Recording Dividend Declarations Following are four separate dividend scenarios. a. On April 1, Meriter Corporation declared a cash dividend of $5 per share on its 83,200 outstanding shares of common stock ($1 par). The dividend is payable on April 21 to stockholders of record on April 14. b. Axe Co. has issued and outstanding 2,600 shares of $100 par, cumulative, 5% preferred stock, and also 52,000 shares of $5 par common stock. Dividends are in arrears for the past year (not including the current year). On December 15, the board of directors of Axe Co. declared dividends of $65,000 to be paid to shareholders at the end of its fiscal year. c. Siri Corp. holds 2,600 shares of Mobile Co. common stock, purchased at the beginning of the year for $30 a share (which is the carrying value on February 1). On February 1, Siri Corp. declared a property dividend of 1,170 shares of Mobile Co. common stock when the Mobile Co. shares were selling at $28 per share. d. Treck Corporation declared a common stock dividend of $117,000 on April 1. Treck Corporation announced to shareholders that 70% of the dividend amount was a return of capital. Required Record the entry(ies) for the declaration of dividends for each of the four separate scenarios. Date a. April 1 b. Dec. 15 c. Feb. 1 c. Feb. 1 d. April 1 To record dividends. To record dividends. To record fair value adjustment. To record dividends. Account Name To record dividends. ; ✪ # + + ; + + + # # # Dr. 0 0 0 0 0 0 0 0 0 0 0 0 Cr. 0 0 0 0 0 0 0 0 0 0 0 0

Recording Dividend Declarations Following are four separate dividend scenarios. a. On April 1, Meriter Corporation declared a cash dividend of $5 per share on its 83,200 outstanding shares of common stock ($1 par). The dividend is payable on April 21 to stockholders of record on April 14. b. Axe Co. has issued and outstanding 2,600 shares of $100 par, cumulative, 5% preferred stock, and also 52,000 shares of $5 par common stock. Dividends are in arrears for the past year (not including the current year). On December 15, the board of directors of Axe Co. declared dividends of $65,000 to be paid to shareholders at the end of its fiscal year. c. Siri Corp. holds 2,600 shares of Mobile Co. common stock, purchased at the beginning of the year for $30 a share (which is the carrying value on February 1). On February 1, Siri Corp. declared a property dividend of 1,170 shares of Mobile Co. common stock when the Mobile Co. shares were selling at $28 per share. d. Treck Corporation declared a common stock dividend of $117,000 on April 1. Treck Corporation announced to shareholders that 70% of the dividend amount was a return of capital. Required Record the entry(ies) for the declaration of dividends for each of the four separate scenarios. Date a. April 1 b. Dec. 15 c. Feb. 1 c. Feb. 1 d. April 1 To record dividends. To record dividends. To record fair value adjustment. To record dividends. Account Name To record dividends. ; ✪ # + + ; + + + # # # Dr. 0 0 0 0 0 0 0 0 0 0 0 0 Cr. 0 0 0 0 0 0 0 0 0 0 0 0

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 11SPA

Related questions

Question

Please help me

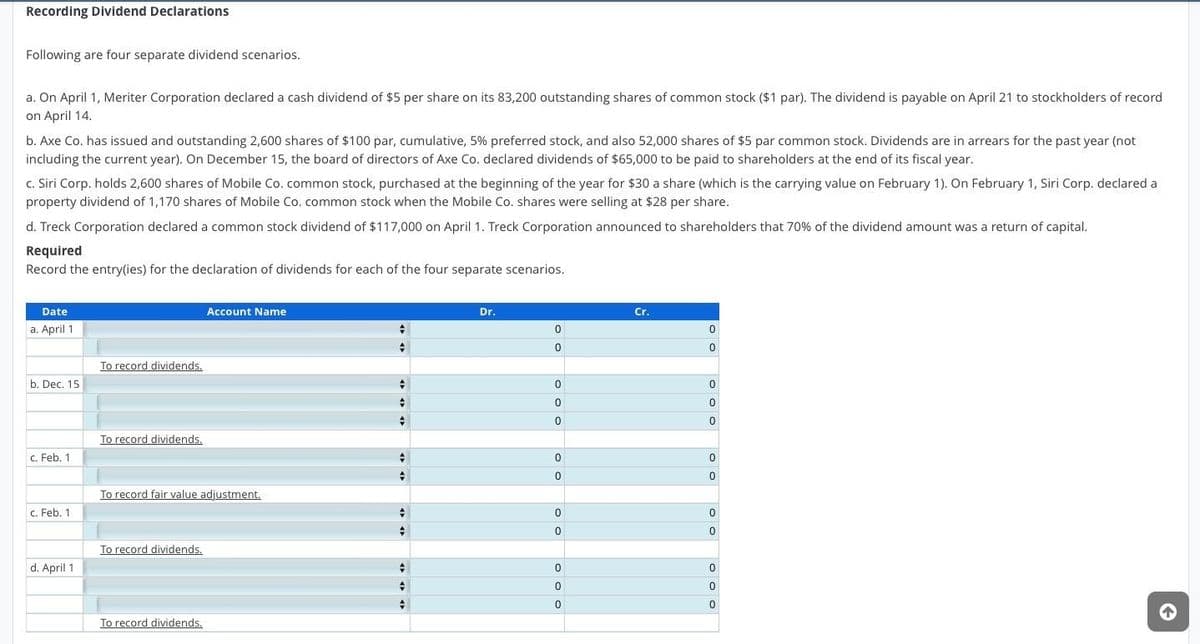

Transcribed Image Text:Recording Dividend Declarations

Following are four separate dividend scenarios.

a. On April 1, Meriter Corporation declared a cash dividend of $5 per share on its 83,200 outstanding shares of common stock ($1 par). The dividend is payable on April 21 to stockholders of record

on April 14.

b. Axe Co. has issued and outstanding 2,600 shares of $100 par, cumulative, 5% preferred stock, and also 52,000 shares of $5 par common stock. Dividends are in arrears for the past year (not

including the current year). On December 15, the board of directors of Axe Co. declared dividends of $65,000 to be paid to shareholders at the end of its fiscal year.

c. Siri Corp. holds 2,600 shares of Mobile Co. common stock, purchased at the beginning of the year for $30 a share (which is the carrying value on February 1). On February 1, Siri Corp. declared a

property dividend of 1,170 shares of Mobile Co. common stock when the Mobile Co. shares were selling at $28 per share.

d. Treck Corporation declared a common stock dividend of $117,000 on April 1. Treck Corporation announced to shareholders that 70% of the dividend amount was a return of capital.

Required

Record the entry(ies) for the declaration of dividends for each of the four separate scenarios.

Date

a. April 1

b. Dec. 15

1-1

c. Feb. 1

12

c. Feb. 1

I

d. April 1

To record dividends.

To record dividends.

To record fair value adjustment.

To record dividends.

Account Name

To record dividends.

+

+

+

+

+

+

+

+

+

+

;

+

Dr.

0

0

0

0

0

0

0

0

0

0

0

0

Cr.

0

0

0

0

0

0

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning