A. Work out the changes for the above transaction. Remember to include the opening capital. Record these in the T-accounts provided in your Workbook. B. For each of the transactions listed below, work out the changes for the transaction and record these changes in the T-accounts.

A. Work out the changes for the above transaction. Remember to include the opening capital. Record these in the T-accounts provided in your Workbook. B. For each of the transactions listed below, work out the changes for the transaction and record these changes in the T-accounts.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.10E: Effects of transactions on Accounting equation On Time Delivery Service had the following selected...

Related questions

Topic Video

Question

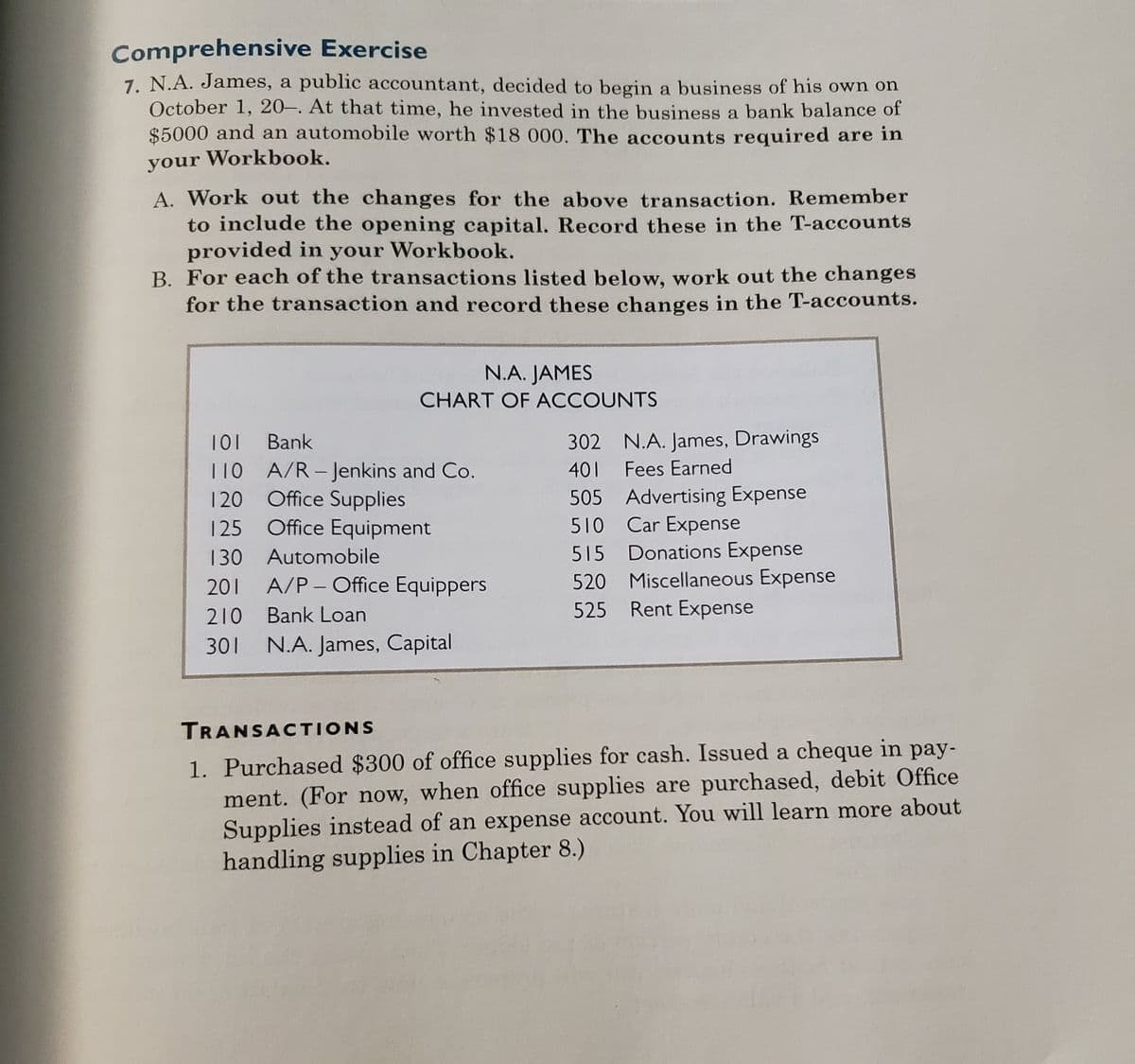

Transcribed Image Text:Comprehensive Exercise

7. N.A. James, a public accountant, decided to begin a business of his own on

October 1, 20-. At that time, he invested in the business a bank balance of

$5000 and an automobile worth $18 000. The accounts required are in

your Workbook.

A. Work out the changes for the above transaction. Remember

to include the opening capital. Record these in the T-accounts

provided in your Workbook.

B. For each of the transactions listed below, work out the changes

for the transaction and record these changes in the T-accounts.

N.A. JAMES

CHART OF ACCOUNTS

101

110 A/R- Jenkins and Co.

120 Office Supplies

125 Office Equipment

Bank

302 N.A. James, Drawings

401 Fees Earned

505 Advertising Expense

510 Car Expense

515 Donations Expense

520 Miscellaneous Expense

525 Rent Expense

130 Automobile

201 A/P- Office Equippers

210 Bank Loan

301

N.A. James, Capital

TRANSACTIONS

1. Purchased $300 of office supplies for cash. Issued a cheque in pay-

ment. (For now, when office supplies are purchased, debit Office

Supplies instead of an expense account. You will learn more about

handling supplies in Chapter 8.)

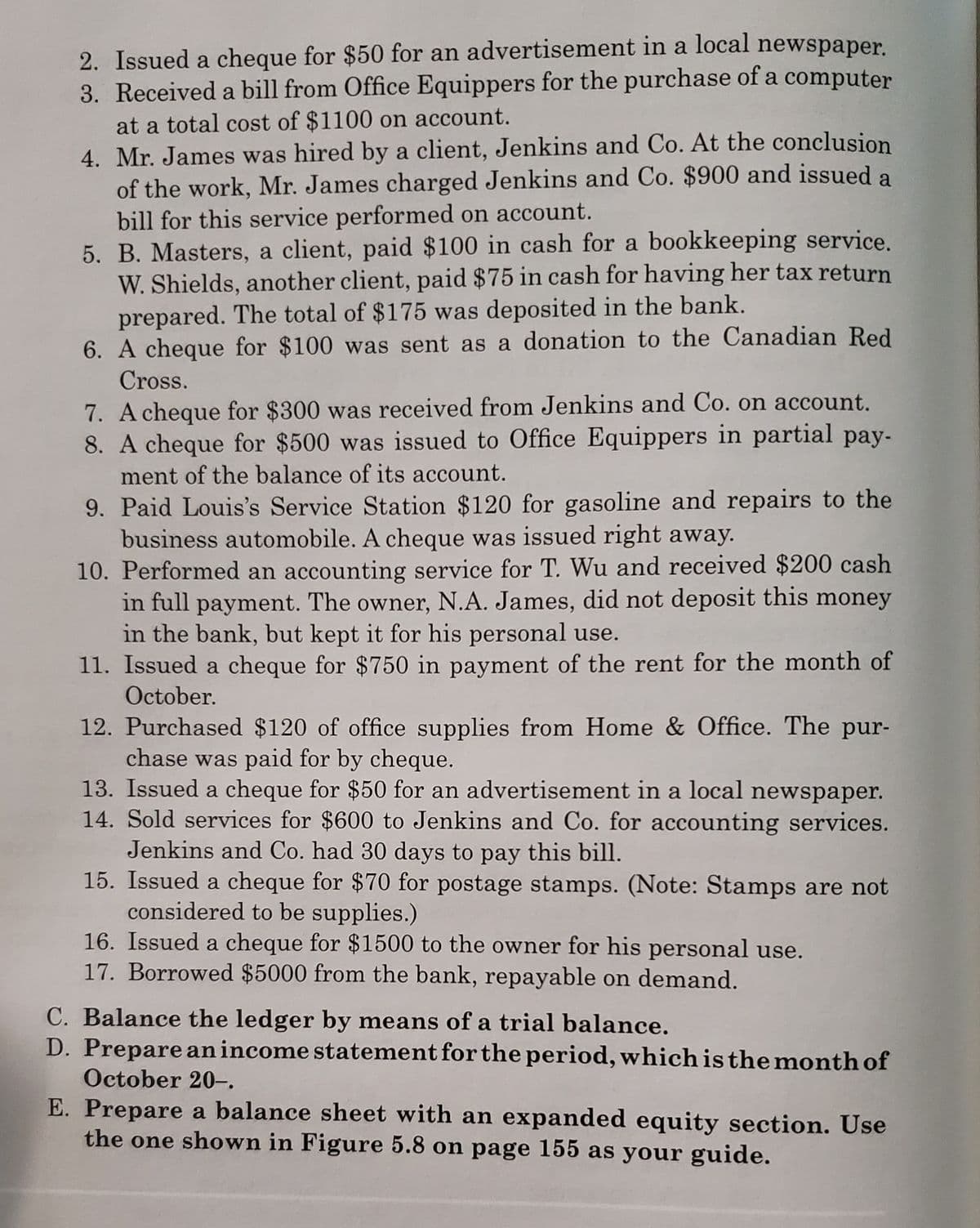

Transcribed Image Text:2. Issued a cheque for $50 for an advertisement in a local newspaper.

3. Received a bill from Office Equippers for the purchase of a computer

at a total cost of $1100 on account.

4. Mr. James was hired by a client, Jenkins and Co. At the conclusion

of the work, Mr. James charged Jenkins and Co. $900 and issued a

bill for this service performed on account.

5. B. Masters, a client, paid $100 in cash for a bookkeeping service.

W. Shields, another client, paid $75 in cash for having her tax return

prepared. The total of $175 was deposited in the bank.

6. A cheque for $100 was sent as a donation to the Canadian Red

Cross.

7. A cheque for $300 was received from Jenkins and Co. on account.

8. A cheque for $500 was issued to Office Equippers in partial pay-

ment of the balance of its account.

9. Paid Louis's Service Station $120 for gasoline and repairs to the

business automobile. A cheque was issued right away.

10. Performed an accounting service for T. Wu and received $200 cash

in full payment. The owner, N.A. James, did not deposit this money

in the bank, but kept it for his personal use.

11. Issued a cheque for $750 in payment of the rent for the month of

October.

12. Purchased $120 of office supplies from Home & Office. The pur-

chase was paid for by cheque.

13. Issued a cheque for $50 for an advertisement in a local newspaper.

14. Sold services for $600 to Jenkins and Co. for accounting services.

Jenkins and Co. had 30 days to pay this bill.

15. Issued a cheque for $70 for postage stamps. (Note: Stamps are not

considered to be supplies.)

16. Issued a cheque for $1500 to the owner for his personal use.

17. Borrowed $5000 from the bank, repayable on demand.

C. Balance the ledger by means of a trial balance.

D. Prepare an income statement for the period, which is the month of

October 20-.

E. Prepare a balance sheet with an expanded equity section. Use

the one shown in Figure 5.8 on page 155 as your guide.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub