Q: Which of the following statement is true? O a. Sunk cost is not relevant in capital…

A: Capital budgeting decisions are used to evaluate new projects, opportunities, and investments such…

Q: Assuming that your capital is constrained, which project should you invest in last?

A: Here we will have to use the PI (profitability index) ratio. We know that profitability index = 1 +…

Q: What is the main disadvantage of discountedpayback? Is the payback method of any realusefulness in…

A: The discounted payback method is a method of evaluating the payback period of the investment carried…

Q: two mutually exclusive projects were being compared, would a high cost of capital favor the…

A: Step -2 in the answer

Q: What are the reasons for using the private rate of return as thethe opportunity cost of capital for…

A: Opportunity cost of capital is the rate which an investor foregoes due to the investment in other…

Q: Which of the following is true regarding capital rationing decisions? a. Companies should always…

A: Capital rationing is a strategy to allocate limited capital to different projects which gives the…

Q: “Only quantitative outcomes are relevant in capital budgeting analyses.” Do you agree? E xplain.

A: “Only quantitative outcomes are relevant in capital budgeting analyses”. This statement is…

Q: What is the crossover rate, and how does its value relative to the cost of capital determinewhether…

A: Crossover rate is a rate where net present values of two mutually exclusive projects are equal to…

Q: What is the Decision-making Criteria in Capital Budgeting?

A: Hi, there, Thanks for posting the question. As per our Q&A honor code, we must answer the first…

Q: Which of the statements below describes the correct capital budgeting decision rule? O A. Reject a…

A: Capital Budgeting Capital budgeting refers to different techniques used to evaluate the project.…

Q: Which of the following are two methods of analyzing capital investment proposals that both ignore…

A: Which of the following methods of evaluating capital investment proposals? Following four methods…

Q: Which of the following is a disadvantage of the internal rate of return criterion? Select one: a.…

A: Internal rate of return (IRR): At IRR, cash outflow will be equal to the present value of cash…

Q: Why might the cost of capital for a foreign project differ from thatof an equivalent domestic…

A: Cost of capital is the amount of return an investment could have garnered if that investment was…

Q: Under what circumstances the cross over rate will be an important point in capital budgeting. Can it…

A: Capital Budgeting is a process in which the company decided on the project investments which would…

Q: Payback period is one of the nondiscounting models used in capital investment decisions. What are…

A: Payback period refers to the period in which the initial investment is recovered.

Q: xplain why sunk costs should be excluded from a capital budgeting study while opportunity costs and…

A: answer are as follows

Q: Compare capital budgeting decision criteria, Net Present Value (NPV) and Internal Rate of Return…

A: Part (1): Answer: Net present value approach predicts how much a future project would add to the…

Q: Discuss the principal limitations of the cash payback method for evaluating capital investment…

A: Cash Payback method:- it is a method which the accountant uses to calculate the different capital…

Q: Why might DCF techniques not lead to proper capital budgeting decisions?

A: Introduction: Capital budgeting is an investment criterion or decision making mechanism for…

Q: What is capital budgeting? Compare the advantages and disadvantages of various capital budgeting…

A: Capital budgeting is indeed the process by which a company evaluates potential large projects or…

Q: When two mutually exclusive projects are being compared, explain whythe short-term project might be…

A: Mutually exclusive projects are the projects with same purpose. Hence, a company chooses only one…

Q: WHAT ARE THE PROBLEMS WITH IRR APPROACH TO CAPITAL BUDGETING?

A: IRR internal rate of return is very common method of capital budgeting decisions making.

Q: For a lending investment project, which of the following is a bad decision rule? If IRR is less than…

A: Internal Rate of Return is the return which equates the present value of cash inflows and present…

Q: For a capital investment project to be acceptable, it must generate a rate of return A) Less than…

A: The correct answer id Option (B).

Q: ic net present value model of capital budgeting deal with the problem of project risk? What…

A: Introduction : In simple words, net present value refers to the amount that is calculated by…

Q: What is the major short coming of using the payback period as the only criterion in making capital…

A: ANSWER the major short coming of using the payback period as the only criterion in making capital…

Q: Financially, what is the economic worth of outbidding thecompetitors for a project?

A: Companies often exploit opportunities in the market because they will create positive NPV for the…

Q: Compare capital budgeting decision criteria, Net Present Value (NPV) and Internal Rateof Return…

A: Part (a): Answer: Net present value approach predicts how much a future project would add to the…

Q: If the net present value of a proposed investment is negative, what is the discount rate used? Less…

A: Net present value (NPV) is the significant present value difference between cash outflows and cash…

Q: Why might the cost of capital for a foreign project differ from that of an equivalentdomestic…

A: There are two approaches to evaluate a foreign project: the home currency approach and the foreign…

Q: State two assumptions when doing capital rationing using a PW analysis for unequal-life projects.

A: Introduction: The planned structure of the revenue’s cost is known as the budget. The projects that…

Q: Which of the following statements is true about the internal rate of return? a. It is the…

A: The internal rate of return is a financial measure used to measure the attractiveness of a…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The companys president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.20, 0.50, and 0.30, respectively. Letting x and y indicate the annual profit in thousands of dollars, the firms planners developed the following profit forecasts for the medium-and large-scale expansion projects. a. Compute the expected value for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of maximizing the expected profit? b. Compute the variance for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of minimizing the risk or uncertainty?Your division is considering two investment projects, each of which requires an up-front expenditure of 25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the regular payback period for each of the projects? b. What is the discounted payback period for each of the projects? c. If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? f. What is the crossover rate? g. If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?

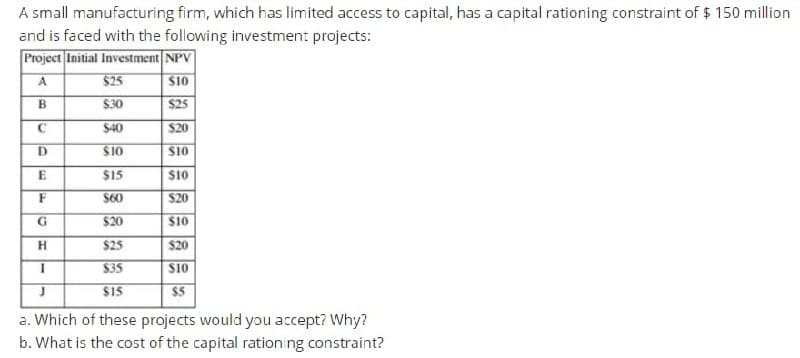

- I know that its the thing to do, insisted Pamela Kincaid, vice president of finance for Colgate Manufacturing. If we are going to be competitive, we need to build this completely automated plant. Im not so sure, replied Bill Thomas, CEO of Colgate. The savings from labor reductions and increased productivity are only 4 million per year. The price tag for this factoryand its a small oneis 45 million. That gives a payback period of more than 11 years. Thats a long time to put the companys money at risk. Yeah, but youre overlooking the savings that well get from the increase in quality, interjected John Simpson, production manager. With this system, we can decrease our waste and our rework time significantly. Those savings are worth another million dollars per year. Another million will only cut the payback to about 9 years, retorted Bill. Ron, youre the marketing managerdo you have any insights? Well, there are other factors to consider, such as service quality and market share. I think that increasing our product quality and improving our delivery service will make us a lot more competitive. I know for a fact that two of our competitors have decided against automation. Thatll give us a shot at their customers, provided our product is of higher quality and we can deliver it faster. I estimate that itll increase our net cash benefits by another 2.4 million. Wow! Now thats impressive, Bill exclaimed, nearly convinced. The payback is now getting down to a reasonable level. I agree, said Pamela, but we do need to be sure that its a sound investment. I know that estimates for construction of the facility have gone as high as 48 million. I also know that the expected residual value, after the 20 years of service we expect to get, is 5 million. I think I had better see if this project can cover our 14% cost of capital. Now wait a minute, Pamela, Bill demanded. You know that I usually insist on a 20% rate of return, especially for a project of this magnitude. Required: 1. Compute the NPV of the project by using the original savings and investment figures. Calculate by using discount rates of 14% and 20%. Include salvage value in the computation. 2. Compute the NPV of the project using the additional benefits noted by the production and marketing managers. Also, use the original cost estimate of 45 million. Again, calculate for both possible discount rates. 3. Compute the NPV of the project using all estimates of cash flows, including the possible initial outlay of 48 million. Calculate by using discount rates of 14% and 20%. 4. CONCEPTUAL CONNECTION If you were making the decision, what would you do? Explain.You are analyzing projects for a firm with a capital budget of $ 150 million. The table below summarizes the projects that are available to the firm and the net present values of these projects. Project Investment needed Net Present Value A $ 35 million $ 5 million B $ 15 million $ 3 million C $ 35 million $ 10 million D $ 25 million $ 8 million E $ 45 million $ 15 million F $ 10 million $ 5 million G $ 15 million $ 5 million H $ 20 million $ 7 million Which projects would you accept, given the capital rationing constraint? Assume that the constraints is internally imposed (by the firm’s management), can you estimate the effect of this constraint on firm value?A firm utilizes a strategy of capital rationing, which is currently $375,000 and is considering the following two projects: Project A has a cost of $335,000 and the following cash flows: year 1$140,000; year 2$150,000; and year 3$100,000. Project B has a cost of $365,000 and the following cash flows: year 1$220,000; year 2$110,000; and year 3$150,000. Using a 6% cost of capital, which decision should the financial manager make? Multiple Choice Do not select either project. Select project B. Select project A. Select both projec

- into.com has developed a powerful new server that would be used for corporations’ Internet activities. It would cost $25 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 12% of the year’s projected sales; for example, NWC0 = 12%(Sales1 ). The servers would sell for $21,000 per unit, and Pinto believes that variable costs would amount to $15,000 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 2.5%. The company’s nonvariable costs would be $1.5 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project’s returns are expected to be highly correlated with returns on the firm’s other assets. The firm believes it could sell 2,000 units per year. The equipment would be depreciated over a…Suppose your company needs $15 million to build a new assembly line. Your target debt-equity ratio is .65. The flotation cost for new equity is 8 percent, but the flotation cost for debt is only 5 percent. Your boss has decided to fund the project by borrowing money because the flotation costs are lower and the needed funds are relatively small. a. What is your company’s weighted average flotation cost, assuming all equity is raised externally? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the true cost of building the new assembly line after taking flotation costs into account? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar, e.g. 1,234,567.)Benson Corporation is considering an investment in equipment that would cost $50,000 and provide annual cash inflows of $14,000. The company's required rate of return is 9%; the internal rate of return for the investment is 10.5%. Should the company make this investment?A. Yes, since the internal rate of return is less than the company's required rate of return. B. No, since the internal rate of return is less than the company's required rate of return. C. Yes since the internal rate of return is more than the company's required rate of return. D. The answer cannot be determined.

- A project costs $1 million and has a base-case NPV of exactly zero (NPV = 0). (A negative answer should be indicated by a minus sign. Enter your answers in dollars, not millions of dollars.) a. If the firm invests, it has to raise $670,000 by a stock issue. Issue costs are 19.25% of net proceeds. What is the project’s APV? b. If the firm invests, there are no issue costs, but its debt capacity increases by $670,000. The present value of interest tax shields on this debt is $93,000. What is the project’s APV?Heckrwee Industries is considering a project that would require an initial investment of $101,000. The project would result in cost savings of $62,000 in year 1 and $70,000 in year 2. The internal rate of return is a.between 18% and 20%. b.between 16% and 17%. c.under 15%. d.None of these choices are correct.A project costs $1 million and has a base-case NPV of exactly zero (NPV = 0). Note: A negative answer should be indicated by a minus sign. Enter your answers in dollars, not millions of dollars. If the firm invests, it has to raise $680,000 by a stock issue. Issue costs are 19.45% of net proceeds. What is the project’s APV? If the firm invests, there are no issue costs, but its debt capacity increases by $680,000. The present value of interest tax shields on this debt is $94,000. What is the project’s APV?