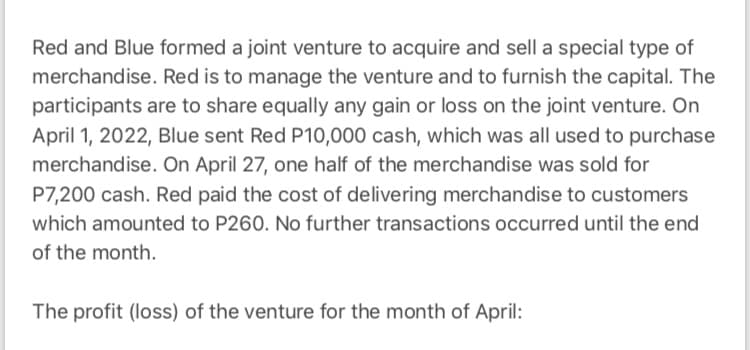

Red and Blue formed a joint venture to acquire and sell a special type of merchandise. Red is to manage the venture and to furnish the capital. The participants are to share equally any gain or loss on the joint venture. On April 1, 2022, Blue sent Red P10,000 cash, which was all used to purchase merchandise. On April 27, one half of the merchandise was sold for P7,200 cash. Red paid the cost of delivering merchandise to customers which amounted to P260. No further transactions occurred until the end of the month. The profit (loss) of the venture for the month of April:

Q: Using HIGH-LOW method, determine the following: 1. The total flexible cost formula? 2. The total ind...

A: Solution Concept Formula for high low method Variable cost per unit =(cost at high point – cost ...

Q: Health ’R Us, Inc., uses a traditional product costing system to assign overhead costs uniformly to ...

A: The question is based on the concept of Cost Accounting.

Q: Due to erratic sales of its sole product-a high-capacity battery for laptop computers-PEM, Incorpora...

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for y...

Q: Determine the missing amounts in the following table: unit sales price unit varible costs unit cont...

A: Contribution margin refers to relationship between Sales and Fixed cost plus Profit.

Q: An investor who is in a 33% tax bracket for normal (ordinary) income buys a stock for $5,000 and sel...

A: Financial Instrument: A financial instrument alludes to a resource that can be exchanged by financia...

Q: Wildhorse Always enters into a contract with Dakota to construct the path for $233,000. In addition,...

A: Solution a: Consideration Bonus Amount Probability of Outcome Revenue Recognized Bonus if ...

Q: Which is true regarding the Investment in Subsidiary Stock account? [a] It is accounted for in the ...

A: Consolidation statement If the parent company acquire the subsidiary company more than the 50% share...

Q: 3 pts The Stoic Bird Company forecasts that total overhead for the current year will be $18,000,000 ...

A: when company uses standard costing method then it certain standard amount of overhead that should be...

Q: A machine costs rs. 22,000 and it's salvage value after its useful life of 5 years is rs. 4,000. Ear...

A: Answer: Given Machine cost 22000 Salvage value 4000 Useful life 5 Depreciation ye...

Q: 1. S acquired 100 percent of F for P275,000. At the date of acquisition, F had the following book an...

A: Consolidated financial statements are the summarized financial statements of an organization includi...

Q: A debit side entry must have a corresponding credit side entry. The normal balance of an account ref...

A: Solution Debit and credit are used in company bookkeeping in order for its books to balance.

Q: If P 10,000 is deposited each year for 9 years, how much annuity can a person get annually from the ...

A: First calculate the future value of annuity for 9 years as below: =FV(14%,9,-10000) => 160,853 No...

Q: Provide one example of a transaction that affect service business and merchandise business.

A: Business refers to all those organization or company who engaged in any type of industrial, commerci...

Q: Suppose you want to invest php 10, 000.00 in the bank forG years. The Land bank of the Philippines (...

A: solution given Amount available (principal) 10000 Compound interest rate 12% Time pe...

Q: Accounts means

A: Financial Accounting- Financial accounting is the process of recording financial events, summarizing...

Q: (The following information applies to the questions displayed below. a On October 1, the Business St...

A: Inventory is the amount of stock that the company has held for the purpose of selling it in the mark...

Q: YOU CAN DO IT Corporation has equipment with a carrying value of 450,000 on December 31, 2021. The f...

A: Solution: An impaired asset is asset which is having market value less than amount listed on balance...

Q: 3. Which is true regarding the Investment in Subsidiary Stock account?

A: It is the single balance sheet in which the financial positions of both the parent and subsidiary co...

Q: payment

A: Time value of money is the concept widely used by the management and individuals to determine the co...

Q: Required 1 Required 2 Compute the overhead volume variance. Indicate variance as favorable or unfavo...

A: Volume variance = (actual units produced - budgeted production units) x budgeted overhead rate per u...

Q: On January 1. 2021, Ackerman sold equipment to Brannigan (a wholly owned subsidiary) for $180,000 in...

A: A consolidated financial statement is inclusive of all the subsidiary companies where the owner has ...

Q: Gowns, Inc. uses 'the percentage of receivables' basis to estimate its impairment loss. At December ...

A: Impairment on accounts receivable refers to loss of value in receivables that is pending to be claim...

Q: Prepare the journals for all transactions

A: Journal entry is the entry which is recorded on the day book whose other name is also journal book o...

Q: Sandoval needs to determine its year-end inventory. The warehouse contains 23,000 units, of which 3,...

A: Inventory is the stock that the company held for the resale purpose and is expected to be sold in ne...

Q: Corporation was granted a patent on a product on January 1, 2004. To protect its patent. the corpora...

A: Patent are intangible asset. Patent are amortized . Below is the explanation regarding amortization...

Q: RR Corporation acquired 80 percent of the stock of GG Company by issuing shares of its common stock ...

A: The question is related to Consolidated. The details are as under RR Corporation Share = 80% Non-con...

Q: Ex 5. Calculate the retained earnings of a retail company considering the following financial inform...

A: >Retained earnings is an Equity account. >This account contains the accumulated amount of ...

Q: You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door ope...

A: Cost variance is a disparity between the expense that was actually incurred and the expense that was...

Q: What are the disadvantages of cutting expenses/costs and utilising trade credit insurance, when it c...

A: Answer: Trade Credit Insurance is the methods that is applied by the company to protect its debts fr...

Q: Journal Entry: 9/19 - Issued a 60-day, 5%, $22,500 note to a customer 11/18 - The note issued on 9...

A: A journal entry is a form of accounting entry that is used to report a business transaction in a com...

Q: Family Fun Time, Inc. makes board games. The following data pertains to the last Direct Labor Hours ...

A: Variable cost = ( Cost at highest activity - Cost at lowest activity ) / ( Highest activity - Lowest...

Q: Alyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier. Ma...

A: The forecast made for future revenues and expenses which is expected to be changed with change in fu...

Q: Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehou...

A: Here, a. Additional Funds Needed = Ao × ΔS/ So -- Lo × ΔS/ So -- S1 × PM × b

Q: rancis worked 10 hours from Monday to Friday. Overtime is based on an 8-hour workday and his daily w...

A: Solution Given Normal hour per day 8 hour Hours worked per day 10 hour Daily wage ra...

Q: In 2020, Ted Baker had total assets of $510.31 million, of which $219.92 million were total noncurre...

A: In order to determine the percentage of current assets on the total assets, the total current assets...

Q: Prepare general journal entries for the following four transactions for Entity Ltd. In this question...

A: Journal Entry The purpose of preparing the journal entry to enter the required transaction into debi...

Q: Your company's average make-up is 90%. The sales per tonne is R4300.It produced 500t during February...

A: Breakeven is the point at which the company will have no profit or loss. The company uses to calcula...

Q: $ 91,300 Harbour Company makes two models of electronic tablets, the Home and the Work. Basic produc...

A: The question is related to Traditional method and Activity Based Costing. The details of two Product...

Q: AA Company produces and sells refrigerator magnets to be sold as novelty items by resorts. Last year...

A: Margin of Safety = Actual sales - Break even sales Break-even sales = Fixed costs / Contribution mar...

Q: (a) Prepare the journal entries (if any) to record the sale on January 2, 2020. (Credit account titl...

A: Journal entries refers to the official book of a company which is used to record the day to day tran...

Q: Exercise 7-3 Sales on store credit card LO C1 Z-Mart uses the perpetual Inventory system and has its...

A: Interest on sale on store credit card is income for the store hence credited to interest account

Q: Carla Vista Choice sells natural supplements to customers with an unconditional sales return if they...

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: Everlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a percenta...

A: Production Cost: It is the cost to manufacture a product Cost is inclusive of raw materials, lab...

Q: If a P2,500 adjustment for depreciation is omitted, which of the following financial statement error...

A:

Q: 4. RR Corporation acquired 80 percent of the stock of GG Company by issuing shares of its common sto...

A: A business acquisition occurs when one company purchases most / all of another company’s shares or c...

Q: vealth of its sh ent in the long pays dividend

A: Dividend-paying funds, like individual stocks, will drop their share values by the amount of the div...

Q: Tiago makes three models of camera lens. Its product mix and contribution margin per unit follow: ...

A: The Break-even point indicates that total units are to be sold by the business entity to recover its...

Q: for Marvin Company revealed the following: Cost Mar. 1 Beginning inventory 1,090 $7.14 Mar.10 Purcha...

A: Average cost per unit = Total cost of goods available for sale / Total no. of units available for sa...

Q: Which of the following entries appear on the parent company’s books to account for its investment in...

A: In case of investment in subsidiary, the effect of inter-company transactions are eliminated from th...

Q: QUESTION 1 Lawn & Order, Inc. reports the following costs for the year: $120,000 Direct materials us...

A: period cost are those cost that cannot be capitalised in to prepaid expenses or inventory or fixed a...

Step by step

Solved in 2 steps

- Reyes and Santos formed a joint operation to acquire and sell a particular lot of merchandise Reyes was to manage the operation and to furnish the capital, and the operators were to share equal in any gain or loss. On June 10, 2024. Santos sent Reyes P10.000 cash, which was immediately used to purchase merchandise which cost P10,000. Reyes paid freight of P240 on the merchandise purchased. On June 24, one half merchandise was sold for P7,200 cash. Reves paid the cost of delivering merchandise to customers, which amounted to P260. No further transactions occurred on June 30, 2024. 1. The profit (loss) of the operation for the period June 10 - June 30, 2024 is: 2.On June 30, 2024 after recognizing the profit (loss) on the uncompleted operation, the account of Santos on the books of Reyes will show a debit (credit) balance of:Kara and Mia formed a joint arrangement to acquire and sell a special type of merchandise. Kara is to manage the joint arrangement and to furnish the capital. The joint operations are to share equally any gain or loss on the joint operations. On April 1,2020, Mia sent Kara P10,000 cash, which was all used to purchase merchandise, Kara paid freight of P240 on the merchandise purchased. On April 27, one half of the merchandise was sold for P7,200 cash. Kara paid the cost of delivering merchandise to customers which amounted to P260. No further transactions occurred until the end of the month. The profit(loss) of the joint arrangement for the month of April,2020 is:Banayo and his very close fiend Buendia formed a partnership on January 1, 2009 with Banayo contributing P160,000 cash and Buendia contributing equipment with a book value of P64,000 and a fair value of P48,000, and inventory items with a book value of P24,000 and a fair value of P32,000. During 2009, Buendia made additional investment of P16,000 on April 1, and P16,000 on June 1. On September 1, he withdrew P40,000. Banayo had no additional investment nor withdrawals during the year. The average capital balance at the end of the fiscal year 2009 for Buendia

- Bang, Bing and Bong formed a joint venture in 2010 to sell computers. They assigned Bing as the manager of the joint venture. They agreed to divide profits equally. They terminated the venture on December 21, 2011 with unsold merchandise. On this date, Bing’s trial balance shows the following account balances before profit distribution: Debits: Joint Venture Cash P90,000, Joint Venture P23,500, Bong, Capital P15,600. Credit: Bang, Capital P32,500. Bing received P 5,300 as her share in the joint venture profit. Bing agreed to be charged for the unsold merchandise as of December 31, 2010. What is the amount due to Bang upon final settlement? *Your answerPedernal, Pating, and Liggayu are forming a new partnership. Pedernal is to invest cash of P100,000 and stapling equipment originally costing P120,000 but has a second-hand market value of P50,000. Pating is to invest cash of P160,000. Liggayu, whose family is engaged in selling stapling equipment, is to contribute cash of P50,000 and a brand new stapling equipment to be used by the partnership with a regular price of P120,000 but which cost their family's business P100,000. The partners agreed to share profits equally. The capital balances upon formation are:Lady and Gaga are partners sharing profits and losses in the ratio of 7:3, respectively. On October 1, 2021, they decided to liquidate the business when the account balances are Debit Credit Cash 50,000 Non-cash Assets 150,000 Liabilities 50,000 Lady, Capital 90,000 Gaga, Capital 60,000 During the same month, the non-cash assets were sold for 100,000. After paying the liabilities, Lady and Gaga, in final settlement of their interest, would receive cash of a. 105,000 and 45,000, respectively b. 90,000 and 60,000, respectively c. 55,000 and 45,000, respectively d. 70,000 and 30,000, respectively

- Kai and her very close friend Bigan formed a partnership on January 1,2015 with Kain contributing P16,000 cash while Bigan contributing equipment with a book value of P6,400 and a fair value of P4,800 and inventory items with a book value of P2,400 and a fair value of P3,200. During 2015, Bigan made additional investments of P1,600 on April 1 and P1,600 on June 1 and on September 1, he withdrew P4,000. Kai had no additional investments or withdrawals during the year. How much is Bigan's average capital balance?In January 2018, Nick Marasigan and Dems Asacta agreed to purchase and sell chocolate candies. Marasigan contributed P2,400,000 in cash to the business. Asacta contributed the building and equipment, valued at P 2,200,000 and P 1,400,000, respectively. The partnership had profits of P480,000 during 2018 but was less successful during 2019, when profit was only P400,000. Required:1. Prepare the journal entry to record the investment of both partners in the partnership.2. Determine the share of profit for each partner in 2018 and 2019 under each of the following conditions:a. The partners agreed to share profit equally.b. The partners failed to agree on a profit-sharing arrangement.c. The partners agreed to share profit according to the ratio of their original investments.d. The partners agreed to share profits by allowing interest of 10% on their original investments and dividing the remainder equally.e. The partners agreed to share profits by allowing salaries of P400,000 for Marasigan…Victoria, Wilda and Xenia are partners in a consultancy firm which commenced its operation on July 1, 2018. Victoria is the managing partner. As per agreement for sharing profits, the managing partner will receive a salary of P12,000 per month and the remaining profit will be shared by the partners equally. On December 31, 2018, the firm determined that its income was P 300,000. How much will Wilda receive as her share in the profit? A. P 76,000 B. P 96,000 C. P 52,000 D. P 84,000

- In January 2019. Nick Marasigan and Dems Asacta agreed to produce and sell chocolate candies. Marasigan contributed P2,400,000 in cash to the business. Asacta contributed the building and equipment, valued at P2,200,000 and P1.400,000, respectively. The partnership had profits of P840,000 during 2019 but was less successful during 2020, when profit was only P400,000. Required: d. The partners agreed to share profits by allowing interest of 10% on their original Investments and dividing the remainder equally The partners agreed to share profits by allowing salaries of P400,000 for Marasigan and P280,000 for Asacta, and dividing the remainder equally. The partners agreed to share profits by paying salaries of P400,000 to Marasigan and P280,000 to Asacta, allowing interest of 9% on their original investments. and dividing the remainder equally.On January 1, 2022, A and B formed a partnership by contributing P200,000 and P180,000 respectively. On April 1, Partner A invested additional P30,000 but withdrew P48,000 on October 31. B, on the other hand, withdrew P45,000 on June 1 but invested P25,000 on September 30. The partnership's operation for the year 2022 resulted in a profit of P98,000 to be divided using the average capital balances of the partners. Determine the capital balance to be used in profit allocation for Partner B..Ranran, Sansan, and Tantan are forming a new partnership. The following are their contributions: • Ranran is to invest cash of P100,000 and stapling equipment originally costing P120,000 but has a second-had market value of P50,000. • Sansan is to invest cash of P 160,000. • Tantan, whose family is engaged in selling stapling equipment, is to contribute cash of P50,000, and a brand-new stapling equipment to be used by the partnership with a regular price of P 120,000 but which cost their family's busmess P100,000. • The partners agreed to share profits and loss equally.The capital balances upon formation are: a) Ranran - ₱220,000; Sansan - ₱160,000; Tantan - ₱220,000 b) Ranran - ₱150,000; Sansan - ₱160,000; Tantan - ₱170,000 c) Ranran - ₱150,000; Sansan - ₱160,000; Tantan - ₱220,000 d) Ranran - ₱176,666; Sansan - ₱176,666; Tantan - ₱176,668