a. What is the effective annual interest rate on this lending arrangement? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.1 b. Suppose you need $25 million today and you repay it in eight months. How much interest will you pay? Note: Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.

a. What is the effective annual interest rate on this lending arrangement? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.1 b. Suppose you need $25 million today and you repay it in eight months. How much interest will you pay? Note: Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

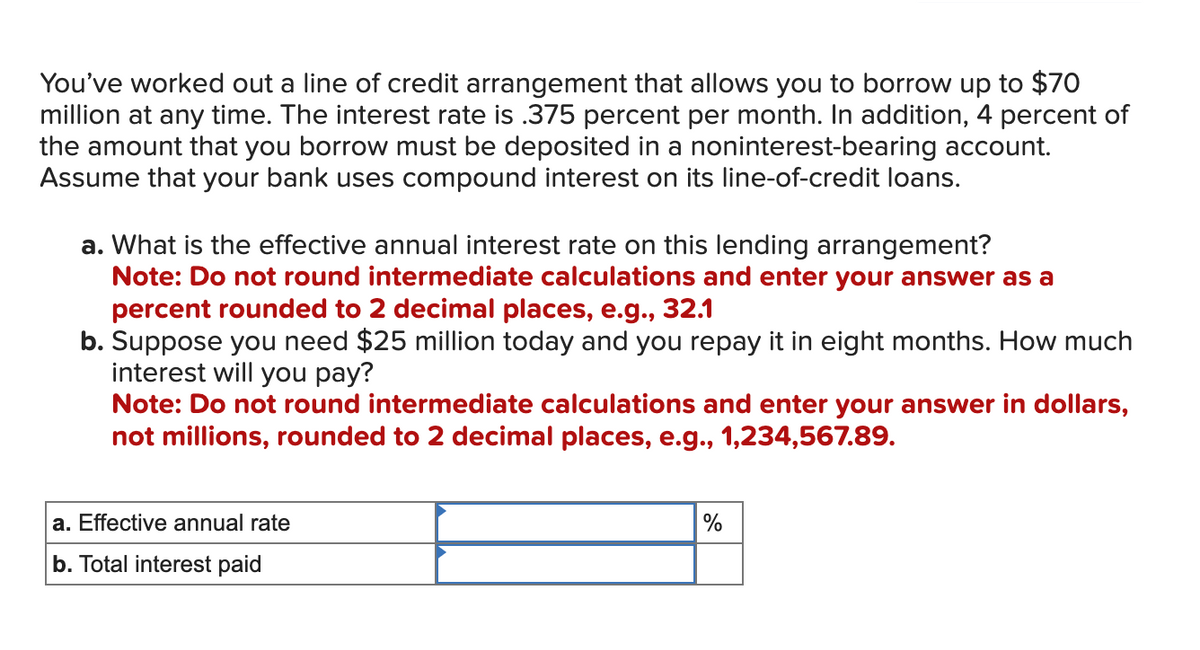

Transcribed Image Text:You've worked out a line of credit arrangement that allows you to borrow up to $70

million at any time. The interest rate is .375 percent per month. In addition, 4 percent of

the amount that you borrow must be deposited in a noninterest-bearing account.

Assume that your bank uses compound interest on its line-of-credit loans.

a. What is the effective annual interest rate on this lending arrangement?

Note: Do not round intermediate calculations and enter your answer as a

percent rounded to 2 decimal places, e.g., 32.1

b. Suppose you need $25 million today and you repay it in eight months. How much

interest will you pay?

Note: Do not round intermediate calculations and enter your answer in dollars,

not millions, rounded to 2 decimal places, e.g., 1,234,567.89.

a. Effective annual rate

b. Total interest paid

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College