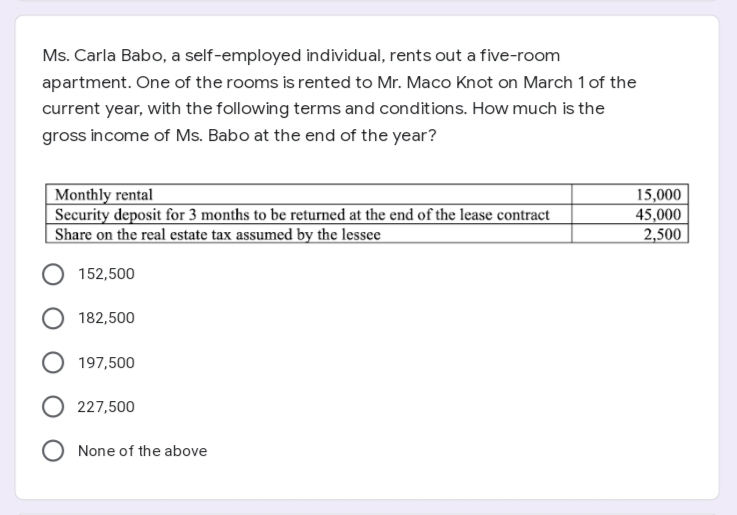

Ms. Carla Babo, a self-employed individual, rents out a five-room apartment. One of the rooms is rented to Mr. Maco Knot on March 1 of the current year, with the following terms and conditions. How much is the gross income of Ms. Babo at the end of the year? Monthly rental Security deposit for 3 months to be returned at the end of the lease contract 15,000 45,000 2,500 Share on the real estate tax assumed by the lessee

Ms. Carla Babo, a self-employed individual, rents out a five-room apartment. One of the rooms is rented to Mr. Maco Knot on March 1 of the current year, with the following terms and conditions. How much is the gross income of Ms. Babo at the end of the year? Monthly rental Security deposit for 3 months to be returned at the end of the lease contract 15,000 45,000 2,500 Share on the real estate tax assumed by the lessee

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 31P: Nissa owns a building (adjusted basis of 600,000 on January 1, 2019) that she rents to Len, who...

Related questions

Question

Transcribed Image Text:Ms. Carla Babo, a self-employed individual, rents out a five-room

apartment. One of the rooms is rented to Mr. Maco Knot on March 1 of the

current year, with the following terms and conditions. How much is the

gross income of Ms. Babo at the end of the year?

Monthly rental

Security deposit for 3 months to be returned at the end of the lease contract

Share on the real estate tax assumed by the lessee

15,000

45,000

2,500

152,500

182,500

197,500

227,500

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning