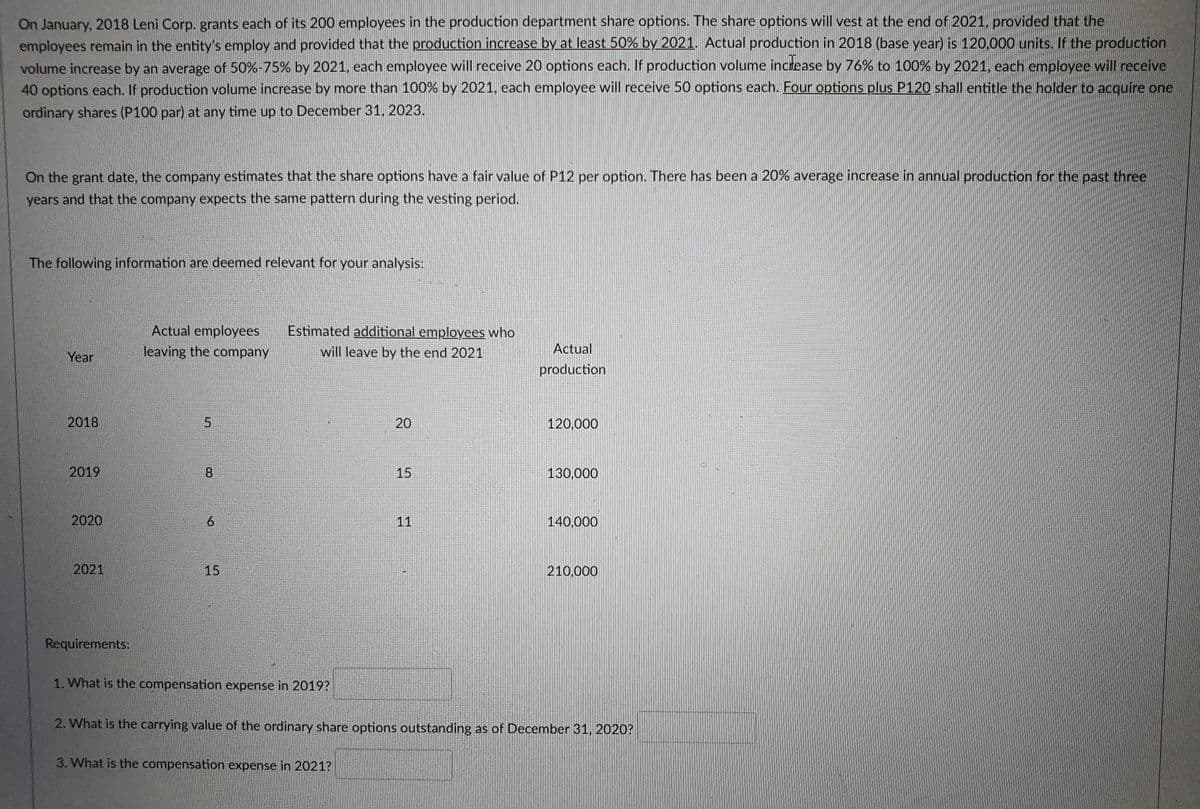

On January, 2018 Leni Corp. grants each of its 200 employees in the production department share options. The share options will vest at the end of 2021, provided that the employees remain in the entity's employ and provided that the production increase by at least 50% by 2021. Actual production in 2018 (base year) is 120,000 units. If the production volume increase by an average of 50%-75% by 2021, each employee will receive 20 options each. If production volume inctease by 76% to 100% by 2021, each employee will receive 40 options each. If production volume increase by more than 100% by 2021, each employee will receive 50 options each. Four options plus P120 shall entitle the holder to acquire one ordinary shares (P100 par) at any time up to December 31, 2023. On the grant date, the company estimates that the share options have a fair value of P12 per option. There has been a 20% average increase in annual production for the past three years and that the company expects the same pattern during the vesting period. The following information are deemed relevant for your analysis: Actual employees Estimated additional employees who leaving the company will leave by the end 2021 Actual Year production 2018 20 120,000 2019 8 15 130,000 2020 11 140,000 2021 15 210.000 Requirements: 1. What is the compensation expense in 2019? 2. What is the carrying value of the ordinary share options outstanding as of December 31, 2020? 3. What is the compensation expense in 2021?

On January, 2018 Leni Corp. grants each of its 200 employees in the production department share options. The share options will vest at the end of 2021, provided that the employees remain in the entity's employ and provided that the production increase by at least 50% by 2021. Actual production in 2018 (base year) is 120,000 units. If the production volume increase by an average of 50%-75% by 2021, each employee will receive 20 options each. If production volume inctease by 76% to 100% by 2021, each employee will receive 40 options each. If production volume increase by more than 100% by 2021, each employee will receive 50 options each. Four options plus P120 shall entitle the holder to acquire one ordinary shares (P100 par) at any time up to December 31, 2023. On the grant date, the company estimates that the share options have a fair value of P12 per option. There has been a 20% average increase in annual production for the past three years and that the company expects the same pattern during the vesting period. The following information are deemed relevant for your analysis: Actual employees Estimated additional employees who leaving the company will leave by the end 2021 Actual Year production 2018 20 120,000 2019 8 15 130,000 2020 11 140,000 2021 15 210.000 Requirements: 1. What is the compensation expense in 2019? 2. What is the carrying value of the ordinary share options outstanding as of December 31, 2020? 3. What is the compensation expense in 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 8RE: On January 2, 2019, Brust Corporation grants its new CFO 2,000 restricted share units. Each of the...

Related questions

Question

Transcribed Image Text:On January, 2018 Leni Corp. grants each of its 200 employees in the production department share options. The share options will vest at the end of 2021, provided that the

employees remain in the entity's employ and provided that the production increase by at least 50% by 2021. Actual production in 2018 (base year) is 120,000 units. If the production

volume increase by an average of 50%-75% by 2021, each employee will receive 20 options each. If production volume inctease by 76% to 100% by 2021, each employee will receive

40 options each. If production volume increase by more than 100% by 2021, each employee will receive 50 options each. Four options plus P120 shall entitle the holder to acquire one

ordinary shares (P100 par) at any time up to December 31, 2023.

On the grant date, the company estimates that the share options have a fair value of P12 per option. There has been a 20% average increase in annual production for the past three

years and that the company expects the same pattern during the vesting period.

The following information are deemed relevant for your analysis:

Estimated additional employees who

Actual employees

leaving the company

will leave by the end 2021

Actual

Year

production

2018

20

120,000

2019

8.

15

130,000

2020

6.

11

140,000

2021

15

210.000

Requirements:

1. What is the compensation expense in 2019?

2. What is the carrying value of the ordinary share options outstanding as of December 31, 2020?

3. What is the compensation expense in 2021?

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

3. What is the compensation expense in 2021?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT