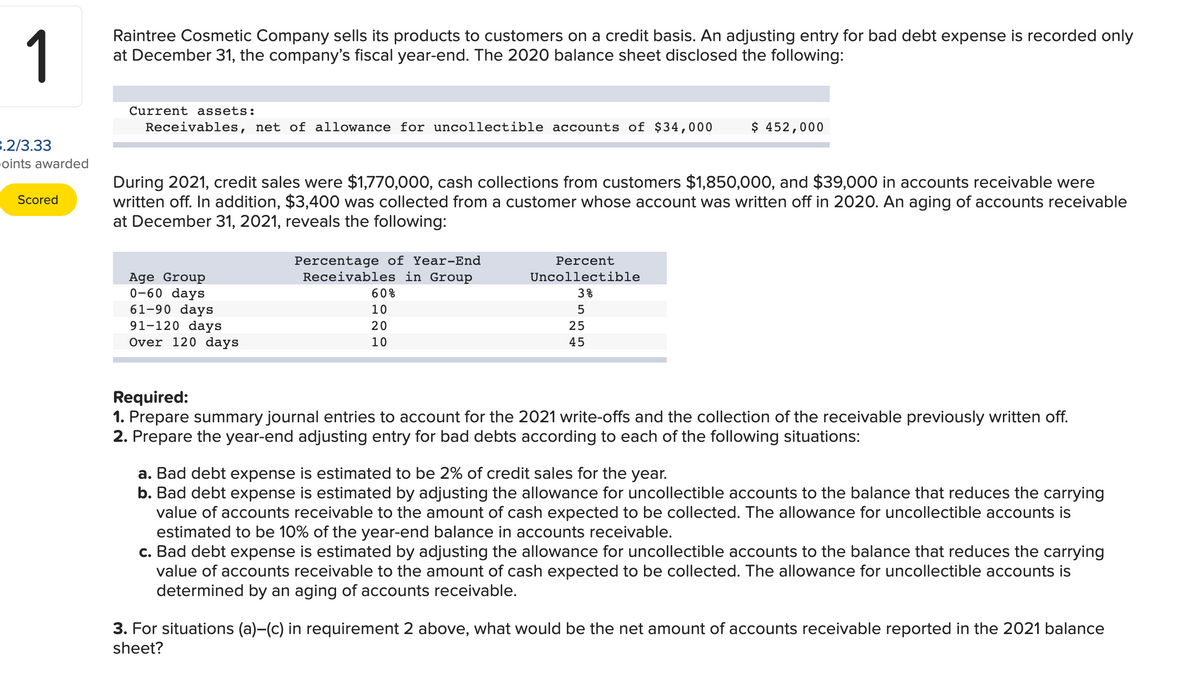

Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year-end. The 2020 balance sheet disclosed the following: Current assets: Receivables, net of allowance for uncollectible accounts of $34,000 $ 452,000 During 2021, credit sales were $1,770,000, cash collections from customers $1,850,000, and $39,000 in accounts receivable were written off. In addition, $3,400 was collected from a customer whose account was written off in 2020. An aging of accounts receivable at December 31, 2021, reveals the following: Percentage of Year-End Receivables in Group Percent Age Group 0-60 days 61-90 days 91-120 days Over 120 days Uncollectible 38 608 10 20 25 10 45

Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year-end. The 2020 balance sheet disclosed the following: Current assets: Receivables, net of allowance for uncollectible accounts of $34,000 $ 452,000 During 2021, credit sales were $1,770,000, cash collections from customers $1,850,000, and $39,000 in accounts receivable were written off. In addition, $3,400 was collected from a customer whose account was written off in 2020. An aging of accounts receivable at December 31, 2021, reveals the following: Percentage of Year-End Receivables in Group Percent Age Group 0-60 days 61-90 days 91-120 days Over 120 days Uncollectible 38 608 10 20 25 10 45

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 6EA: Millennium Associates records bad debt using the allowance, balance sheet method. They recorded...

Related questions

Question

100%

Could you tell me the third answer and how did you receive the right answers?

Transcribed Image Text:1

Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only

at December 31, the company's fiscal year-end. The 2020 balance sheet disclosed the following:

Current assets:

Receivables, net of allowance for uncollectible accounts of $34,000

$ 452,000

3.2/3.33

oints awarded

During 2021, credit sales were $1,770,000, cash collections from customers $1,850,000, and $39,000 in accounts receivable were

written off. In addition, $3,400 was collected from a customer whose account was written off in 2020. An aging of accounts receivable

at December 31, 2021, reveals the following:

Scored

Percentage of Year-End

Receivables in Group

Percent

Uncollectible

Age Group

0-60 days

61-90 days

91-120 days

Over 120 days

60%

3%

10

20

25

10

45

Required:

1. Prepare summary journal entries to account for the 2021 write-offs and the collection of the receivable previously written off.

2. Prepare the year-end adjusting entry for bad debts according to each of the following situations:

a. Bad debt expense is estimated to be 2% of credit sales for the year.

b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying

value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is

estimated to be 10% of the year-end balance in accounts receivable.

c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the carrying

value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible accounts is

determined by an aging of accounts receivable.

3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2021 balance

sheet?

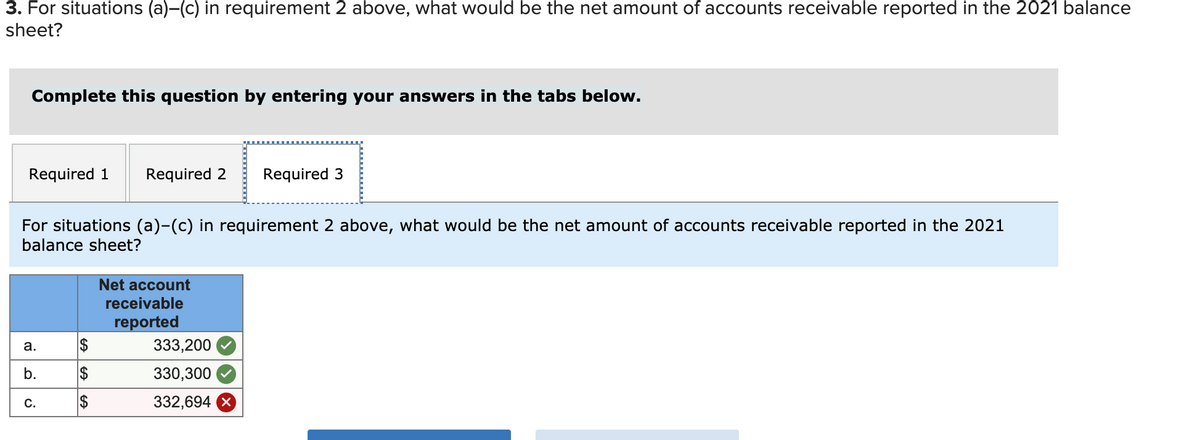

Transcribed Image Text:3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2021 balance

sheet?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2021

balance sheet?

Net

unt

receivable

reported

а.

333,200

b.

330,300

332,694 X

С.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning