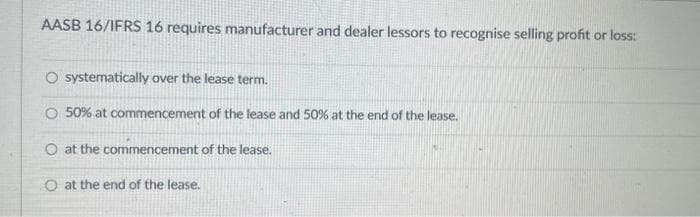

AASB 16/IFRS 16 requires manufacturer and dealer lessors to recognise selling profit or loss: O systematically over the lease term. O 50% at commencement of the lease and 50% at the end of the lease. O at the commencement of the lease. O at the end of the lease.

Q: Assess TWO ethical responsibility of Management Accountants in fulfilling their roles. Give relevant…

A: The role of management accountants involves providing financial information to the management team…

Q: On June 30, 2021, the market interest rate is 5%. Team Corporation issues $600,000 of 10%, 25-year…

A: A firm or group may issue bonds payable as a form of long-term debt to raise capital from investors.…

Q: Ellery Products manufactures various components for the fashion industry. Ellery buys fabric from…

A: Management accounting deals with various parts of financial information related to the cost and…

Q: d City Products Inc. (MCP), developed standard costs for direct material and direct labor. In 2020,…

A: The variance is the difference between the actual and standard cost of production. The materials…

Q: Anna receives one-third of each of the partnership assets. She has a basis in her partnership…

A: This question asks about the tax implications of a partner's exit from a partnership and the…

Q: I need only d

A: Journal entries are used to record business transactions into book of accounts in chronological…

Q: On January 1, 2015, Wanja Limited (which has a Dec 31st year end) purchased the assets of Kong…

A: Depreciation expense :— It is allocation of depreciable cost over the life of asset. Depreciable…

Q: Recording Dividend Declarations Following are four separate dividend scenarios. a. On April 1,…

A: Journal entry is the first step in recording financial transactions in the books of company. It must…

Q: Quetzaltenango Candle Inc. projected sales of 40,000 candles for March. The estimated March 1…

A: Production budget is the statement which is prepared by the entity for the purpose of determining…

Q: Radford Products adds materials at the beginning of the process in Department A. The following…

A: Lets understand the basics. Equivalent Units For Production : a. Weighted Average Method: In this…

Q: 3. Hayley Dole owns a car stereo store with 3 departments. Net sales for July are as follows:…

A: Given, Net Sales for Deluxe = $33,600 Net Sales for Standard = $38,400 Net Sales for Economy =…

Q: The stockholders' equity section of Ironworks is presented here. IRONWORKS Balance Sheet (partial)…

A: Preferred shares are those which are issued by the entity with a fixed rate of dividend. These are…

Q: able Corporate Services uses EVA to evaluate the performance of division managers. For the Media…

A: Economic value added (EVA) is a measure of a company's financial performance based on the residual…

Q: Ottoson Fencing Inc. uses job order costing. The following data summarize the operations related to…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a…

A: Financial advantage is considered the company’s benefit as it assists in growing the business by…

Q: The variable operating cost consists of gasoline, oil, tires, maintenance, anc the car will have…

A: Cost drivers are the activities or factors that cause costs to be incurred in a business. In…

Q: hich of the following statements are true? a. Recording purchase transactions in a general journal…

A: As per Bartleby's guidelines, I am bound to solve one question at a time. As there is 2 questions…

Q: Mammoth Mats has two service departments (maintenance and administration) and two operating…

A: Cost allocation is the technique of allocating costs of service departments to the production…

Q: On January 1, 2026, Sheffield Inc. granted stock options to officers and key employees for the…

A: Introduction:- This question presents a scenario where Sheffield Inc. granted stock options to…

Q: Cymbal E-Motors is a fast-growing start-up firm that manufactures electric motors for bicycles. The…

A: BUDGETED INCOME STATEMENT Budgeted Income Statement is the Estimated Income Statement of the Company…

Q: Lily Tucker (single) owns and

A: As per IRS . standard dedcution for 2021 for single filer is $ 12,550…

Q: Required information [The following information applies to the questions displayed below.] Chuck…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: Prepare a production budget for 2022 under each plan. BONITA INDUSTRIES Production Budget Plan A…

A: Budget: A budget can be defined as a financial plan or an estimation of revenues, expenditure,…

Q: The machining division has a capacity of 4,300 units. Its sales and cost data are: Selling price per…

A: One division of a company will often charge another division of the same company a different price…

Q: temporary difference that would result in a deferred tax liability is O Excess of tax depreciation…

A: A deferred tax liability represents an obligation to pay taxes in the future. Temporary…

Q: Required: a. Compute the sales activity variance for Lee for May. b. Compute the sales mix and sales…

A: a. To compute the sales activity variance, we need to compare the actual number of lamps sold to the…

Q: Eddie Limited has the following non- current asset section in its Statement of Financial Position as…

A: Cash is constantly moving in and out of the business. The term cash flow refers to the net amount of…

Q: Assume instead of one product (the Ripped Pig sandwich), Cat & Joe’s Pig Rig served three items: 1.…

A: The contribution margin refers to sales or revenue less variable costs during the period. It is used…

Q: Fischer Fabrication reported the following information concerning its direct materials: Direct…

A: Material cost variances shows difference in standard costs of materials and actual cost of…

Q: Futura Company purchases the 62,000 starters that it installs in its standard line of farm tractors…

A: A make-or-buy decision is a useful business decision-making process for an organization, which is…

Q: Feemster Corporation manufactures and sells a single product. The company uses units as the measure…

A: Variance arises when the actual costs is different from the standard costs. The results are…

Q: Sweet Home, Inc., includes the following selected accounts in its general ledger at December 31,…

A: BALANCE SHEET Balance sheet is one of the Important Financial Statement of the Company. Balance…

Q: ACC 102 Departmental Accounting Assignment 1. ABC Company sells three different types of athletic…

A: Gross Margin Ratio = (Gross Profit / Net Sales ) x 100 Gross Profit = Sales - Cost of Goods Sold.…

Q: You expect KStreet Co's trade at $100 per share right after paying a $2.00 dividend per share in one…

A: COST OF CAPITAL The cost of Capital is the minimum rate of return that must be Earned on investment,…

Q: The following transactions occurred during 2025.Assume that depreciation of 10% per year is charged…

A: A journal is made to record all business transactions. All the financial transactions are recorded…

Q: The income from operations and the amount of invested assets in each division of Beck Industries are…

A: Return on investment = (Income from operation / Invested Asset)*100 To compute the return on…

Q: Assume that when you were in high school you saved $1,000 to invest for your college education. You…

A: Stock dividend: Stock dividend is the dividend paid by the company to its shareholders in form of…

Q: Standard Quantities and Costs: DM (.25 ft per unit at $10 per foot) = $2.50 DL (.5 hour per unit at…

A: Variance analysis is an important tool for management to understand the performance of the business…

Q: . Prepare the stockholders' equity section of the balance sheet at December 31, 2021. a supporting…

A: Stockholders' equity is a part of our Balance sheet which shows the amount that is invested through…

Q: Identify 2 weaknesses (being sure that your response identifies why they are weaknesses - what risk…

A: A weakness in process is any vulnerability which may result in adverse outcome happening in process.…

Q: Entries for Notes Receivable, Including Year-End Entries The following selected transactions were…

A: Notes Receivable - Notes Receivable is an instrument issued by the payer to the payee against the…

Q: The IT Audit Director is responsible for monitoring and approving network-related changes to the…

A: An IT Audit Director is a senior-level professional responsible for overseeing and managing the IT…

Q: The following information relates to Novak Corp. for the year 2022. Retained earnings, January 1,…

A: INCOME STATEMENT Income Statement is one of the Important Financial Statement of the Company. Income…

Q: Which of the following best describes the selling and administrative budget? An estimate of cash…

A: A budget is an important tool for businesses because it helps an organization manage its finances,…

Q: 1. ChwelveCo was incorporated on January 1 of Year 1. Below are a number of equity-related…

A: Stockholder's Equity - Stockholder's Equity is a statement which includes issuance of Common and…

Q: Arrasmith Corporation uses customers served as its measure of activity. During February, the company…

A: Variable costs are costs that varies with the change in the level of output whereas fixed costs are…

Q: Chubbs Inc.'s manufacturing overhead budget for the first quarter of 2017 contained the following…

A: budget can help a business communicate its financial situation to stakeholders, such as investors or…

Q: Various capital structures Charter Enterprises currently has $1.7 million in total assets and is…

A: The capital structure consists of both debt and equity. The management decides how much debt it…

Q: XYZ Corporation generated a 1.20 total asset turnover in its total assets of P2,000,000. The firm’s…

A: RETURN ON SHAREHOLDERS EQUITY Return on Shareholders Equity is the Ratio express the Net Profit in…

Q: In our discussions on pensions, we learned about two different types of pension plans – Defined…

A: Defined Contribution Plans and Defined Benefit Plans are two types of retirement plans that differ…

Sh1

Please help me.

Thankyou.

Step by step

Solved in 6 steps

- Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease of equipment entered into on March 1, 2019. The lease is classified as a sales-type lease by the lessor (Anson Company) and as a finance lease by the lessee (Bullard Company). Assume that the lease payments are nude at the beginning of each month, interest and straight-line depreciation are recognized at the end of each month, and the residual value of the leased asset is zero at the end of a 3-year life. Required: 1. Record the lease (including the initial receipt of 2,000) and the receipt of the second and third installments of 2,000 in Ansons accounts. Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of 2,000), the payment of the second and third installments of 2,000, and monthly depreciation in Bullards accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar.Sales-Type Lease with Guaranteed Residual Value Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. The annual rentals are 65,000, payable at the end of each year. The interest rate implicit in the lease is 15%. Darwin agrees to pay all executory costs directly to a third party. The cost of the equipment is 280,000. The fair value of the equipment to Calder is 308,021.03. Calder incurs no material initial direct costs. Calder expects that it will be able to collect all lease payments. Calder estimates that the fair value at the end of the lease term will be 50,000 and that the economic life the equipment is 9 years. This residual value is guaranteed by Darwin. The following present value factors are relevant: PV of an ordinary annuity n = 8, i = 15% = 4.487322 PV n = 8, i = 15% = 0.326902 PV n = 1, i = 15% = 0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next years payment approach to classify the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent.t27 In IFRS 16 par. 74, initial direct costs incurred by a lessor in consummating a manufacturer’s or dealer’s lease areA. charged to unearned income in the first period of the lease term.B. charged to expense in the first period of the lease term.C. deferred and allocated over the lease term in proportion to the recognition of rent revenue.D. deferred and allocated over the lease term on a straight-line basis.

- 22 Lessors are required to account for lease receipts from operating leases asA. revenue, on a reducing balance over the lease term.B. income, on inception date of the lease.C. income, on a straight-line basis over the lease term.D. revenue, at the end of the lease term.WITH SOLUTION/COMPUTATION 55. On January 1, 2019, Babson, Inc., leased two automobiles for executive use. The lease requires Babson to make five annual payments of P13,000 beginning January 1, 2019. At the end of the lease term, Babson guarantees the residual value of the automobiles will total P10,000. The interest rate implicit in the lease is 9%. Babson’s recorded lease liability on initial recognition isa. 48, 620 b. 44,070 ` c. 35,620 d. 31,070A lessee company signed a lease for equipment from a lessor on January 1, Year 1. The lease requires equal rental payments of $18,820 at the beginning of each year of the term. The PV of the lease payments is $108,950. The company pays all executory costs directly to third parties. The appropriate interest rate is 8.65%. Assume IFRS 16 applies. Both the lessor and lessee have December 31 year ends. How much wil be the balance of the Lease Liability in the lessee's books at the end of Year 1 after all adjusting entries assuming (1) the fair value of the equipment equals the PV of the lease payments and (2) any interest is accrued directly to the Lease Liability? 1. $88,134 2. $90,582 3. $93,030 4. $95,478 5. $97,926

- t34 Initial direct costs incurred by the lessor in an operating lease should beA. expensed in the year of incurrence by including them in the cost of goods sold or by treating them as a sellingexpense.B. deferred and recognized as reduction in the interest rate implicit in the lease.C. capitalized as part of asset cost and depreciated over the lease term.D. deferred and carried on the statement of financial position until the end of the lease term.b) The information below relates to a leasing arrangement between Simmonds Leasing Company and Telsan Company, a lessee. Inception date January 1, 2020 Lease term 6 years Annual lease payment due at the beginning ofeach year, beginning with January 1, 2020 $150,000 Fair value of asset at January 1, 2020 $760,000 Economic life of leased equipment 7 years Residual value of equipment at end of lease term,guaranteed by the lessee $65,500 Lessor’s implicit rate 10% Lessee’s incremental borrowing rate 12% January 1, 2020 The asset will revert to the lessor at the end of the lease term. The lessee has guaranteed the lessor a residual value of $65,500. The lessee uses the straight-line depreciation method for all equipment. Instructions (i) What is the lease liability for Telsan Company? (ii) Record the lease on Telsan Company’s books at the date of inception. (iii)Record the first year’s depreciation on Telsan Company’s books. (iv) Record interest expense and lease liability for Telsan…MN.17. On 1 July 2020 Jane Ltd (lessor) leased equipment to Austin Ltd (Lessee). The equipment had a fair value of $369,824. This was also the present value of the lease payments .The lease agreement contained the following details: Lease term 5 years Economic life 6 years Annual rental payment in arrears commencing 30June 2021 $90,000 Residual Value at end of lease term $80,000 Residual Value guaranteed by lessee 80,ooo Interest rate implicit in lease 12% Lease is cancellable with permission of lessor, Jane Ltd .Lease is classified as a finance Lease by the Lessor . Required: (a)Prepare the Lease payment schedule for Austin Ltd, Lessee, for the first two years, for the year ended 30 June 2021 and for the year ended 30 June 2022.

- 2....continues The following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Splish Company, a lessee. Commencement date January 1, Annual lease payment due at the beginning of each year, beginning with January 1, $119,127 Residual value of equipment at end of lease term, guaranteed by the lessee $54,000 Expected residual value of equipment at end of lease term $49,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, $659,000 Lessor’s implicit rate 6 % Lessee’s incremental borrowing rate 6 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment.Click here to view factor tables. Suppose Splish received a lease incentive of $5,000 from Faldo Leasing to enter the lease. How would the initial measurement of the lease liability and right-of-use asset be…35. The following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Pina Company, a lessee. Commencement date January 1, Annual lease payment due at the beginning of each year, beginning with January 1, $104,218 Residual value of equipment at end of lease term, guaranteed by the lessee $51,000 Expected residual value of equipment at end of lease term $46,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, $540,000 Lessor’s implicit rate 9 % Lessee’s incremental borrowing rate 9 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment.Click here to view factor tables. (a) Prepare an amortization schedule that would be suitable for the lessee for the lease term. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final…35.... The following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Pina Company, a lessee. Commencement date January 1, Annual lease payment due at the beginning of each year, beginning with January 1, $104,218 Residual value of equipment at end of lease term, guaranteed by the lessee $51,000 Expected residual value of equipment at end of lease term $46,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, $540,000 Lessor’s implicit rate 9 % Lessee’s incremental borrowing rate 9 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Suppose Pina received a lease incentive of $5,000 from Faldo Leasing to enter the lease. How would the initial measurement of the lease liability and right-of-use asset be affected? Right-of-use asset $incorrect 514,590 Lease…