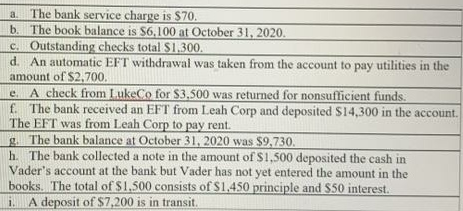

a. The bank service charge is $70. b. The book balance is $6,100 at October 31, 2020. C. Outstanding checks total $1.300. d. An automatic EFT withdrawal was taken from the account to pay utilities in the amount of $2,700. e. A check from LukeCo for $3,500 was returned for nonsufficient funds. f. The bank received an EFT from Leah Corp and deposited S14,300 in the account

a. The bank service charge is $70. b. The book balance is $6,100 at October 31, 2020. C. Outstanding checks total $1.300. d. An automatic EFT withdrawal was taken from the account to pay utilities in the amount of $2,700. e. A check from LukeCo for $3,500 was returned for nonsufficient funds. f. The bank received an EFT from Leah Corp and deposited S14,300 in the account

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 2SEQ

Related questions

Question

BRS

Transcribed Image Text:The bank service charge is $70.

b. The book balance is $6,100 at October 31, 2020.

c. Outstanding checks total $1,300.

d. An automatic EFT withdrawal was taken from the account to pay utilities in the

amount of $2,700.

TeA check from LukeCo for $3,500 was returned for nonsufficient funds.

f. The bank received an EFT from Leah Corp and deposited S14,300 in the account.

The EFT was from Leah Corp to pay rent.

g. The bank balance at October 31, 2020 was $9,730.

h. The bank collected a note in the amount of $1,500 deposited the cash in

Vader's account at the bank but Vader has not yet entered the amount in the

books. The total of $1,500 consists of S1,450 principle and $50 interest.

i. A deposit of $7,200 is in transit.

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,