a. You plan to take a credit with $1500 installment size per year with an annual interest rate of 8% over six years from a bank. What is the amount of your current credit? (i). (ii). b. A bank is required to deposit money for four years with an interest rate 10%. The money deposited at the end of the first year is 6000 TL and the amount of money deposited in the next three years will be reduced by 500 TL every year. How much money will be in the bank at the end of the fourth year? (i).

a. You plan to take a credit with $1500 installment size per year with an annual interest rate of 8% over six years from a bank. What is the amount of your current credit? (i). (ii). b. A bank is required to deposit money for four years with an interest rate 10%. The money deposited at the end of the first year is 6000 TL and the amount of money deposited in the next three years will be reduced by 500 TL every year. How much money will be in the bank at the end of the fourth year? (i).

Chapter2: Mathematics For Microeconomics

Section: Chapter Questions

Problem 2.4P

Related questions

Question

Q2

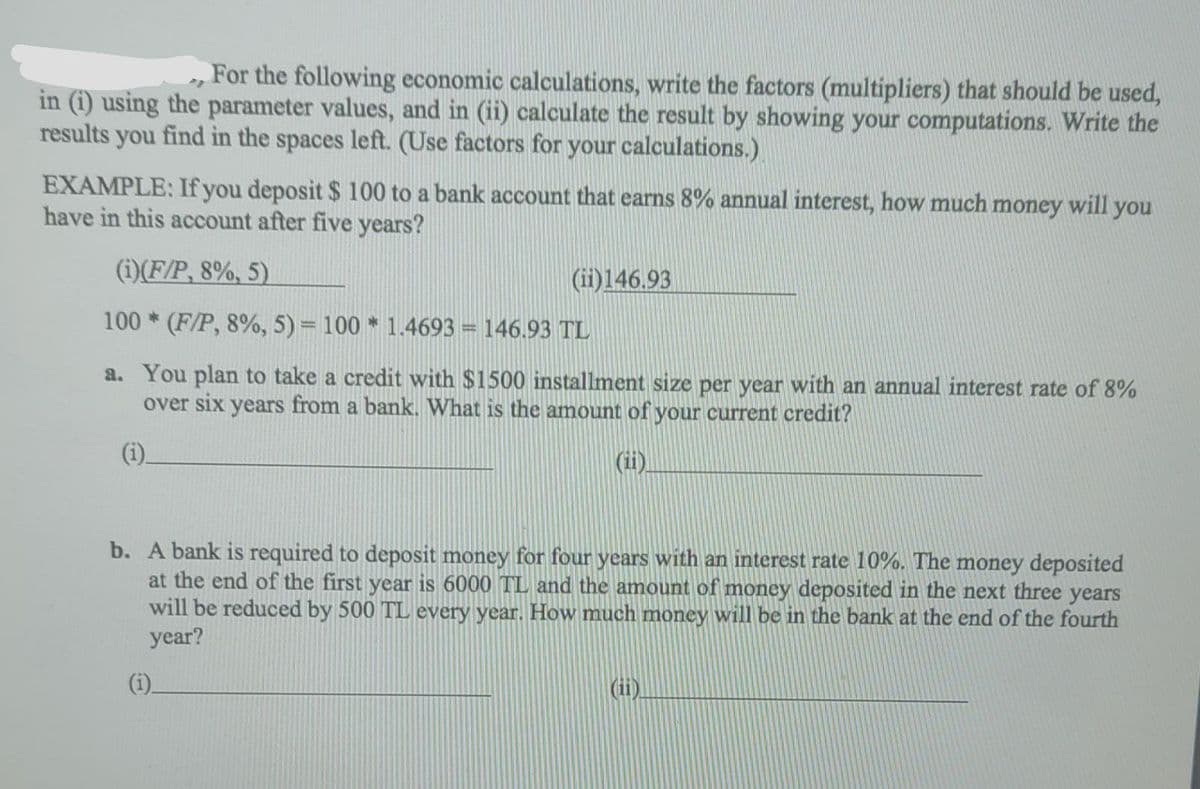

Transcribed Image Text:For the following economic calculations, write the factors (multipliers) that should be used,

in (i) using the parameter values, and in (ii) calculate the result by showing your computations. Write the

results you find in the spaces left. (Use factors for your calculations.).

EXAMPLE: If you deposit $ 100 to a bank account that earns 8% annual interest, how much money will you

have in this account after five years?

(i)(F/P, 8%, 5)

(ii)146.93

100 * (F/P, 8%, 5) = 100 * 1.4693 = 146.93 TL

a. You plan to take a credit with $1500 installment size per year with an annual interest rate of 8%

over six years from a bank. What is the amount of your current credit?

(i).

(ii.

b. A bank is required to deposit money for four years with an interest rate 10%. The money deposited

at the end of the first year is 6000 TL and the amount of money deposited in the next three years

will be reduced by 500 TL every year. How much money will be in the bank at the end of the fourth

year?

(ii).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you