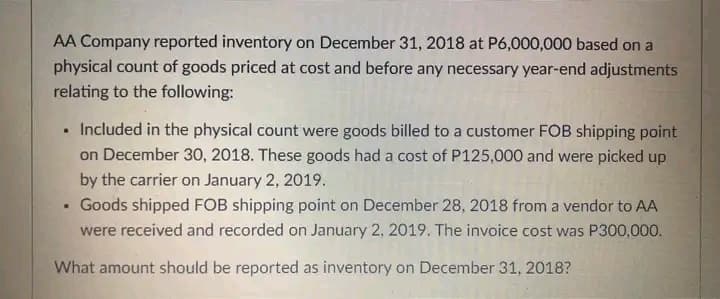

AA Company reported inventory on December 31, 2018 at P6,000,000 based on a physical count of goods priced at cost and before any necessary year-end adjustments relating to the following: Included in the physical count were goods billed to a customer FOB shipping point on December 30, 2018. These goods had a cost of P125,000 and were picked up by the carrier on January 2, 2019. Goods shipped FOB shipping point on December 28, 2018 from a vendor to AA were received and recorded on January 2, 2019. The invoice cost was P300,000. What amount should be reported as inventory on December 31, 2018?

AA Company reported inventory on December 31, 2018 at P6,000,000 based on a physical count of goods priced at cost and before any necessary year-end adjustments relating to the following: Included in the physical count were goods billed to a customer FOB shipping point on December 30, 2018. These goods had a cost of P125,000 and were picked up by the carrier on January 2, 2019. Goods shipped FOB shipping point on December 28, 2018 from a vendor to AA were received and recorded on January 2, 2019. The invoice cost was P300,000. What amount should be reported as inventory on December 31, 2018?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 1MC: The balance in Ashwood Companys accounts payable account at December 31, 2019, was 1,200,000 before...

Related questions

Question

Transcribed Image Text:AA Company reported inventory on December 31, 2018 at P6,000,000 based on a

physical count of goods priced at cost and before any necessary year-end adjustments

relating to the following:

Included in the physical count were goods billed to a customer FOB shipping point

on December 30, 2018. These goods had a cost of P125,000 and were picked up

by the carrier on January 2, 2019.

Goods shipped FOB shipping point on December 28, 2018 from a vendor to AA

were received and recorded on January 2, 2019. The invoice cost was P300,000.

What amount should be reported as inventory on December 31, 2018?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub