a. What amount should Ray include in his gross income from receiving the life insurance proceeds? b. The insurance company paid Ray $16,000 interest on the life insurance proceeds during the period Carin's estate was in administration. During this period, Ray had left the insurance proceeds with the insurance company. Is this interest taxable? c. When Ray paid $800,000 for Carin's partnership interest, priced as specified in the agreement, the fair market value of Carin's interest was $1,000,000. Indicate whether the following statements are "True" or "False" regarding how much, if any, Ray would include in his gross income from this bargain purchase. Since Ray did not recognize a gain on the purchase, Ray would include nothing from the transaction in his gross income. Ray would include the difference between the purchase price and what he paid in his gross income.

a. What amount should Ray include in his gross income from receiving the life insurance proceeds? b. The insurance company paid Ray $16,000 interest on the life insurance proceeds during the period Carin's estate was in administration. During this period, Ray had left the insurance proceeds with the insurance company. Is this interest taxable? c. When Ray paid $800,000 for Carin's partnership interest, priced as specified in the agreement, the fair market value of Carin's interest was $1,000,000. Indicate whether the following statements are "True" or "False" regarding how much, if any, Ray would include in his gross income from this bargain purchase. Since Ray did not recognize a gain on the purchase, Ray would include nothing from the transaction in his gross income. Ray would include the difference between the purchase price and what he paid in his gross income.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 32P

Related questions

Question

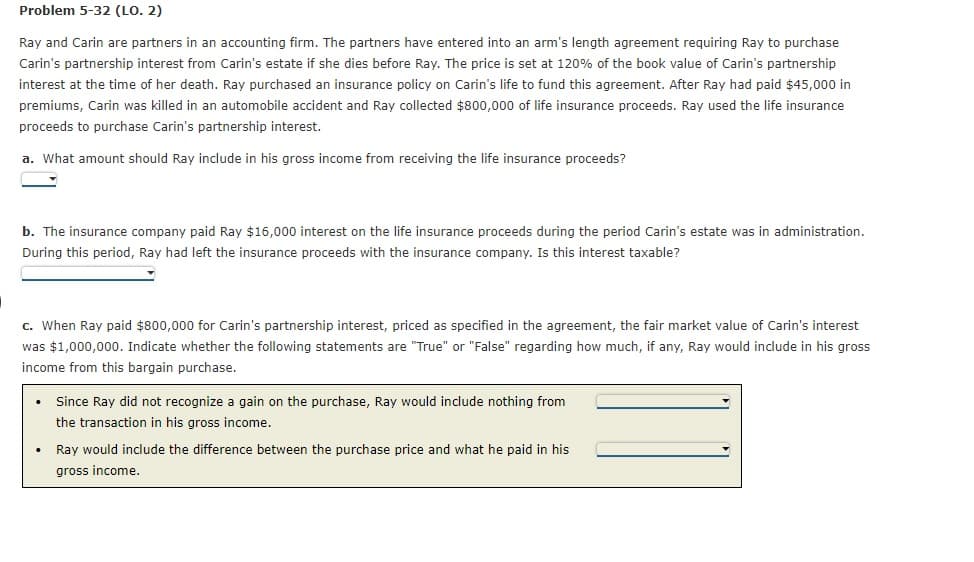

Transcribed Image Text:Problem 5-32 (LO. 2)

Ray and Carin are partners in an accounting firm. The partners have entered into an arm's length agreement requiring Ray to purchase

Carin's partnership interest from Carin's estate if she dies before Ray. The price is set at 120% of the book value of Carin's partnership

interest at the time of her death. Ray purchased an insurance policy on Carin's life to fund this agreement. After Ray had paid $45,000 in

premiums, Carin was killed in an automobile accident and Ray collected $800,000 of life insurance proceeds. Ray used the life insurance

proceeds to purchase Carin's partnership interest.

a. What amount should Ray include in his gross income from receiving the life insurance proceeds?

b. The insurance company paid Ray $16,000 interest on the life insurance proceeds during the period Carin's estate was in administration.

During this period, Ray had left the insurance proceeds with the insurance company. Is this interest taxable?

c. When Ray paid $800,000 for Carin's partnership interest, priced as specified in the agreement, the fair market value of Carin's interest

was $1,000,000. Indicate whether the following statements are "True" or "False" regarding how much, if any, Ray would include in his gross

income from this bargain purchase.

Since Ray did not recognize a gain on the purchase, Ray would include nothing from

the transaction in his gross income.

Ray would include the difference between the purchase price and what he paid in his

gross income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT