a. What is Smith family's adjusted gross income? b. What is the family's taxable income? c. What is the family's federal income tax liability for the year? d. What are the family's average and marginal tax rates?

a. What is Smith family's adjusted gross income? b. What is the family's taxable income? c. What is the family's federal income tax liability for the year? d. What are the family's average and marginal tax rates?

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 30P: Lisa records nonrefundable Federal income tax credits of 65,000 for the year. Her regular income tax...

Related questions

Question

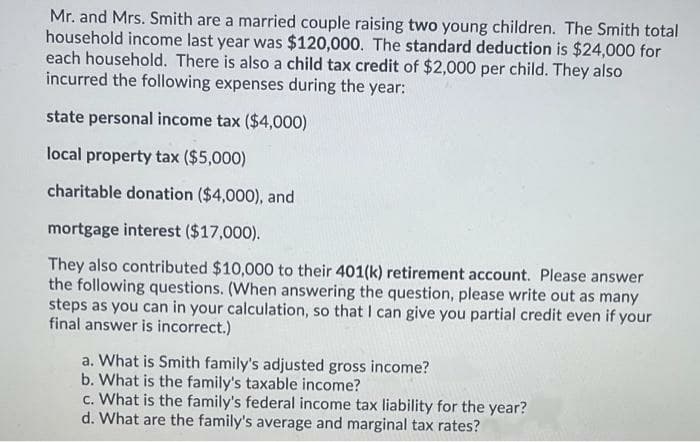

Transcribed Image Text:Mr. and Mrs. Smith are a married couple raising two young children. The Smith total

household income last year was $120,000. The standard deduction is $24,000 for

each household. There is also a child tax credit of $2,000 per child. They also

incurred the following expenses during the year:

state personal income tax ($4,000)

local property tax ($5,000)

charitable donation ($4,000), and

mortgage interest ($17,000).

They also contributed $10,000 to their 401(k) retirement account. Please answer

the following questions. (When answering the question, please write out as many

steps as you can in your calculation, so that I can give you partial credit even if your

final answer is incorrect.)

a. What is Smith family's adjusted gross income?

b. What is the family's taxable income?

c. What is the family's federal income tax liability for the year?

d. What are the family's average and marginal tax rates?

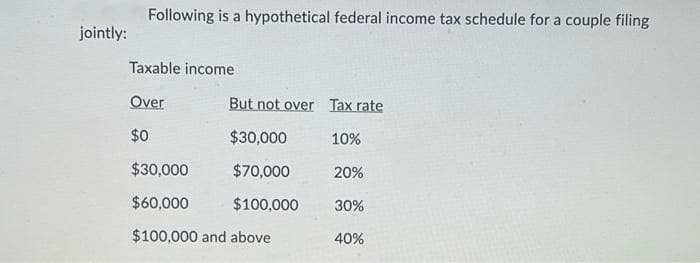

Transcribed Image Text:Following is a hypothetical federal income tax schedule for a couple filing

jointly:

Taxable income

Over

But not over Tax rate

$0

$30,000

10%

$30,000

$70,000

20%

$60,000

$100,000

30%

$100,000 and above

40%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning