a. to determine the ACA for the joining entity's asset Incorrect b. to spread the ACA over the joining entity. c. to determine the ACA for the joining entity d. to spread the ACA over the joining entity's assets.

a. to determine the ACA for the joining entity's asset Incorrect b. to spread the ACA over the joining entity. c. to determine the ACA for the joining entity d. to spread the ACA over the joining entity's assets.

Chapter28: Income Taxation Of Trusts And Estates

Section: Chapter Questions

Problem 17P

Related questions

Question

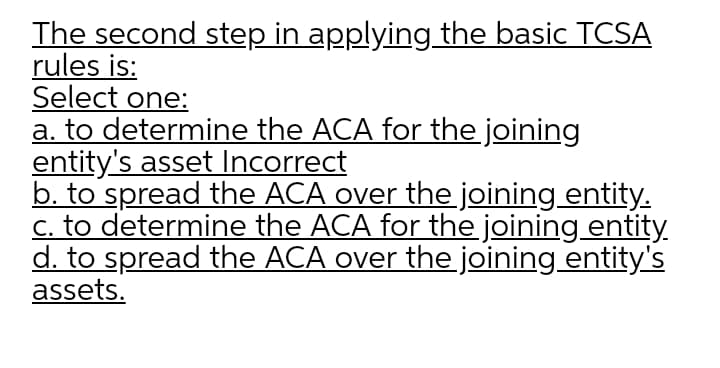

Transcribed Image Text:The second step in applying the basic TCSA

rules is:

Select one:

a. to determine the ACA for the joining

entity's asset Incorrect

b. to spread the ACA over the joining entity.

c. to determine the ACA for the joining entity.

d. to spread the ACA over the joining entity's

assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you