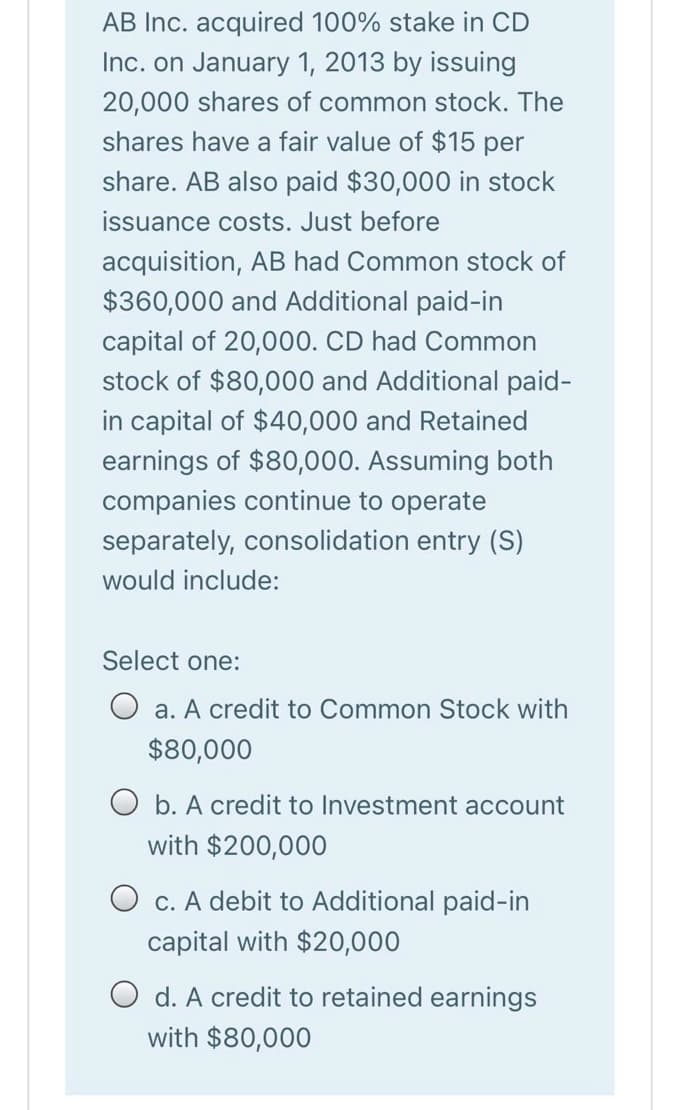

AB Inc. acquired 100% stake in CD Inc. on January 1, 2013 by issuing 20,000 shares of common stock. The shares have a fair value of $15 per share. AB also paid $30,000 in stock issuance costs. Just before acquisition, AB had Common stock of $360,000 and Additional paid-in capital of 20,000. CD had Common stock of $80,000 and Additional paid- in capital of $40,000 and Retained earnings of $80,000. Assuming both companies continue to operate separately, consolidation entry (S) would include: Select one: O a. A credit to Common Stock with $80,000 O b. A credit to Investment account with $200,000 O c. A debit to Additional paid-in capital with $20,000 O d. A credit to retained earnings with $80,000

AB Inc. acquired 100% stake in CD Inc. on January 1, 2013 by issuing 20,000 shares of common stock. The shares have a fair value of $15 per share. AB also paid $30,000 in stock issuance costs. Just before acquisition, AB had Common stock of $360,000 and Additional paid-in capital of 20,000. CD had Common stock of $80,000 and Additional paid- in capital of $40,000 and Retained earnings of $80,000. Assuming both companies continue to operate separately, consolidation entry (S) would include: Select one: O a. A credit to Common Stock with $80,000 O b. A credit to Investment account with $200,000 O c. A debit to Additional paid-in capital with $20,000 O d. A credit to retained earnings with $80,000

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter13: Earnings Per Share (eps)

Section: Chapter Questions

Problem 2R: Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8%...

Related questions

Question

Transcribed Image Text:AB Inc. acquired 100% stake in CD

Inc. on January 1, 2013 by issuing

20,000 shares of common stock. The

shares have a fair value of $15 per

share. AB also paid $30,000 in stock

issuance costs. Just before

acquisition, AB had Common stock of

$360,000 and Additional paid-in

capital of 20,000. CD had Common

stock of $80,000 and Additional paid-

in capital of $40,000 and Retained

earnin

of

Assuming both

companies continue to operate

separately, consolidation entry (S)

would include:

Select one:

O a. A credit to Common Stock with

$80,000

O b. A credit to Investment account

with $200,000

O c. A debit to Additional paid-in

capital with $20,000

O d. A credit to retained earnings

with $80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning