a.) What does Pat report for Sales, COGS, Net Profit, and Inventory for 2020? What does Sam report for Sales, COGS, Net Profit, and Inventory for 2020? What should be the consolidated totals for these accounts for 2020? b.) What are the consolidation entries that Pat writes down for 2020 regarding this inventory sale? Repeat for a.) and b.) for 2021. c.) What is the overall reported profit across the two years from the sale of both widgets? d.) If Pat sold the widgets for $5 each to Sam, how do the consolidation entries change? How does the answer to c.) change?

a.) What does Pat report for Sales, COGS, Net Profit, and Inventory for 2020? What does Sam report for Sales, COGS, Net Profit, and Inventory for 2020? What should be the consolidated totals for these accounts for 2020? b.) What are the consolidation entries that Pat writes down for 2020 regarding this inventory sale? Repeat for a.) and b.) for 2021. c.) What is the overall reported profit across the two years from the sale of both widgets? d.) If Pat sold the widgets for $5 each to Sam, how do the consolidation entries change? How does the answer to c.) change?

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 72P

Related questions

Question

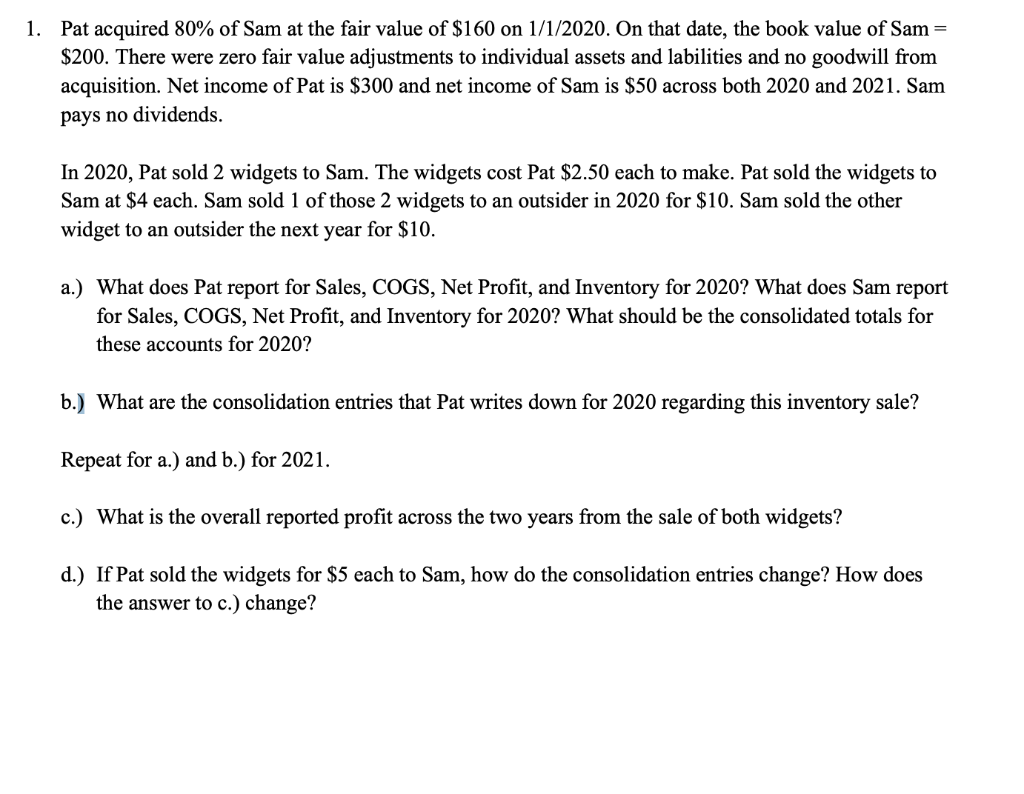

Transcribed Image Text:1. Pat acquired 80% of Sam at the fair value of $160 on 1/1/2020. On that date, the book value of Sam=

$200. There were zero fair value adjustments to individual assets and labilities and no goodwill from

acquisition. Net income of Pat is $300 and net income of Sam is $50 across both 2020 and 2021. Sam

pays no dividends.

In 2020, Pat sold 2 widgets to Sam. The widgets cost Pat $2.50 each to make. Pat sold the widgets to

Sam at $4 each. Sam sold 1 of those 2 widgets to an outsider in 2020 for $10. Sam sold the other

widget to an outsider the next year for $10.

a.) What does Pat report for Sales, COGS, Net Profit, and Inventory for 2020? What does Sam report

for Sales, COGS, Net Profit, and Inventory for 2020? What should be the consolidated totals for

these accounts for 2020?

b.) What are the consolidation entries that Pat writes down for 2020 regarding this inventory sale?

Repeat for a.) and b.) for 2021.

c.) What is the overall reported profit across the two years from the sale of both widgets?

d.) If Pat sold the widgets for $5 each to Sam, how do the consolidation entries change? How does

the answer to c.) change?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT