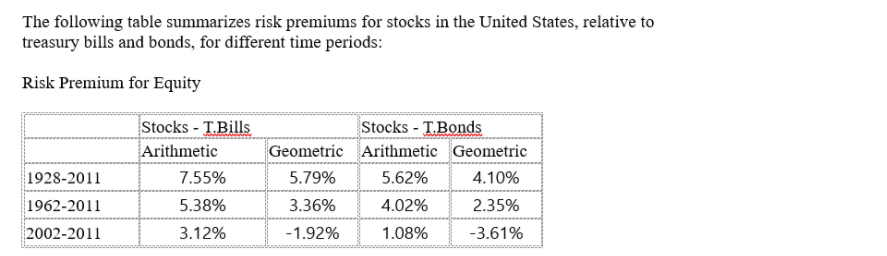

A. What risk premium do you use? Why? B. Why is the geometric mean lower than the arithmetic mean for both bonds and bills? C. If you had to use a risk premium with the longer periods, what biases will the investor have?

Q: 2) You find bond A priced to yield 6%, and a similar-risk bond B priced to yield 6.5%. If you expect…

A: Solution:- Yield means the return earned by the bond holder if he holds the bond until maturity.

Q: If you decide to invest in both stocks and bonds, which has a greater percentage, how will you…

A: When building my own investment portfolio I will invest in both stocks and bonds.

Q: How do bond ratings and interest rate spreads on bonds differ? Which measure is considered by many…

A: Bond rating is a categorization provided to fixed income instruments by approved agencies that aids…

Q: All other things being equal, if you tend to invest in bonds with longer maturities, which of the…

A: Bonds are debt instruments having periodic interest obligations. Bonds have fixed maturity and are…

Q: A bonds expected return is sometimes estimated by its YTM and sometimes by its YTC. Under what…

A: Yield to maturity: Yield to maturity can be defined as the interest rate on fixed income securities.…

Q: Explain whether the following statements are true or false. Justify your answer. a) If interest…

A: Bonds used to have the fixed income that used to show the loan, which prepare through an investors…

Q: Describe the relationship between bond prices and inclation. would you be more inclined to buy bonds…

A: Bond prices have an inverse relation o interest rates. When the interest rates increase, the bond…

Q: If the risk associated with bonds issued by a particular issuer decreases, how will this affect the…

A: The relationship between price and yield are inverse. If yield increased, the price of the bond will…

Q: why is ESG important for genera

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Explain whether the following statements are true or false. Justify your answer. a) If interest…

A: A bond is a kind of debt financial instrument that is being issued by corporations and the…

Q: Briefly describe why investors should buy high-quality (non-speculative) bonds based on…

A: Bonds are fixed income instruments and are rated according to their risk of default by independent…

Q: When a firm gets riskier what will happen to its bonds Multiple Choice the market interest rate…

A: The primary risk associated with bonds are interest rate risk and market risk some corporation bonds…

Q: If you buy a callable bond and interest rates decline, will the value of your bond rise by asmuch as…

A: Bond valuation refers to the evaluation of bond value at any point of time, which can be used for…

Q: What’s TRUE regarding long-term and short-term bonds (assume they have the same par value and coupon…

A: Interest Rate Risk: It is the chance of a decline in the value of security due to changes in…

Q: How do stocks and bonds differ in terms of the future payments that they are expected to make? Which…

A: Introduction: Bond is nothing but debt securities issued by a company or government if they want to…

Q: Which of the following is incorrect regarding margin trading? O a. The relationship between security…

A: Margin trading (MT) is the benefit which is provided by the trader to the investors to purchase…

Q: Does it make any difference if the coupon rate on a bond is more than the needed rate of return on…

A: Introduction: Bond prices are determined by the needed rate of return on the bond, and bond prices…

Q: Describe each of the following methods for estimating the cost of equity: (a) the CAPM, (b) DCF,and…

A: a) CAPM The full form of CAPM is the Capital asset pricing model. It is used in determining the…

Q: Which of the following is correct? Group of answer choices 1. The lower the price you pay for a…

A: An overpriced bond is one whose price is more than its value. Therefore, 2nd option is incorrect.…

Q: An investor invests in a fixed-rate bond because: His calculated value for the bond is greater…

A: Correct option is (3)- He is happy with the yield of the bond when considering its risk

Q: Explain whether the following statements are true or false. Justify your answer. a) If interest…

A: Bonds act as long-term debt for the issuer as the issuer is under the obligation to pay regular…

Q: For the cost of equity (stock) is it better to use the current US Treasury bill rate or a…

A: For a debt commitment to be called entirely risk-free, investors must have perfect assurance that…

Q: Explain whether the following statements are true or false. Justify your answer and solve all the…

A: The bond refers to the debt security issued by the companies to raise the funds at low rates. The…

Q: We learned that if the market interest rate for a given bond increased, the price of the bond would…

A: a) When the risk aversion of investors starts decreasing, it indicates that they now assume that…

Q: Which of the following statements is false? A. Other things being equal, an increase in a…

A: A bond is a fixed income instrument, that is used by borrowers to raise money at a certain interest…

Q: Briefly explain the following statement: Although long-term bonds are heavily exposedto interest…

A: Long term bonds are those bonds which pays high interest rates & the bonds issuing them will…

Q: After the calculation of the correct equity beta, then i want to calculate the expected return by…

A: The CAPM: The CAPM or the Capital Asset Pricing model gives the expected rate of the equity of a…

Q: When you have a fixed investment horizon, it is important to maximize your earnings. You must…

A: An investor should take into consideration the risk and return associated with the security while…

Q: There is an inverse relationship between market interest rates and bond prices true false

A: Bonds indicate an instrument introduced by the corporation for raising funds from the market by…

Q: Which of the following statements is/are most CORRECT? O 1) A yield curve depicts the relationship…

A: Bond: Bond is a kind of debt instrument typically issued by corporations, government organizations…

Q: Do you agree with the statement "if you expect interest rates to go down, you would invest in bonds…

A: Bonds are debt securities issued by Government or other companies, who seek to raise money from…

Q: Historical evidence indicates that stocks Seleccione una: O a. underperform bonds. b. outperform…

A: Higher risk assets includes stocks/ equity investments and stock mutual funds, but they also offer…

Q: When it comes to bond values, what role do interest rates play? How can you value a bond if you…

A: Introduction: Bonds are a kind of debt owed by the corporation that must be paid back. Coupon…

Q: What is a bond’s market value when the required rate of return (ie market rate) is less than the…

A: Bond: A bond is a kind of debt instrument shaped for the determination of raising capital. It is…

Q: Use the following information to answer this question. In your answers, ignore the negative sign, if…

A: Yield spread between two bonds The yield spread between two bonds is the yield of one bond less the…

Q: . Which of the following statements is most correct? a. All else equal, long-term bonds have more…

A: Bonds are considered a financial instrument used to raise finance for the organization. It is also…

Q: If the yield curve in the bond market shows a flat curve, what do you think about the prediction of…

A: Yield Curve - It is a line on graph withbond yield in Y-axis and Maturity in X-axis. These curves…

Q: Assume that the risk-free rate increases, but the market risk premium remains constant. What impact…

A: Risk free rate is the return which investors expect from an investment with zero risk. One such…

Q: When interest rates __________, the market required rates of return ________, and the bond prices…

A: Bond is debt-instrument that is used by entities t raise debt funds from public-at-large. Bonds pay…

Q: If two bonds are said to be perfect substitutes to the investors, then these two bonds offer the…

A: Bonds are the debt security which is issued by corporates or the governments to arrange the funds.…

Q: if an investor expects interest rates to _______________ she/he will choose a bond with

A: A bond is a debt component issued by the entity for generating cash. It is recorded as non-current…

Q: Money duration is the appropriate measure of interest rate risk for bonds with embedded options.…

A: A bond's money duration is a measurement of the bond's price change in reaction to a 1% change in…

Q: Which of the following is TRUE concerning the distinction between interest rates and returns? Select…

A: The Rate of return refers to a rate at which return is generated which is based on the initial…

Do solve all parts

A. What risk premium do you use? Why?

B. Why is the geometric mean lower than the arithmetic mean for both bonds and bills?

C. If you had to use a risk premium with the longer periods, what biases will the investor have?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Historical stock returns show that small - company stocks produced an average return of 17.4 percent, inflation averaged 3.1 percent, U.S. Treasury bills returned an average 3.8 percent, and long - term corporate bonds returned 6.2 percent. What was the risk premium on small - company stocks for that period?The following return series comes from Global Financial Data. Year Large Stocks LT Gov Bonds US T-bills CPI (Rf asset) (inflation) 2017 21.83% 6.24% 0.80% 2.07% 2018 -5.28% -1.25% 1.81% 2.10% 2019 25.45% 3.35% 2.15% 1.10% 2020 18.16% 10.25% 4.50% 1.88% 2021 28.70% -1.54% 0.40% 7.00% 2022 -19.78% -8.55% 2.20% 6.50% Calculate the average real risk premium earned on large-company stocks using the approximate Fisher equation. (Enter percentages as decimals and round to 4 decimals)Assume these are the stock market and Treasury bill returns for a 5-year period in the attached image: A. What was the risk premium on common stock in each year? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Risk Premium 2013 % 2014 % 2015 % 2016 % 2017 % b. What was the average risk premium? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

- Which one of the following categories has the widest frequency distribution of returns for the period 1926-2014? Multiple Choice Small-company stocks U.S. Treasury bills Long-term government bonds Inflation Large-company stockAmong the following types of investments, small-company stocks, large-company stocks, long-term corporate bonds, long-term government bonds, and U.S. Treasury bills, small-company stocks had a risk premium of 13.2 percent for the past 90 years. What does the term "risk premium" mean? Is the risk premium on small-company stocks considered to be relatively high or relatively low when compared to other investment classes? Explain why.The attached file contains hypothetical data for working this problem. Goodman Corporation’s and Landry Incorporated’s stock prices and dividends, along with the Market Index, are shown in the file. Stock prices are reported for December 31 of each year, and dividends reflect those paid during the year. The market data are adjusted to include dividends. The risk-free rate on long-term Treasury bonds is 8.04%. Assume that the market risk premium is 6%. What is the expected return on the market? Now use the SML equation to calculate the two companies' required returns.

- Suppose the following table shows yields to maturity of U.S. Treasury securities as of January 1, 2000. Based on the data in the table, calculate the implied forward one-year and two-year rates at January 1, 2002. y1=3.0% y2=3.5% y3=4.0% y4=4.5%Use the data in the tables below to answer the following questions: Average rates of return on Treasury bills, government bonds, and common stocks, 1900–2020. Portfolio Average Annual Rate of Return (%) Average Premium (Extra return versus Treasury bills) (%) Treasury bills 3.7 Treasury bonds 5.4 1.7 Common stocks 11.5 7.8 Standard deviation of returns, 1900–2020. Portfolio Standard Deviation (%) Treasury bills 2.8 Long-term government bonds 8.9 Common stocks 19.5 What was the average rate of return on large U.S. common stocks from 1900 to 2020? What was the average risk premium on large stocks? What was the standard deviation of returns on common stocks? Note: Enter your answer as a percent rounded to 1 decimal place.Annual and Average Returns for Stocks, Bonds, and T-Bills, 1950 to 2019 Stocks Long - Term Treasury Bonds T-bills 1950 to 2019 Average 12.7% 6.6% 4.2% 1950 to 1959 Average20.9 0.0 2.0 1960 to 1969 Average 8.7 1.6 4.0 1970 to 1979 Average 7.5 5.7 6.3 1980 to 1989 Average18.2 13.5 8.9 1990 to 1999 Average 19.0 9.5 4.9 2000 to 2009 Average 0.9 8.0 2.7 2010 Annual Return15.1 9.4 0.01 2011 Annual Return 2.1 29.9 0.02 2012 Annual Return 16.0 3.6 0.02 2013 Annual Return32.4-12.7 0.07 2014 Annual Return 13.7 25.10.05 2015 Annual Return 1.4-1.2 0.21 2016 AnnualReturn 12.0 1.2 0.51 2017 Annual Return 21.8 8.4 1.39 2018 Annual Return -4.4 1.8 1.94 2019 Annual Return 31.5 14.8 2.06 2010 to 2019 Average 14.2 7.7 0.63 You have a portfolio with an asset allocation of 62 percent stocks, 30 percent long-term Treasury bonds, and 8 percent T-bills. Use these weights and the returns given in the above table to compute the return of the portfolio in the year 2010 and each year since. Then compute the…

- Assume these are the stock market and Treasury bill returns for a 5-year period: Year Stock Market Return (%) T-Bill Return (%) 2016 13.0 0.2 2017 21.0 0.8 2018 -6.2 1.8 2019 29.8 2.1 2020 20.6 0.4 Required: What was the risk premium on common stock in each year? What was the average risk premium? What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.)-- expressed in % (NOTE: 11.31% is incorrect)The following return series comes from Global Financial Data. Year Large Stocks LT Gov Bonds US T-bills CPI (Rf asset) (inflation) 2017 21.83% 6.24% 0.80% 2.07% 2018 -5.28% -1.25% 1.81% 2.10% 2019 25.45% 3.35% 2.15% 1.10% 2020 18.16% 10.25% 4.50% 1.88% 2021 28.70% -1.54% 0.40% 7.00% 2022 -19.78% -8.55% 2.20% 6.50% Calculate the average nominal return earned on large-company stocks. (Enter percentages as decimals and round to 4 decimals)Bato Co is currently estimating the value of its securities given the following information: Government securities currently trade at 4.5% Credit spread for Bato Co is estimated as follows based on its maturity 3 year maturity - 3.5% 4 year maturity - 5.0% 5 year maturity - 6.0% Based on current estimates the Beta of Bato is estimated at 0.75 Market risk premium for equity instruments is estimated at 6.5% The following summarizes the instruments currently issued by Bato: Bond Graphite - Php500,000 face value bond with a 5-year tenor carrying 8.0% coupon issued two years ago Bond Quartz - Php750,000 face value bond with a 4-year tenor carrying 8.0% coupon issued just today Bond Marble - Php1,000,000 face value bond with a 5-year tenor carrying a 12.0% coupon issued last year 10,000 common shares - Bato just declared a dividend of Php2.50 per share and is expected to grow by 20% over the next five years before slowing down to 5% beginning year 6 23. How much is the value of Bond…