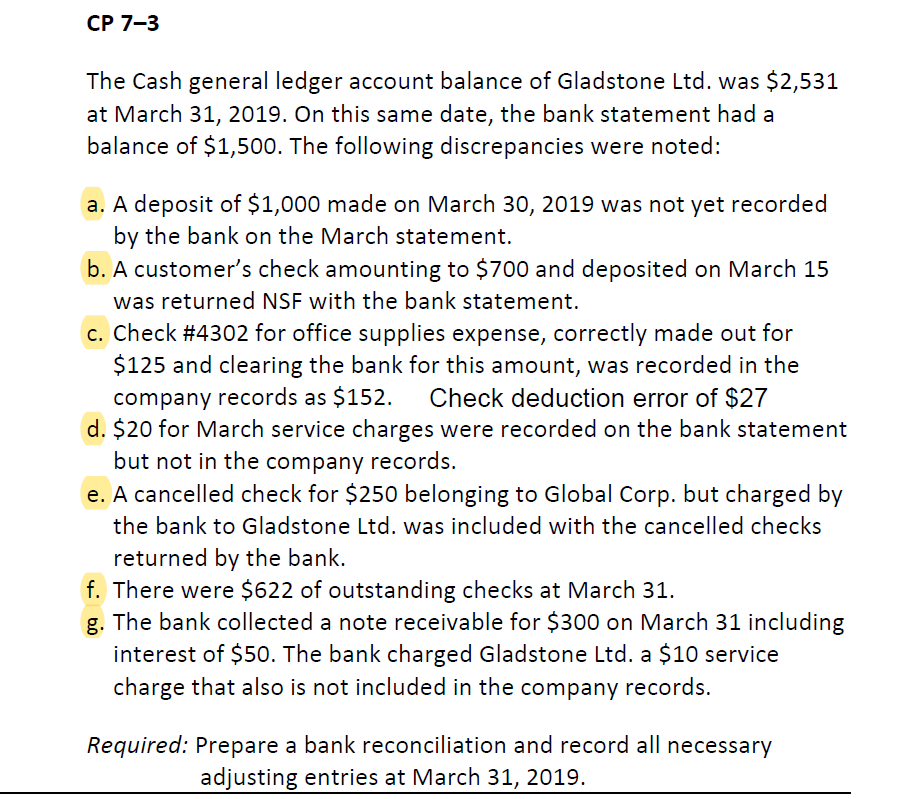

The Cash general ledger account balance of Gladstone Ltd. was $2,531 at March 31, 2019. On this same date, the bank statement had a balance of $1,500. The following discrepancies were noted: a. A deposit of $1,000 made on March 30, 2019 was not yet recorded by the bank on the March statement. b. A customer's check amounting to $700 and deposited on March 15 was returned NSF with the bank statement. c. Check #4302 for office supplies expense, correctly made out for $125 and clearing the bank for this amount, was recorded in the company records as $152. Check deduction error of $27 d. $20 for March service charges were recorded on the bank statement but not in the company records. e. A cancelled check for $250 belonging to Global Corp. but charged by the bank to Gladstone Ltd. was included with the cancelled checks returned by the bank. f. There were $622 of outstanding checks at March 31. g. The bank collected a note receivable for $300 on March 31 including interest of $50. The bank charged Gladstone Ltd. a $10 service charge that also is not included in the company records. Required: Prepare a bank reconciliation and record all necessary adjusting entries at March 31, 2019.

The Cash general ledger account balance of Gladstone Ltd. was $2,531 at March 31, 2019. On this same date, the bank statement had a balance of $1,500. The following discrepancies were noted: a. A deposit of $1,000 made on March 30, 2019 was not yet recorded by the bank on the March statement. b. A customer's check amounting to $700 and deposited on March 15 was returned NSF with the bank statement. c. Check #4302 for office supplies expense, correctly made out for $125 and clearing the bank for this amount, was recorded in the company records as $152. Check deduction error of $27 d. $20 for March service charges were recorded on the bank statement but not in the company records. e. A cancelled check for $250 belonging to Global Corp. but charged by the bank to Gladstone Ltd. was included with the cancelled checks returned by the bank. f. There were $622 of outstanding checks at March 31. g. The bank collected a note receivable for $300 on March 31 including interest of $50. The bank charged Gladstone Ltd. a $10 service charge that also is not included in the company records. Required: Prepare a bank reconciliation and record all necessary adjusting entries at March 31, 2019.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.18EX

Related questions

Question

Please balance, if unable to balance please explain

Transcribed Image Text:CP 7-3

The Cash general ledger account balance of Gladstone Ltd. was $2,531

at March 31, 2019. On this same date, the bank statement had a

balance of $1,500. The following discrepancies were noted:

a. A deposit of $1,000 made on March 30, 2019 was not yet recorded

by the bank on the March statement.

b. A customer's check amounting to $700 and deposited on March 15

was returned NSF with the bank statement.

c. Check #4302 for office supplies expense, correctly made out for

$125 and clearing the bank for this amount, was recorded in the

Check deduction error of $27

company records as $152.

d. $20 for March service charges were recorded on the bank statement

but not in the company records.

e. A cancelled check for $250 belonging to Global Corp. but charged by

the bank to Gladstone Ltd. was included with the cancelled checks

returned by the bank.

f. There were $622 of outstanding checks at March 31.

g. The bank collected a note receivable for $300 on March 31 including

interest of $50. The bank charged Gladstone Ltd. a $10 service

charge that also is not included in the company records.

Required: Prepare a bank reconciliation and record all necessary

adjusting entries at March 31, 2019.

Expert Solution

Step 1 Introduction

The difference between the cash book balance and bank book balance due to some extra transactions in the bank account like cheque issued but not collected and cheque received but dishonored, bank charges, interest on the deposit amount, and so on.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning