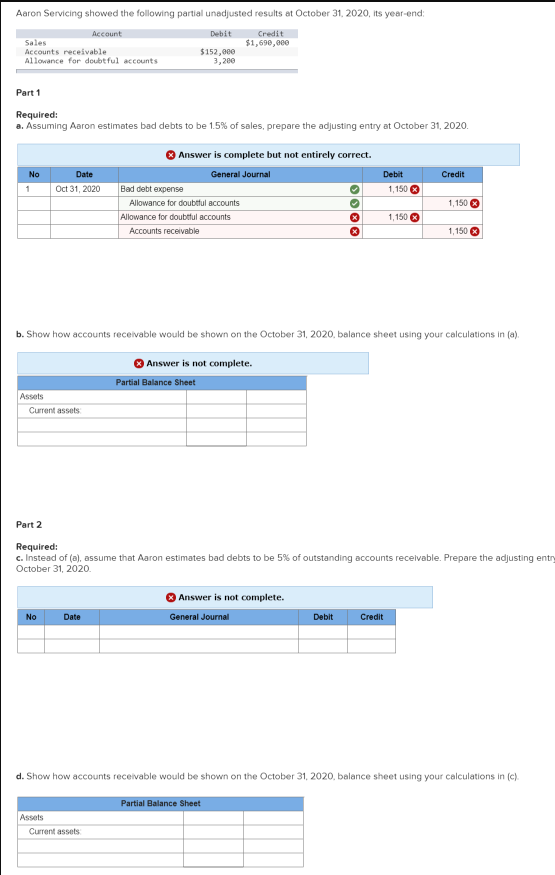

Aaron Servicing showed the following partial unadjusted results at October 31, 2020, its year-end: Account Debit Credit Sales $1,690,000 Accounts receivable Allowance for doubtful accounts $152,000 3,200 Part 1 Required: a. Assuming Aaron estimates bad debts to be 1.5% of sales, prepare the adjusting entry at October 31, 2020. Answer is complete but not entirely correct. No Date General Journal Debit Credit Oct 31, 2020 Bad debt expense 1,150 8 Allowance for doubtul accounts 1,150 0 Allowance for doubttul accounts 1,150 O Accounts receivable 1,150 0 b. Show how accounts receivable would be shown on the October 31, 2020, balance sheet using your calculations in (a). Answer is not complete.

Aaron Servicing showed the following partial unadjusted results at October 31, 2020, its year-end: Account Debit Credit Sales $1,690,000 Accounts receivable Allowance for doubtful accounts $152,000 3,200 Part 1 Required: a. Assuming Aaron estimates bad debts to be 1.5% of sales, prepare the adjusting entry at October 31, 2020. Answer is complete but not entirely correct. No Date General Journal Debit Credit Oct 31, 2020 Bad debt expense 1,150 8 Allowance for doubtul accounts 1,150 0 Allowance for doubttul accounts 1,150 O Accounts receivable 1,150 0 b. Show how accounts receivable would be shown on the October 31, 2020, balance sheet using your calculations in (a). Answer is not complete.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

pls help

Transcribed Image Text:Aaron Servicing showed the following partial unadjusted results at October 31, 2020, its year-end:

Account

Debit

Credit

Sales

$1,690,000

Accounts receivable

Allowance for doubtful accounts

$152,000

3,200

Part 1

Required:

a. Assuming Aaron estimates bad debts to be 1.5% of sales, prepare the adjusting entry at October 31, 2020.

Answer is complete but not entirely correct.

No

Date

General Journal

Debit

Credit

Oct 31, 2020

Bad debt expense

1,150 8

Allowance for doubtul accounts

1,150 0

Allowance for doubttul accounts

1,150 O

Accounts receivable

1,150 0

b. Show how accounts receivable would be shown on the October 31, 2020, balance sheet using your calculations in (a).

Answer is not complete.

Partial Balance Sheet

Assets

Current assets:

Part 2

Required:

c. Instead of (a), assume that Aaron estimates bad debts to be 5% of outstanding accounts receivable. Prepare the adjusting entry

October 31, 2020.

Answer is not complete.

No

Date

General Journal

Debit

Credit

d. Show how accounts receivable would be shown on the October 31, 2020, balance sheet using your calculations in (c).

Partial Balance Sheet

Assets

Current assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning