a. What is the variable cost per ton of beach sand mined? What is the fixed cost to CM per month? b. Plot a graph of the variable costs and another graph of the fixed costs of CM. c. What is the unit cost per ton of beach sand mined (a) if 180 tons are mined each day and (b) if 220 tons are mined each day? Explain the difference in the unit-cost figures.

a. What is the variable cost per ton of beach sand mined? What is the fixed cost to CM per month? b. Plot a graph of the variable costs and another graph of the fixed costs of CM. c. What is the unit cost per ton of beach sand mined (a) if 180 tons are mined each day and (b) if 220 tons are mined each day? Explain the difference in the unit-cost figures.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter5: Business Deductions

Section: Chapter Questions

Problem 50P

Related questions

Question

please solve B first

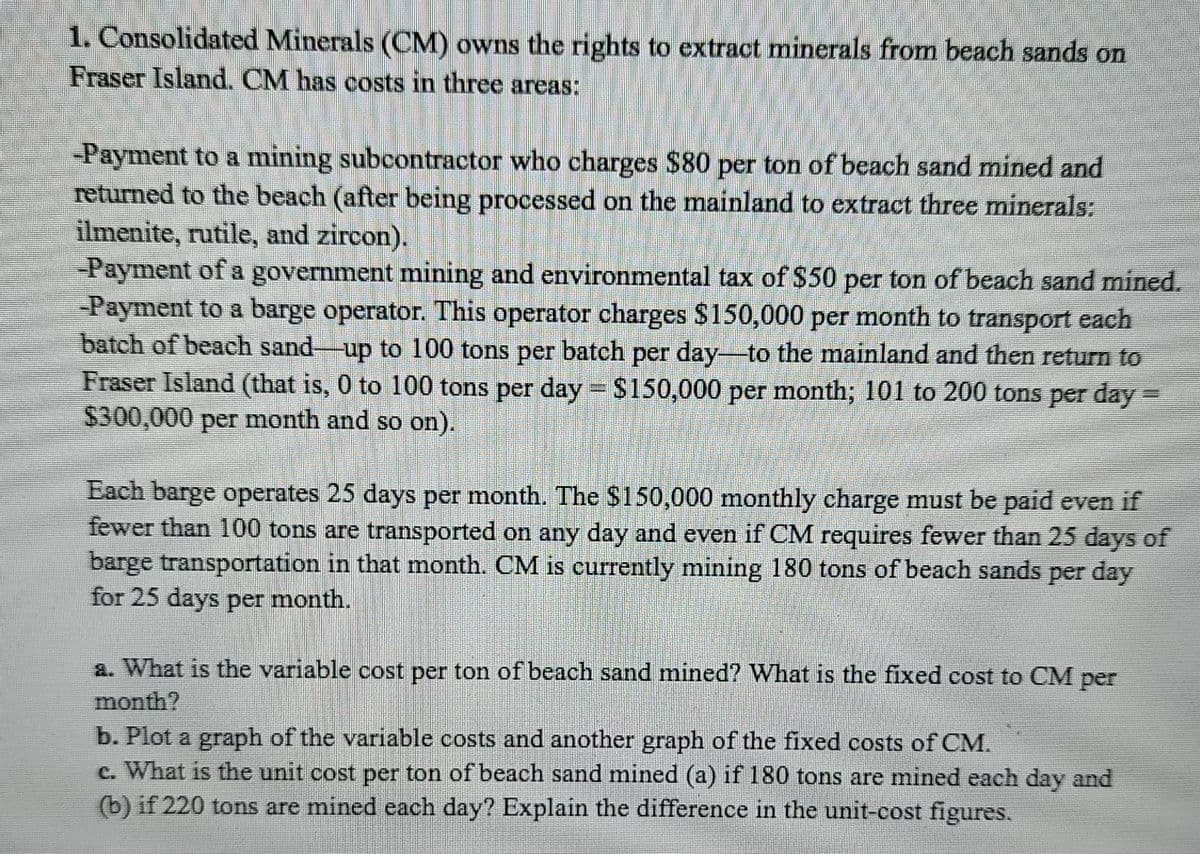

Transcribed Image Text:1. Consolidated Minerals (CM) owns the rights to extract minerals from beach sands on

Fraser Island. CM has costs in three areas:

-Payment to a mining subcontractor who charges $80 per ton of beach sand mined and

returned to the beach (after being processed on the mainland to extract three minerals:

ilmenite, rutile, and zircon).

-Payment of a government mining and environmental tax of $50 per ton of beach sand mined.

Payment to a barge operator. This operator charges $150,000 per month to transport each

batch of beach sand-up to 100 tons per batch per day-to the mainland and then return to

Fraser Island (that is, 0 to 100 tons per day $150,000 per month; 101 to 200 tons per day=

$300,000

per

month and so on).

Each barge operates 25 days per month. The $150,000 monthly charge must be paid even if

fewer than 100 tons are transported on any day and even if CM requires fewer than 25 days of

barge transportation in that month. CM is currently mining 180 tons of beach sands per day

for 25 days per month.

a. What is the variable cost per ton of beach sand mined? What is the fixed cost to CM per

month?

b. Plot a graph of the variable costs and another graph of the fixed costs of CM.

c. What is the unit cost per ton of beach sand mined (a) if 180 tons are mined each day and

(b) if 220 tons are mined each day? Explain the difference in the unit-cost figures.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage