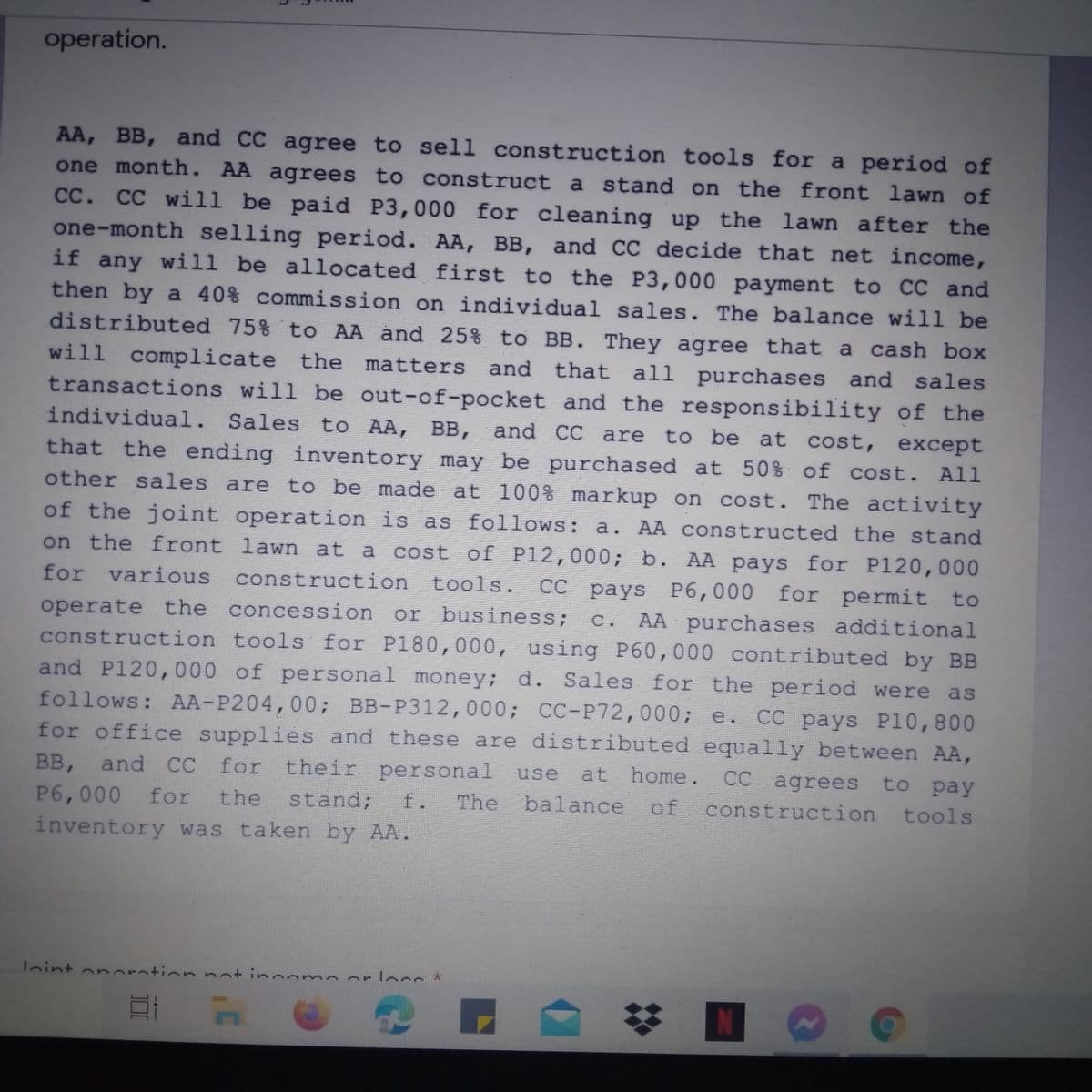

AA, BB, and CC agree to sell construction tools for a period of one month. AA agrees to construct a stand on the front lawn of CC. CC willl be paid P3,000 for cleaning up the lawn after the one-month selling period. AA, BB, and CC decide that net income, if any will be allocated first to the P3,000 payment to CC and then by a 40% commission on individual sales. The balance will be distributed 75% to AA and 25% to BB. They agree that a cash box will complicate the matters and that all purchases and sales transactions will be out-of-pocket and the responsibility of the individual. Sales to AA, BB, and CC are that the ending inventory may be purchased at 50% of cost. other sales are to be made at 100% markup on cost. The activity to be at cost, except All of the joint operation is as follows: a. AA constructed the stand on the front lawn at a cost of P12,000; b. AA pays for P120,000 for various tools. CC pays P6,000 for permit to AA purchases additional construction operate the concession construction tools for P180,000, using P60,000 contributed by BB and P120,000 of personal money; d. Sales for the period were as follows: AA-P204,00; BB-P312,000; CC-P72,000; e. CC pays P10,800 for office supplies and these are distributed equally between AA, BB, and CC for their personal P6,000 for inventory was taken by AA. or business; с. at home. CC agrees to pay use the stand; f. The balance of construction tools

AA, BB, and CC agree to sell construction tools for a period of one month. AA agrees to construct a stand on the front lawn of CC. CC willl be paid P3,000 for cleaning up the lawn after the one-month selling period. AA, BB, and CC decide that net income, if any will be allocated first to the P3,000 payment to CC and then by a 40% commission on individual sales. The balance will be distributed 75% to AA and 25% to BB. They agree that a cash box will complicate the matters and that all purchases and sales transactions will be out-of-pocket and the responsibility of the individual. Sales to AA, BB, and CC are that the ending inventory may be purchased at 50% of cost. other sales are to be made at 100% markup on cost. The activity to be at cost, except All of the joint operation is as follows: a. AA constructed the stand on the front lawn at a cost of P12,000; b. AA pays for P120,000 for various tools. CC pays P6,000 for permit to AA purchases additional construction operate the concession construction tools for P180,000, using P60,000 contributed by BB and P120,000 of personal money; d. Sales for the period were as follows: AA-P204,00; BB-P312,000; CC-P72,000; e. CC pays P10,800 for office supplies and these are distributed equally between AA, BB, and CC for their personal P6,000 for inventory was taken by AA. or business; с. at home. CC agrees to pay use the stand; f. The balance of construction tools

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 1BD

Related questions

Question

Transcribed Image Text:operation.

AA, BB, and CC agree to sell construction tools for a period of

one month. AA agrees to construct a stand on the front lawn of

CC. CC will be paid P3,000 for cleaning up the lawn after the

one-month selling period. AA, BB, and CC decide that net income,

if any will be allocated first to the P3,000 payment to CC and

then by a 40% commission on individual sales. The balance will be

distributed 75% to AA and 25% to BB. They agree that a cash box

will complicate the matters and that all purchases and sales

transactions will be out-of-pocket and the responsibility of the

to be at cost, except

individual. Sales to AA, BB, and CC are

that the ending inventory may be purchased at 50% of cost. All

other sales are to be made at 100% markup on cost. The activity

of the joint operation is as follows: a. AA constructed the stand

cost of P12,000; b. AA pays for P120,000

P6,000 for permit to

on the front lawn at a

for various construction tools.

operate the concession or business;

construction tools for P180,000, using P60,000 contributed by BB

and P120,000 of personal money; d. Sales for the period were

follows: AA-P204,00; BB-P312,000; CC-P72,000; e.

for office supplies and these are distributed equally between AA,

BB, and CC for their personal

P6,000 for

inventory was taken by AA.

CC

Сс раys

AA purchases additional

C .

as

CC pays P10,800

use

at home.

CC agrees to pay

the stand;

The balance

f.

of

construction tools

laint on oration not income orlocs *

Transcribed Image Text:Joint operation net income or loss *

Your answer

Net income allocation-AA *

Your answer

Net income allocation-BB *

Your answer

Net income allocation-CC

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning