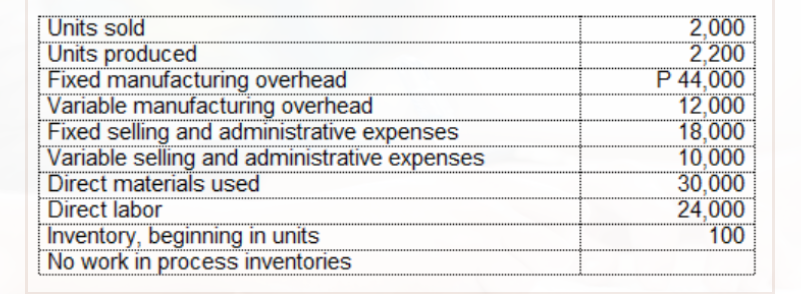

A.Compute for the ending Finished Goods Inventory under Absorption costing B.Compute for the ending Finished Goods Inventory under Absorption costing

Q: Fill in the blank. ______ method is a costing method which includes beginning work-in-process…

A: There are various methods for valuation of inventory in cost accounting. Mainly, inventory is found…

Q: a. Prepare an income statement according to the absorption costing concept. b. Prepare an income…

A: The income statement represents the net income where the expenses are deducted from the revenues of…

Q: Which account is not used in JIT costing? a. Finished Goods Inventory b. Raw and In-Process…

A: The JIT is a management strategy that minimizes the inventory and increases efficiency. JIT is to…

Q: As production takes place, al manufacturing costs are added to the Multiple Choice Workin Process…

A: At the time of production, different costs are incurred such as direct material cost, direct labor…

Q: Instruction: Identify the following: 1. The amount which represents cost incurred to produce goods…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: (d)What is the balance in the Cost of Goods Sold account after the adjustment? (e) Compute KRAFT 'R’…

A: Job Costing: Job Costing is also known as Job Order Costing. This method is best suited to those…

Q: r the amount of "Cost of goods manufactured" during a period exceeds the amount of "Total…

A: Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: When the weighted-average method of process costing is used, a department's equivalent units are…

A: Under the weighted average method of costing, beginning inventory is added to the units started and…

Q: inventory computed.? a) Cost of materials used in production during the period/ Average materials…

A: Inventory refers to the goods and services of the business which the company holds for a motive of…

Q: Compute cost of goods manufactured. using a formal schedule of cost of good manufactured then…

A: Cost of goods manufactured shows the total costs incurred on the production of goods. It includes…

Q: When products and their costs are moved from one process to the next process, these costs are…

A: Process costing is a method of costing used to ascertain the cost of a product at each stage or…

Q: Work in Process inventory shows the cost of completed goods available for sale to customers. True…

A: We shall answer the first question since the exact question wasn't specified. Please resubmit a new…

Q: If the cost of goods manufactured is less than the cost of goods sold, which of the following is…

A: Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: The equivalent of finished goods inventory for a merchandising firm is referred to as a) inventory.…

A: Completed goods / Finished goods are the only type of inventory which is purchased or sold for…

Q: Required: Compute the ending inventory (February) under variable costing. Compute the ending…

A: Here in this question, we are required to calculate closing stock for the month of February by…

Q: Which of the following is not relevant is not relevant in determining weighted average unit cost in…

A: Under the weighted average unit cost in process costing, the beginning inventory is combined with…

Q: the equivalent units for materials and conversion costs. 2. Compute the unit costs for materials…

A: Answer 1) Equivalent units for material and conversion costs. Physical units % material %…

Q: Which account is not used in JIT costing? Finished Goods Inventory Raw and In-Process Inventory…

A:

Q: The equivalent of finished goods inventory for a merchandising firm is referred to as • a)…

A: Merchandising firm means a firm which only deals in sale and purchase of a commodity but do not…

Q: Products that have been completed and are ready for sale at the end of the accounting period are…

A: For a manufacturing organization, there are 3 types of products: 1. Raw-material 2. Work in Progress…

Q: Product costs … a. are costs that are included in the determining the value of the inventory. b. are…

A: The costs can be classified as product cost and period cost. The product costs are the costs that…

Q: r of indirect materials, such as nails and screv count? nished goods inventory vork-in-process…

A: When production takes place , raw material cost , labour cost and manufacturing overhead cost are…

Q: Product costs are: * Treated in the same manner as period costs Subtracted from cost of goods sold O…

A: Product costs : Product costs are also known as inventoriable costs. These costs that are incurred…

Q: Requirements: • 1. Compute the equivalent units for materials and conversion costs. • 2. Compute the…

A: Calculation of all requirement with necessary workings are as follows.

Q: Identifying job order costing journal entries Analyze the following T-accounts, and describe each…

A: Job order costing: Job order costing is one of the methods of cost accounting under which cost is…

Q: How much fixed overhead cost is included in ending finished goods inventory under absorption…

A: Absorption costing considers the fixed overhead costs for production as per the units sold and not…

Q: In the cost reconciliation report under the weighted-average method, the "Costs to be accounted for"…

A: The cost accounted should always equal the units completed and transferred out and ending inventory…

Q: Product costs are: Treated in the same manner as period costs Subtracted from cost of goods sold…

A: There are two types of costs that are incurred in business. One is product costs and other is Period…

Q: When the sale of finished goods is recorded, the balance in which of the following accounts will…

A: The entities that are involved in the making or manufacturing of goods, usually have three types of…

Q: The purpose of costing are as follows EXCEPT: a) Value inventory b) Record costs c) Price products…

A: The purpose of costing is. 1. To Formulate cost of a product 2. To facilitate decision making 3. To…

Q: Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income…

A: Solution:- First we need to calculate schedule of cost of goods manufactured as follows under:-

Q: Direct material costs are recorded: O Indirectly to Goods in Process account. O Indirectly to a…

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: If the cost of goods manufactured is less than the cost of goods sold, which of the following is…

A: Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: The component of a company's inventory that is partially completed is called direct raw materials…

A: The raw materials are used for production process.

Q: required, round unit cost answers to the nearest cent. Calculate the unit cost and the cost of…

A: Solution:- 1)Calculate the unit cost and the cost of finished goods inventory under absorption…

Q: Cost c For the Mo shed goods inventory, Septe k in process inventory, Sept t materials: irect…

A: From the information given in the problem we will prepare COGS budget ----

Q: QUESTIONS A. Compute for the ending Finished Goods Inventory under Absorption costing B. Compute…

A: Variable costing means that inventory is valued at variable manufacturing cost and fixed cost is…

Q: The purpose of costing are as follows EXCEPT: Price products Make decisions record cost Formulate…

A: The purpose of costing 1. To fix the price of the product 2. For decision making 3. For…

Q: Work in process inventory, 08/31/x2? Finished goods inventory, 08/31/x2?

A: Work in process inventory means inventory which is not in process yet, which is not completely…

Q: Compute cost of goods sold using the following information Finished goods inventory, beginning work…

A: Cost of goods sold represents the amount of expenses incurred on the goods that are sold in the…

Q: methods. variable costing system, fixed overhead cost is included of the cost of inventory.…

A: Option a, c and d are incorrect The correct statements are a) In variable and absorption costing ,…

Q: the costs transferred to finished goods inventory are called ?

A: Cost of goods manufactured referred to the total cost incurred in order to manufacture the goods.…

Q: On the costs of goods manufactured schedule, the item raw materials inventory (ending) appears as…

A: Cost of goods manufactured: It is the total cost that is incurred for manufacturing the products and…

Q: r the amount of "Cost of goods manufactured" during a pertod exceeds the amount of "Total…

A: Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: Given Belle Company's data, compute cost per unit of finished goods under absorption costing.

A: Absorption (full) costing is a costing technique in which all the manufacturing costs including…

QUESTIONS

A.Compute for the ending Finished Goods Inventory under Absorption costing

B.Compute for the ending Finished Goods Inventory under Absorption costing

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- During production, how are the costs in process costing accumulated? A. to cost of goods sold B. to each individual product C. to manufacturing overhead D. to each individual departmentOverhead costs are assigned to each product based on __________________. A. the proportion of that products use of the cost driver B. a predetermined overhead rate for a single cost driver C. price of the product D. machine hours per productJournalizing the distribution of service department costs to production departments Required: Using your solution to P4-7, prepare journal entries for the following: The distribution of the total factory overhead of $79,400 to the individual production and service departments where it originated. The distribution of the Building Maintenance overhead to the appropriate other departments. The distribution of the Factory Office overhead to the appropriate other departments.

- Title Brahtz Company uses an activity-based costing system. It has the following manufacturing activity ar Description Brahtz Company uses an activity-based costing system. It has the following manufacturing activity areas, related cost drivers and cost allocation rates:ActivityCost DriverCost Allocation RateMachine setupNumber of setups$25.00Materials handlingNumber of parts0.25MachiningMachine hours13.00AssemblyDirect labor hours22.00InspectionNumber of finished units7.00During the month, 100 units were produced, with no defects, requiring three setups. Each unit consisted of 17 parts, 3 direct labor hours and 2.5 machine hours. Direct materials cost $50 per finished unit.What is the total manufacturing cost for inspections?$-0-$700$90$7Sheridan Company developed the following data: Beginning work in process inventory $ 120000 Direct materials used 520000 Actual overhead 640000 Overhead applied 610000 Cost of goods manufactured 1620000 Ending work in process 90000 How much are total manufacturing costs for the period? $1590000 $1770000 $1530000 $1250000Accounting Delta Manufacturing Co uses Process costing. The following data is related to department 2. Details Units Amounts Unit received in process. Units completed and transferred to department 3 . Units in process (50% complete) Units lost in process Abnormal (80% complete) 12000 7000 4000 1000 $ Cost incurred by the department Material Labor F.O.H Cost from preceding department 30000 20000 10000 96000 Requirement: Prepare a cost of production report for department 2.

- Equivalent Units of Production and Cost per Equivalent Unit—FIFO Method Required: Assume that the company uses the FIFO method in its process costing system. 1. Compute the first department’s equivalent units of production for materials, labor, and overhead for the month. 2. Compute the first department’s cost per equivalent unit for materials, labor, overhead, and in total for the month.How can I do this problem? Required: Calculate the cost per equivalent unit for materials, labor and manufacturing overhead and in total Cost per equivalent unit-Weighted-Average Method Material Labor Overhead Working in process, May 1…. $18,000 $5,500 $27,500 Cost Added during May 238,900 $80,300 $401,500 Equivalent units of production 35,000 33,000 33,000Bonita Industries developed the following data: Beginning work in process inventory $ 120000 Direct materials used 620000 Actual overhead 740000 Overhead applied 610000 Cost of goods manufactured 1620000 Ending work in process 90000 How much are total manufacturing costs for the period? $1430000 $1590000 $1970000 $1350000

- ssume the following information: Milling Department Materials Conversion Total Cost of beginning work in process inventory $ 10,000 $ 15,000 $ 25,000 Costs added during the period 291,600 394,500 686,100 Total cost $ 301,600 $ 409,500 $ 711,100 Assume the equivalent units of production for materials and conversion, when using the weighted-average method, are 5,200 units and 5,000 units, respectively. If the equivalent units in ending work in process inventory for materials and conversion are 400 units and 200 units, respectively, then what is the total cost of ending work in process for the Milling Department?Princeton 3 Company has the following information for May:Cost of direct materials used in production $17,300Direct labor 44,700Factory overhead 28,800Work in process inventory, May 1 72,100Work in process inventory, May 31 76,400Finished goods inventory, May 1 30, 300Finished goods inventory, May 31 34,600For May, determine a) the cost of goods manufactured and b) the cost of goods soldAssigning Costs to Units—FIFO Method Data concerning a recent period’s activity in the Assembly Department, the first processing department in a company that uses the FIFO method in its process costing, appear below: A total of 26,000 units were completed and transferred to the next processing department during the period. Beginning work in process inventory consisted of 2,000 units and ending work in process inventory consisted of 1,000 units. Required: 1. Compute the Assembly Department’s cost of ending work in process inventory for materials, conversion, and in total for the period. 2. Compute the Assembly Department’s cost of units transferred out to the next department for materials, conversion, and in total for the period.