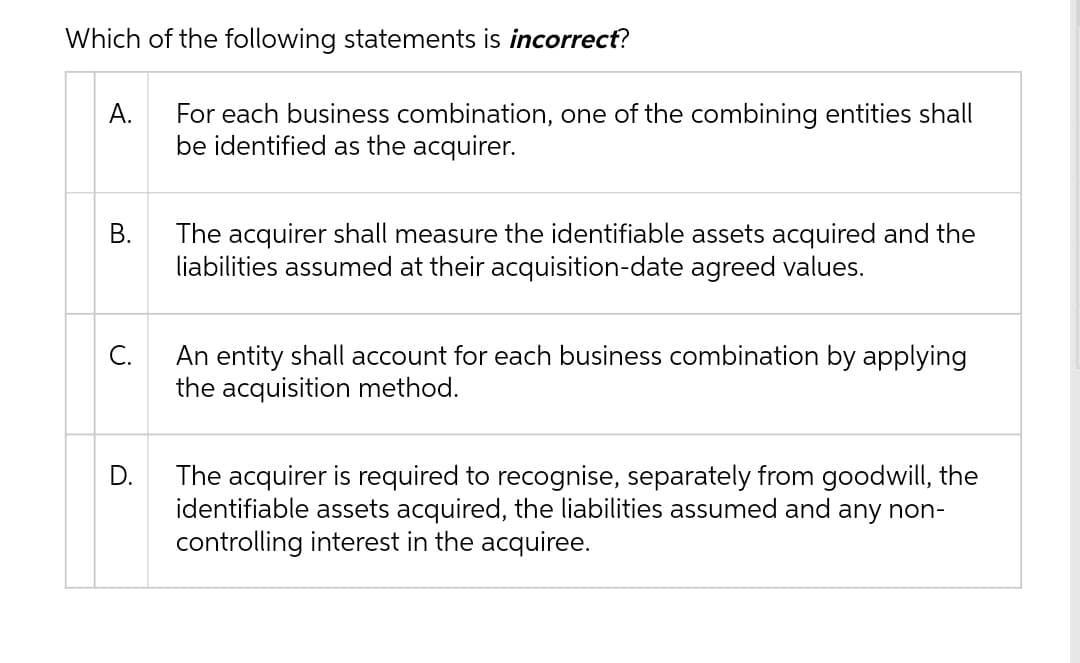

Which of the following statements is incorrect? For each business combination, one of the combining entities shall be identified as the acquirer. А. The acquirer shall measure the identifiable assets acquired and the liabilities assumed at their acquisition-date agreed values. An entity shall account for each business combination by applying the acquisition method. С. The acquirer is required to recognise, separately from goodwill, the identifiable assets acquired, the liabilities assumed and any non- controlling interest in the acquiree. D. B.

Which of the following statements is incorrect? For each business combination, one of the combining entities shall be identified as the acquirer. А. The acquirer shall measure the identifiable assets acquired and the liabilities assumed at their acquisition-date agreed values. An entity shall account for each business combination by applying the acquisition method. С. The acquirer is required to recognise, separately from goodwill, the identifiable assets acquired, the liabilities assumed and any non- controlling interest in the acquiree. D. B.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter16: Advanced Topics Concerning Complex Auditing Judgments

Section: Chapter Questions

Problem 21MCQ

Related questions

Question

Transcribed Image Text:Which of the following statements is incorrect?

А.

For each business combination, one of the combining entities shall

be identified as the acquirer.

The acquirer shall measure the identifiable assets acquired and the

liabilities assumed at their acquisition-date agreed values.

An entity shall account for each business combination by applying

the acquisition method.

C.

D.

The acquirer is required to recognise, separately from goodwill, the

identifiable assets acquired, the liabilities assumed and any non-

controlling interest in the acquiree.

B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning