Concept explainers

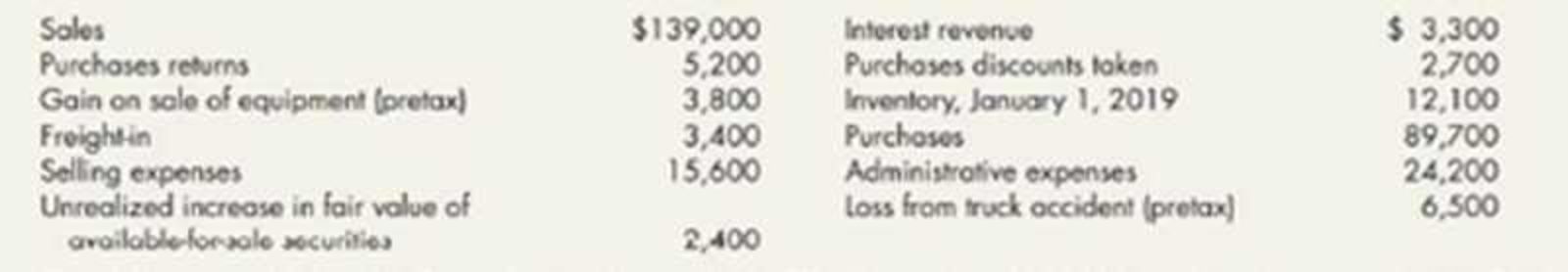

Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives the following items from its adjusted

The following; additional information is also available. The December 31, 2019, ending inventory is $14,700. During 2019, 4,200 shares of'common stock were outstanding the entire year. The income tax rate а 30% on all items of income.

Required:

- 1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Gaskin’s cost of goods sold.

- 2. Prepare a 2019 single-step income statement.

- 3. Prepare a 2019 multiple-step income statement.

- 4. Prepare a 2019 statement of comprehensive income.

1.

Prepare a schedule for Company G’ cost of goods sold.

Explanation of Solution

Cost of goods sold: Cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Schedule of cost of goods sold is a report which reports cost of goods sold in a detailed manner.

Prepare a schedule for Company G’ cost of goods sold.

| Company G | ||

| Schedule 1: Cost of goods sold | ||

| For the year ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning inventory | $12,100 | |

| Purchases | $89,700 | |

| Freight-in | $3,400 | |

| Cost of purchase | $93,100 | |

| Less: Purchases returns | ($5,200) | |

| Less: Purchase discount takes | ($2,700) | |

| Net purchases | $85,200 | |

| Cost of goods available for sale | $97,300 | |

| Less: Ending inventory | ($14,700) | |

| Cost of goods sold | $82,600 | |

Table (1)

2.

Prepare a single step income statement for Company G for the year ended December 31, 2019.

Explanation of Solution

Single-step income statement: It is an income statement format in which a single subtotal of all revenue items are listed in one column, and a single subtotal of all expense items including cost of goods sold are listed in another column. Thus, the subtotal of all expense items is deducted from the subtotal of all revenue items to arrive at the net income at the bottom of the statement.

Prepare a single-step income statement for Company G for the year ended December 31, 2019.

| Company G | ||

| Single-Step Income Statement | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Revenues: | ||

| Sales | $139,000 | |

| Interest revenue | $3,300 | |

| Gain on sale of equipment | $3,800 | |

| Total revenues (A) | $146,100 | |

| Expenses: | ||

| Cost of goods sold | $82,600 | |

| Selling expenses | $15,600 | |

| Administrative expense | $24,200 | |

| Loss from truck accident | $6,500 | |

| Income tax expense (1) | $5,160 | |

| Total expenses (B) | $134,060 | |

| Net income | $12,040 | |

| Number of common shares (D) | 4,200 shares | |

| Earnings per share | $2.87 | |

Table (3)

Working note (1):

Calculate the income tax expense:

3.

Prepare a multi-step income statement for Company G for the year ended December 31, 2019.

Explanation of Solution

Multi step income statement: A multiple step income statement refers to the income statement that shows the operating and non-operating activities of the business under separate head. In different steps of the multi-step income statement, principal operating activities are reported that starts from the record of sales revenue with all contra sales revenue account like sales returns, allowances and sales discounts.

Prepare a multi-step income statement for Company G for the year ended December 31, 2019.

| Company G | ||

| Multi-Step Income Statement | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Sales | $139,000 | |

| Less: Cost of goods sold | $82,600 | |

| Gross profit | $56,400 | |

| Operating expenses: | ||

| Selling expenses | $15,600 | |

| General and administrative expenses | $24,200 | |

| Total operating expenses | $39,800 | |

| Operating income | $16,600 | |

| Other items | ||

| Gain on sale of equipment | $3,800 | |

| Loss from truck accident | ($6,500) | |

| Interest revenue | $3,300 | $600 |

| Income before income tax | $17200 | |

| Less: Income taxes @30% | ($5,160) | |

| Net income (A) | $12,040 | |

| Number of common shares (B) | 4,200 shares | |

| Earnings per share | $2.87 | |

Table (2)

4.

Prepare a statement of comprehensive income for the year ended December 31, 2019.

Explanation of Solution

Prepare a statement of comprehensive income for the year ended December 31, 2019.

| Company G | ||

| Statement of comprehensive income | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount | Amount |

| ($) | ($) | |

| Net income | $12,040 | |

| Other comprehensive income: | ||

| Unrealized increase in fair value of available for sale securities | $1,680 | |

| Comprehensive income | $13,720 | |

Table (4)

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting And Analysis

- Cost of Goods Sold and Income Statement Schuch Company presents you with the following account balances taken from its December 31 adjusted trial balance: Additional data: 1. A physical count reveals an ending-inventory of 22,500 on December 31. 2. Twenty-five thousand shares of common stock have been outstanding the entire year. 3. The income tax rate is 30% on all items of income. Required: 1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Schuchs cost of goods sold. 2. Prepare a multiple-step income statement. 3. Prepare a single-step income statement.arrow_forwardRefer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020. Prepare Hellers partial income statements (through gross profit) for 2019 and 2020. RE22-2 Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.arrow_forwardFava Company began operations in 2018 and used the LIFO inventory method for both financial reporting and income taxes. At the beginning of 2019, the anticipated cost trends in the industry had changed, so that it adopted the FIFO method for both financial reporting and income taxes. Fava reported revenues of 300,000 and 270,000 in 2019 and 2018, respectively. Fava reported expenses (excluding income tax expense) of 125,000 and 120,000 in 2019 and 2018, which included cost of goods sold of 55,000 and 45,000, respectively. An analysis indicates that the FIFO cost of goods sold would have been lower by 8,000 in 2018. The tax rate is 21%. Fava has a simple capital structure with 15,000 shares of common stock outstanding during 2018 and 2019. It paid no dividends in either year. Required: 1. Prepare the journal entry to reflect the change. 2. At the end of 2019, prepare the comparative income statements for 2019 and 2018. Notes to the financial statements are not necessary. 3. At the end of 2019, prepare the comparative retained earnings statements for 2019 and 2018.arrow_forward

- Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.arrow_forwardOn June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was 508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardOn December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2019. The merchandise inventory as of December 31, 2019, was 305,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 30,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forward

- The following items were included in Venicio Corporations inventory account on December 31, 2019: What amount should Venicio report as inventory at December 31, 2019? a. 21,000 b. 20,400 c. 26,000 d. 35,000arrow_forwardThe following select account data is taken from the records of Reese Industries for 2019. A. Use the data provided to compute net sales for 2019. B. Prepare a simple income statement for the year ended December 31, 2019. C. Compute the gross margin for 2019. D. Prepare a multi-step income statement for the year ended December 31, 2019.arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the allowance method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forward

- Schmidt Company began operations on January 1, 2018, and used the LIFO inventory method for both financial reporting and income taxes. However, at the beginning of 2020, Schmidt decided to switch to the average cost inventory method for financial and income tax reporting. It had previously reported the following financial statement information for 2019: An analysis of the accounting records discloses the following cost of goods sold under the LIFO and average cost inventory methods: There are no indirect effects of the change in inventory method. Revenues for 2020 total 130,000; operating expenses for 2020 total 30,000. Schmidt is subject to a 21% income tax rate in all years; it pays all income taxes payable in the next quarter. Assume that any deferred tax liability was paid in the subsequent year. Schmidt had 10,000 shares of common stock outstanding during all years; it paid dividends of 1 per share in 2020. At the end of 2020, Schmidt had cash of 15,600, inventory of 34,000, other assets of 76,000, income taxes payable of 4,200, and accounts payable of 3,000. It desires to show financial statements for the current year and previous year in its 2020 annual report. Required: 1. Prepare the journal entry to reflect the change in method at the beginning of 2020. Show supporting calculations. 2. Prepare the 2020 financial statements. Notes to the financial statements are not necessary. Show supporting calculations.arrow_forwardMultiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December 31, 2019, Opgenorth Company listed the following items in its adjusted trial balance: Additional data: 1. Seven thousand shares of common stock have been outstanding the entire year. 2. The income tax rate is 30% on all items of income. Required: 1. Prepare a 2019 multiple-step income statement. 2. Prepare a 2019 single-step income statement. 3. Prepare a 2019 statement of comprehensive income.arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the direct method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning