoice #6546 9 The company purchased $1,500 (plus HST) worth of landscaping supplies on account from Yard Supplies Inc. Invoice # 8945. Terms 30 days. 15 Paid $4,000 to Payroll Services Inc. for wages for the office and field staff for the first two weeks of March. Cheque # 003. 15 Paid Yard Supplies Inc. for Invoice # 532740. Cheque #005. 20 Paid $500 (including HST) to repair landscaping equipment Invoice #56854. Cheque #006. 25 Provided services to a client (M Wilson) for $700 (plus HST) on account. Invoice # 10042. Payable by end of month 29 Had to repair truck engine. Paid by debit $850 (including HST). Invoice #642451 29 Provided services to customer Amelie Carson Invoice # 56565 in the amount of $1,750 plus HST. She paid $1,000 cash and will pay the balance in 30 days. 31 Paid the phone bill Invoice#56556 for March, $368.00 (including HST). Cheque #007. 31 Paid the fuel bill for trucks $1,525.00 (including HST). Cheque #008. 31 Paid $500 on account towards Invoice # 8945 to Yard Supplies Inc., Cheque #009 31 Received payment in full from M Wilson of Invoice #10042

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5PB: Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet...

Related questions

Topic Video

Question

Transcribed Image Text:a. Record the following transactions in the General

Journal,

b. Create the necessary T- accounts to post the journal

Entries at the end of the month.

Gerard Packard opened a new landscaping business called

Weeds r' Us on March 1, 20XX. Please calculate HST at

15%

Mar 1 Mr. Packard invested $25,000 cash and $15,500 worth of landscaping

equipment into the new business.

2

Paid Rent of $1,725 (including HST) for the month of March. Cheque #001.

3

The company purchased $5,500 (HST included) worth of landscaping

equipment on account from Yard supplies Inc. Invoice # 532740.

for one month's insurance, paid $675 (no HST). Cheque #002.

6

Provided landscaping services to customers throughout the week for $3,000

(plus HST) and they all paid immediately by cash, debit, or cheque. (Cash

sales for the week)

8 Purchased $345 (including HST) for office supplies on account from Office

Depot. Due in 30 days. Invoice #6546

9

The company purchased $1,500 (plus HST) worth of landscaping supplies on

account from Yard Supplies Inc. Invoice # 8945. Terms 30 days.

15

Paid $4,000 to Payroll Services Inc. for wages for the office and field staff

for the first two weeks of March. Cheque # 003.

15 Paid Yard Supplies Inc. for Invoice # 532740. Cheque #005.

20

Paid $500 (including HST) to repair landscaping equipment Invoice #56854.

Cheque #006.

25

Provided services to a client (M Wilson) for $700 (plus HST) on account.

Invoice # 10042. Payable by end of month

29

Had to repair truck engine. Paid by debit $850 (including HST). Invoice

#642451

29 Provided services to customer Amelie Carson Invoice # 56565 in the amount

of $1,750 plus HST. She paid $1,000 cash and will pay the balance in 30

days.

31

Paid the phone bill Invoice#56556 for March, $368.00 (including HST).

Cheque #007.

31 Paid the fuel bill for trucks $1,525.00 (including HST). Cheque #008.

31 Paid $500 on account towards Invoice # 8945 to Yard Supplies Inc., Cheque

#009

31

Received payment in full from M Wilson of Invoice #10042

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning