a. What is the total amount realized by Barry on the sale? b. How much, if any, ordinary income must Barry recognize on the sale?

Q: The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited…

A: In partnership, a basis can be calculated as =[contribution made toward partnership firm as…

Q: ark and Landry are partners who share income and losses in the ratio of 3:2, respectively. On August…

A: Partnership is an arrangement or agreement between two or more persons in which they invest capital,…

Q: BDD Partnership is a service-oriented partnership that has three equal general partners. One of…

A: Hello, I am only answering first three sub parts of the question as per the policy and if you want…

Q: partnership

A: Amount Should be realized in Profit Sharing Ratio i.e; 5:3:2 Total Cash = 444000 + 375000 - 165000 =…

Q: Gorman and Morton form a partnership on May 1, 2019. Gorman contributes cash of $50,000; Morton…

A: Partnership: The partnership is a relationship among 2 or more persons to manage daily operations as…

Q: On January 1, 2019, David and Enrile decided to form a partnership. At the end of the year, the…

A: The partners of a firm divides the profit generated during the year as per the agreed profit and…

Q: This Grey and Redd Company was founded on January 2, 2021, and each partner has an equal beginning…

A: The Bonus Payment Act of 1965 mandates a minimal bonus of 8.33 percentage of income. The income…

Q: A partnership begins its first year of operations with the following capital balances: According to…

A:

Q: The partnership agreement of Du-sik and Hye-Jin provides for salary allowances of P45,000 to Du-sik…

A: Partner's Equity Capital: In the accounting records of a partnership, the partnership capital…

Q: What outside basis do Lance and Francesca have in their partnership interests at the end of the…

A: Given in the question: Lance Limited Partner Francesca General Partner Profits and…

Q: Gloria Detoya and Esterlina Gevera have operated a successful partnership for years, sharing profit…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: The partnership of Matteson, Richton, and O’Toole has existed for a number of years. At the present…

A: Journal Entry Journal entry is used to record the transaction of a business enterprise.

Q: On December 31, 2013, Alan and Dino are partners with capital balances of P80,000 and P40,000,…

A: Given information is: Alan's Capital = P80,000 Dino's Capital = P40,000 Steve invested P36,000 cash…

Q: Lemon and Parks are partners. On October 1, Lemon's capital balance is $75,000, and Parks' capital…

A: Partnership: This is the form of business entity that is formed by an agreement, owned and managed…

Q: The E.N.D. partnership has the following capital balances as of the end of the current year: Answer…

A: Under the bonus method, the total capital investment is calculated by adding the investment of new…

Q: Lori and Peter enter into a partnership and decide to share profits and losses as follows: 1 The…

A: Appropriation is the act of setting aside money for a specific purpose. In accounting, it refers to…

Q: total increase in the capital

A: A partnership firm refers to a contract between two or more persons to form a business together and…

Q: The partnership of Matteson, Richton, and O’Toole has existed for a number of years. At the present…

A: Working Notes: 1. O'Toole's Total Capital Investment = Capital Investment + Share from Building =…

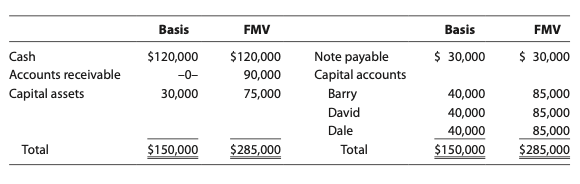

Q: c. How much capital gain must Barry report? d. What is Dale’s basis in the partnership interest…

A: Since, there are two parts to this question. They are as follows:- c. How much capital gain must…

Q: Nagisa and Karma are partners in an electrical repair business. Their respective capital balances…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited…

A: Introduction Partners basis is the partners interest in partner ship, partnership tax law often…

Q: On January 1, 2019, David and Enrile decided to form partnership. At the end of the year, the…

A: Partnership refers to the formal agreement between two or more person who agreed to carry out the…

Q: Gale, McLean, and Lux are partners of Burgers and Brew Company with capital balances as follows:…

A: JOURNAL ENTRIES DATE PARTICULARS DEBIT CREDIT a)May 1,2020 MC lean Capital $91000…

Q: Phil Phoenix and Tim Tucson are partners in an electrical repair business. Their respective capital…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: Tom and Jerry are partners who share profits and losses in a ratio of 2:3, respectively, and have…

A: Solution c) Tom Jerry Ben Partnership Capital before admission of Ben P1,00,000…

Q: The partnership agreement of Alix, Gise, and Bosco provides for the following income ratio: (a)…

A: Answer) Calculation of Amount allocated to Alix out of Net Income of $ 544,000 Alix…

Q: Christie and Jergens formed a partnership with capital contributions of $350,000 and $450,000,…

A: Introduction: Partnership: Its an agreement between two or more partners for forming a business and…

Q: May and Jun are partners with profit and loss ratio of 50:50 and capital balances of $300,000 and…

A: A partnership is an agreement between two or more partners where partners are agreed to work…

Q: Partners Fojas and Gomez share profits and loss equally after each has been credited in all…

A: Solution: Since the salary allowances are credited to the partners’ accounts before sharing the…

Q: [The following information applies to the questions displayed below.] Megan and Matthew are equal…

A: Megan's basis in the distributed assets is as follows :- The sum of the basis ($35,500) is less than…

Q: Pike, Quinn, and Reed are considering adding Shipp as a new partner on April 31 Shipp invests…

A: Partnership is a form of business in which two or more than two persons agree to form a business and…

Q: The partnership of Matteson, Richton, and O’Toole has existed for a number of years. At the present…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: ry and Rose are partners in a retail business and divide profits at 60% and 40%, respectively. The…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: The partnership agreement of Alix, Gise, and Bosco provides for the following income ratio: (a)…

A: Given that: Salary Allowance to Alix = $108900 Interest on Capital = 15%

Q: At December 31, year 1, RR and SH are partners with capital balances of $40,000 and $20,000, and…

A: Total capital of partnership = Amount invested by PP / PP share = $17000 *5/1 = $85,000

Q: Peter and Paul formed a partnership on January 1, 2020, and agreed to share net income and losses 90…

A: Interest on Peter's capital = P250,000 × 5% = P12,500 Paul's Salary = P10,000 × 12 months =…

Q: On January 1, 2021, the partnership of TM, JK and AB, who share profits and losses in the ratio of…

A: At the time of liquidation of the partnership, the cash to be distributed to the partners is equal…

Q: Amy and Mitchell are equal partners in the accrual basis AM Partnership.At the beginning of the…

A: Partnership: It is formal agreement between two individuals to manage and operate their business and…

Q: Gale, McLean, and Lux are partners of Burgers and Brew Company with capital balances as follows:…

A: The first step in accounting is a journal entry, which is used to record a business transaction in…

Q: The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited…

A: To calculate a partner's exact tax liability, the relevant tax regulations require each partner to…

Q: A partnership begins its first year with the following capital balances: The articles of…

A: People start their own business and select the form of organisation depend upon their need and kind…

Q: Prepare the journal entry to record O’Toole’s withdrawal from the partnership. 1. Record the…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: Derek Howat, Gina Rosales, and Amin Karem formed a partnership 10 years ago called HRK LLP, which…

A: For calculating ,closing balances before retirement we need to distribute profit,salary and interest…

Q: and P 200,000, respectively, sharing profits and losses on a 5:3:2 ratio. On July 1, 2021, Arlean…

A: Introduction If any partner withdraw from the partnership then such partnership should pay the…

Q: The BCD Partnership plans to distribute cash of $20,000 to partner Brad at the end of the tax year.…

A: Partnership is done between two or more than two partners for running a commerce/business. There is…

Q: Rubio and Bisana established a trading partnership. They share profits equally after allowing…

A: A partnership is defined as a formal agreement, written or oral, between two or more parties to…

Q: Barth, Holt, and Tran have been partners of a ski, snowboard, and mountain bike shop in Whistler,…

A: The journal entries are prepared to keep the record of day to day transactions of the business. The…

Q: Calculate the capital balances of each partner after the admission of Palatino, assuming that…

A: At the time of admission, the adjustment of the partners’ capital shall be done on the basis of the…

BDD

Immediately before the sale (after reflecting operations for the year), the partner- ship’s cash basis balance sheet is as shown below. Assume that the capital accounts before the sale reflect the partners’ bases in their partnership interests, excluding liabilities. The payment exceeds the stated fair market value of the assets because of

a. What is the total amount realized by Barry on the sale?

b. How much, if any, ordinary income must Barry recognize on the sale?

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 Question 9 What is the firm's Debt Ratio? Group of answer choices 60.0% 65.0% 70.0% 75.0% Question 10 What is the firm's Inventory Turnover? 4.41 4.55 4.69 4.83 Question 11 What is the firm's DPS…BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 Question 5 What is the firm's EBITDA coverage? Group of answer choices 3.51 3.69 3.88 4.17 Question 6 What is the firms DSO (Days Sales Outstanding)? Group of answer choices 51.30 days 52.80 days 53.50…Capital 1 January 2019 350 000Drawings 20 000Sales (70% on credit) 950 000Gross profit 250 000Total expenses 80 000Bank favourable 26 000Net profit 74 000Trade creditors 26 000Property, plant and equipment 350 000Fixed deposit 20 000Inventory 72 000Trade Debtors 80 000Mortgage Loan 100 000 Additional InformationThe opening balance of the inventory, debtors and creditors was R50 000, R60 000 and R30 000respectively. Assume a 365 day year. Calculate the following ratios and explain what each ratio means in relation to theindustry average given in brackets. Show your calculations as marks will be awardedfor these. Round off to 2 decimal places. Q.2.1.3 Average creditors settlement period (60 days). Assume purchases are equalto cost of sales and 60% of all purchases are on credit. Q.2.2 Discuss how the solvency ratio is calculated and what is measured by this ratio. Please help with the both questions mentioned

- Capital 1 January 2019 350 000Drawings 20 000Sales (70% on credit) 950 000Gross profit 250 000Total expenses 80 000Bank favourable 26 000Net profit 74 000Trade creditors 26 000Property, plant and equipment 350 000Fixed deposit 20 000Inventory 72 000Trade Debtors 80 000Mortgage Loan 100 000 Additional InformationThe opening balance of the inventory, debtors and creditors was R50 000, R60 000 and R30 000respectively. Assume a 365 day year. Calculate the following ratios and explain what each ratio means in relation to theindustry average given in brackets. Show your calculations as marks will be awardedfor these. Round off to 2 decimal places. Q.2.1.3 Average creditors settlement period (60 days). Assume purchases are equalto cost of sales and 60% of all purchases are on credit. Q.2.2 Discuss how the solvency ratio is calculated and what is measured by this ratio.Life-Positive’s Account Balances 2021 ($) 2022 ($) accounts payable 24,600.00 21,250.00Accounts receivable 15,700.00 12,340.00Cash 23,450.00 28,600.00Cost of goods sold 19,700.00 23,000.00Depreciation 3,090.00 4,590.00Dividends 5,800.00 10,800.00Interest 2,340.00 2,890.00Inventory 7,050.00 8,640.00Long-term debt 28,000.00 30,000.00Net fixed assets 41,500.00 48,000.00Other expenses 2,400.00 2,800.00Sales 58,000.00 62,500.00Short-term Notes Payable 2,890.00 2,340.00Shares outstanding 85,000.00 90,000.00 tax rate is 32% 4. Calculate the cash flow from assets, cash flow to creditors,and cash flow to stockholders…Cajegas Trucking ServicesTrial BalanceJune 30, 2021Debit CreditCash in Bank P 1,020,000Petty Cash Fund 1,000Accounts Receivable 120,000Est. Uncollectible Account P 1,200Unused Supplies 15,000Prepaid Insurance 8,500Prepaid Rent 30,000Delivery Truck 1,500,000Acc. Depreciation – Delivery Truck 250,000Accounts Payable 130,000P. Cagejas, Capital 1,818,500P. Cagejas, Drawings 50,000Trucking Income 935,000Taxes and Licences 10,000Repairs and Maintenance 27,000Retainer Fees 25,000Salaries and Wages 320,000Utilities Expense 8,200Total P 3,134,700 P 3,134,700Additional Information1. Provision for Uncollectible Account should be at 2% of the outstanding receivable account.2. Supplies actually on hand, P5,000.3. Of the Prepaid Insurance, P6,200 has actually expired.4. P18,000 of the Prepaid Rental has expired.5. Depreciation Expense for the period is P105,000.Required:a. An 8-column worksheetb. Balance Sheetc. Income Statementd. Statement of Changes in Owner’s Equity

- Sign Language Hearing Co Ltd Comparative Balance Sheet October 31, 2020, and 2021 2021 2020 Assets Cash and cash equivalent 320,000 275,000 Accounts Receivable 180,000 240,000 Prepaid expenses 240,000 220,000 Equipment, net 350,000 210,000 Total Assets 1,090,000 945,000 Liabilities Accounts payable 305,000 285,000 Accrued liabilities 285,000 305,000 Bond payable 195,000 95,000 Stockholders' Equity: Common Stock 95,000 55,000 Retained earnings 350,000 255,000 Treasury stock (140,000) (50,000) Total liabilities and stockholders' equity 1,090,000 945,000 Sign Language Hearing Co Ltd Income Statement Year Ended October…Sign Language Hearing Co Ltd Comparative Balance Sheet October 31, 2020, and 2021 2021 2020 Assets Cash and cash equivalent 320,000 275,000 Accounts Receivable 180,000 240,000 Prepaid expenses 240,000 220,000 Equipment, net 350,000 210,000 Total Assets 1,090,000 945,000 Liabilities Accounts payable 305,000 285,000 Accrued liabilities 285,000 305,000 Bond payable 195,000 95,000 Stockholders' Equity: Common Stock 95,000 55,000 Retained earnings 350,000 255,000 Treasury stock (140,000) (50,000) Total liabilities and stockholders' equity 1,090,000 945,000 Sign Language Hearing Co Ltd Income Statement Year Ended October 31,2021 Revenues and gains: Sales…Sign Language Hearing Co Ltd Comparative Balance Sheet October 31, 2020, and 2021 2021 2020 Assets Cash and cash equivalent 320,000 275,000 Accounts Receivable 180,000 240,000 Prepaid expenses 240,000 220,000 Equipment, net 350,000 210,000 Total Assets 1,090,000 945,000 Liabilities Accounts payable 305,000 285,000 Accrued liabilities 285,000 305,000 Bond payable 195,000 95,000 Stockholders' Equity: Common Stock 95,000 55,000 Retained earnings 350,000 255,000 Treasury stock (140,000) (50,000) Total liabilities and stockholders' equity 1,090,000 945,000 Sign Language Hearing Co Ltd Income Statement Year Ended October 31,2021…

- Home office BranchSales P 365,000 P174,000Shipment to branch 90,000Purchases from outsiders 220,000 35,000Advertising expense 13,700 2,500Salaries and Commission 35,000 9,500Rent Expense 10,000 2,000Miscellaneous expense 3,300 500Shipment from home Office 112,500Inventories, January 1:Home Office 85,000Branch:From outsiders 9,500From home office at 2018 billed price30,000Inventories, December 31:Home Office 65,000BranchFrom outsider 6,500From Home office at 2018 billed price30,0001. The branch inventory at cost on December 31, 2021 is:a. P30,500 c. P70,000b. 31,500 d. 36,5002. The combined net income of the Home Office and the Branch on December 31, 2021 is:a. P111,000 c. P250,500b. 63,000 d. 174,000Summerfields Sdn BhdBalance Sheet as at 31 December 2020 (RM’000)Cash 400 Account payable 1,200Marketable securities 500 Accrued wages 1,200Accounts receivable 750 Notes payable 700Inventories 500 Mortgage payable 2,200Net Fixed Asset 4,850 Common stock 500Retained earnings 1,200TOTAL ASSETS 7,000 TOTAL CLAIMS 7,000Additional information:-i) Sales in 2020 was RM 12 million and it is projected to increase to 18 million in 2021.ii) The company is operating at full capacity.iii) The net profit for this company in 2020 was RM1,200,000 and dividend payment wasRM300,000.iv) All external financing will be absorbed and met by common stock.Prepare a pro-forma balance sheet for Summerfields Sdn Bhd for the year ended 2021by using percent of sales method and determine the external funds required.Some selected balances of DD Co. for year ended Dec-31-2019 are as follows with theirnormal balances before adjustments:Cash and Cash Equivalent Br 20,000 Owners’ Capital 40,000Notes Receivables45,000Retained Earnings75,000Office Supplies12,000Sales Revenues640,000Prepaid Insurance72,000Interest Income12,000Inventory (Average Cost)24,000Cost of Goods Sold320,000Fixed Assets120,000Selling Expenses21,000Accum. Depr- Fixed assets36,000Salary and Wages Expense105,000Unearned Rent (Liability)56,000Rent Expense15,000Requireda. Prepare the necessary adjusting entries for the following items as not yet recorded on Dec-31-2019:i. The office supplies consumed during the year is Br 8,000ii. The Unexpired part of insurance is only Br 26,000iii. Br 30,000 is earned sales revenues from the unearned advance collectioniv. Salary and wages accrued as on 31-Dec-2019 amounts to be Br 18,000v. Depreciation Expenses allocated for the year amounts to be Br 15,000vi. There are accrued interest of Br 8,000 on…