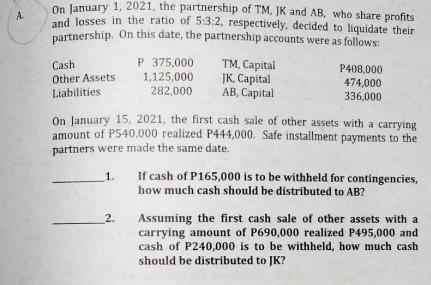

On January 1, 2021, the partnership of TM, JK and AB, who share profits and losses in the ratio of 5:3:2, respectively, decided to liquidate their partnership. On this date, the partnership accounts were as follows: Cash TM, Capital P 375,000 1,125,000 P408,000 Other Assets JK, Capital 474,000 Liabilities. 282,000 AB, Capital 336,000 On January 15, 2021, the first cash sale of other assets with a carrying amount of P540,000 realized P444,000. Safe installment payments to the partners were made the same date. 1. If cash of P165,000 is to be withheld for contingencies, how much cash should be distributed to AB? 2. Assuming the first cash sale of other assets with a arrying amount of P690,000 realized P495,000 and cash of P240,000 is to be withheld, how much cash should be distributed to JK?

On January 1, 2021, the partnership of TM, JK and AB, who share profits and losses in the ratio of 5:3:2, respectively, decided to liquidate their partnership. On this date, the partnership accounts were as follows: Cash TM, Capital P 375,000 1,125,000 P408,000 Other Assets JK, Capital 474,000 Liabilities. 282,000 AB, Capital 336,000 On January 15, 2021, the first cash sale of other assets with a carrying amount of P540,000 realized P444,000. Safe installment payments to the partners were made the same date. 1. If cash of P165,000 is to be withheld for contingencies, how much cash should be distributed to AB? 2. Assuming the first cash sale of other assets with a arrying amount of P690,000 realized P495,000 and cash of P240,000 is to be withheld, how much cash should be distributed to JK?

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

Transcribed Image Text:A

On January 1, 2021, the partnership of TM, JK and AB, who share profits

and losses in the ratio of 5:3:2, respectively, decided to liquidate their

partnership. On this date, the partnership accounts were as follows:

Cash

P 375,000

1,125,000

TM, Capital

JK, Capital

P408,000

474,000

Other Assets

Liabilities.

282,000

AB, Capital

336,000

On January 15, 2021, the first cash sale of other assets with a carrying

amount of P540,000 realized P444,000. Safe installment payments to the

partners were made the same date.

1.

If cash of P165,000 is to be withheld for contingencies,

how much cash should be distributed to AB?

2.

Assuming the first cash sale of other assets with a

carrying amount of P690,000 realized P495,000 and

cash of P240,000 is to be withheld, how much cash

should be distributed to JK?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,